Public sector and private sector general insurers are in neck-to-neck competition as far as settling of claims is concerned, shows data from the Claims Handbook released by the Insurance Brokers Association of India (IBAI).

For customers, looking at the claims settlement ratio is imperative to decide on the insurer to buy a policy. Higher the claims settlement ratio and quicker the claims is settled, better it is for the customers.

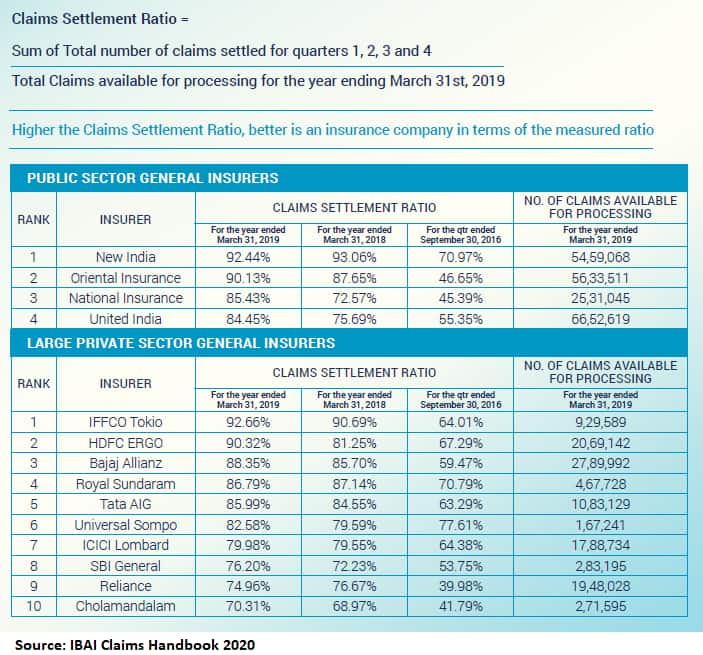

Figures for FY19 showed that New India Assurance and IFFCO Tokio General Insurance topped the list as far as overall claims settlement is concerned.

Among the public sector general insurers, despite the number of claims filed being more than 2.5 million in FY19, the claims settlement ratio was above 84 percent for all the state-owned general insurers.

In the private sector, insurers like IFFCO Tokio, HDFC ERGO, Bajaj Allianz, Royal Sundaram and Tata AIG had a claims settlement ratio above 85 percent.

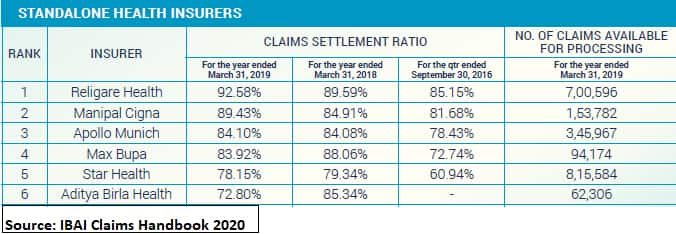

When it comes to health insurance, Religare Health had a claims settlement ratio of 92.58 percent for FY19. The health insurer handled 7,00,596 claims in the financial year and settled almost 93 percent of them.

For the industry as a whole, the claims settlement ratio stood at 85.18 percent for the year ended March 31, 2019. This rose from 80.77 percent in the year-ago period.

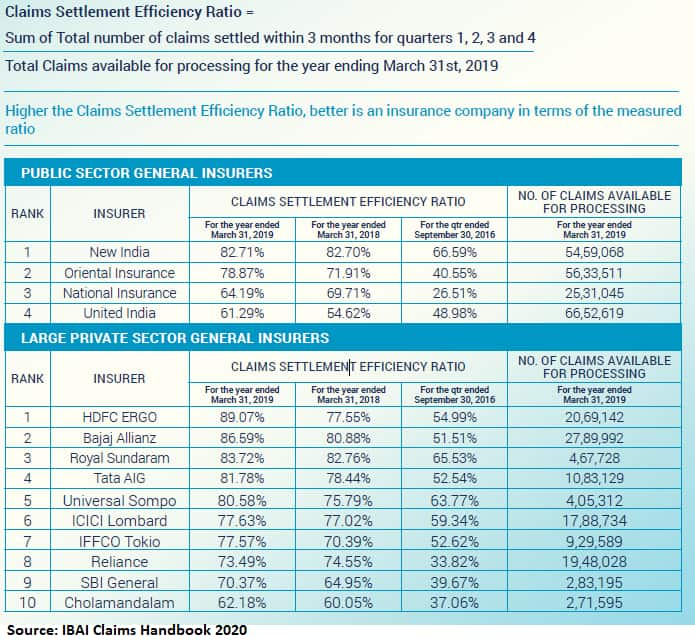

However, the private sector insurers scored as far as claims settlement efficiency ratio is concerned. This refers to the number of claims settled in three months of being filed as compared to the total number of claims available for processing.

Among the public sector players, only New India Assurance had claims settlement efficiency ratio above 80 percent in FY19.

Here, HDFC ERGO General Insurance topped the list with claims settlement efficiency ratio with 89.07 percent for FY19. This improved from 77.55 percent in FY18. For the general insurance industry as a whole, this ratio stood at 74.16 percent for FY19.

Closely linked to the efficiency ratio in settling claims is the outstanding claims. Data from IBAI showed that Tata AIG had the lowest claims outstanding in FY19 at 4.73 percent. Among the public sector insurers, New India Assurance's claims outstanding ratio stood at 5.49 percent.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.