Shankar Sharma and Devina Mehra

One of us made a presentation at the Morningstar conference in 2019 which created quite a ripple amongst investors.

The theme of the presentation was that Indian equities had been an extremely disappointing asset class over the last 10, 5, 3 and 1 year time frames.

From 2010, the Dollex (Sensex in USD terms) is down 6 percent. That means, in USD 6, India has delivered zero returns over a 10 year period.

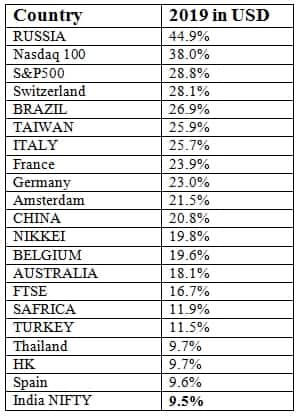

The data for 2019 is, too, a shocker.

Even a so-called basket case market like Turkey did better than India.

Let alone equities: even Global fixed income gave far higher returns than Indian equities, in 2019!

This data really set the cat among the pigeons. Implanted the seed in the minds of Emerging Market InCluding Indian investors that having a single country, single currency, single asset risk (SCCARS) was simply not wise for long term wealth building and risk management.

And then came the rush to international diversification.

All with disastrous consequences!

Global markets, the US in particular, in fact, fell more than the Indian markets, in the last two months.

So the question now on everybody's mind is: where did they go wrong in their quest to diversify globally?

The answers to this are not easy.

Let us start with the simpler answer: International diversification is a very very difficult, complicated endeavor, and practically, most available ways to do this are sub- optimal, because in reality, they do not give any meaningful diversification beyond a dollar exposure.

Don't go for the easy solutions here because there are no easy solutions.

Before we go to the complicated part, let's look at the typical routes available for Indian investors to invest globally.

Feeder Funds offered by Domestic Fund Houses

The simplest method is to buy Feeder funds of various international funds, available via local fund houses.

These funds give you exposure usually to single markets or even to single narrow indexes/ sectors such as NASDAQ/ Technology.

The Problems with Feeder Funds

First, you don't get real diversification.

Now, you have exposure to two markets, instead of one and that's it! This does not solve the problem of getting away from SCCARS.

These feeder funds are also fairly costly with their expense ratios around 2-3 percent. This, frankly, is absolutely unacceptably high.

These expense ratios are so high because the Domestic fund houses that offers these feeder funds get an additional layer of Management fees for doing precisely nothing. Talk about getting a free ride on investor money!

Plus, the domestic fund house provider of the feeder fund has zero accountability towards investors and investment performance, since the Investment Management function has been outsourced to someone sitting in New York or London.

The domestic entity is nothing but a glorified intermediary.

Buying International Exchange Traded Funds (ETFs)

This is the second method for you to get International exposure.

The only thing that these instruments have going for them is that they are lower cost as compared to feeder funds.

However how does the investor decide which ETF to buy? Which markets to invest in through these ETFs? How to balance risk and reward? How to decide on what is a perfect portfolio construction of these instruments, across markets and asset classes?

ETFs simply don't work for all but the most sophisticated investors.

And as regards buying individual stocks, leave that to the pros because that carries massive risks and volatility.

Remember, globally, including the US, stocks routinely fall 20-50 percent even if they miss forecasts by even one cent!

Doing International diversification, the Right Way

None of the above give proper International diversification because they have their own unique problems.

The holy grail of investing is correct top-down asset allocation. Without getting that right, just buying a feeder fund or exchange traded fund or individual stocks, will give suboptimal returns over the long run because these feeder funds or ETFs cannot give you Global top-down asset allocation in a tactical, dynamic manner.

Asset classes go in and out of favor.

Nothing is permanent about any particular asset class.

For example Emerging Markets did very well from 2004 to 2007.

Therefore, all feeder funds guided you to invest in Emerging Market funds.

Results were disastrous from 2008 onwards for Emerging Market equities.

And just in the last 2 months one can see how dangerous going long on US technology/ NASDAQ, has been where most stocks are down 40-50% within one month.

At any point in time, some Asset Class is going to be in a Bull Market (For example, Technology in 1998, Emerging Markets 2004-07, Commodities: 2003-08, US equities: 2010 onwards, Global Fixed Income: 2009 onwards), even as others are in a bear market.

The right way to do Global diversification is to get your top-down asset allocation right and for this, the fund manager that you select must be capable of managing your investments on this basis so that you have a well constructed portfolio of international equities, International fixed income as well as commodities.

Even more importantly, your investment manager must have the skills to manage these allocations dynamically.

If you do not get proper top-down asset allocation right, you are destined to suffer the vagaries of markets.

And last but most important, get expertise that is available locally for you to discuss with and plan, rather than the Investment Management process being outsourced to some faceless set of people sitting thousands of miles away.

Shankar Sharma and Devina Mehra are Founders of First Global, a Global Asset Management & Securities Firm.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.