Bharti AXA’s non-life insurance business will merge with ICICI Lombard’s general insurance business through a scheme of arrangement, said the companies in a statement to the exchanges.

While the financial details were not disclosed, sources said that the deal values Bharti AXA General at around Rs 2,700 crore. Moneycontrol reported about this deal on July 29.

Based on the share exchange ratio recommended by independent valuers and accepted by the respective boards of ICICI Lombard and Bharti AXA, the shareholders of Bharti AXA shall receive two shares of ICICI Lombard for every 115 shares of Bharti AXA held by them as on the date on which the scheme is approved by the board.

When the companies get the necessary approvals, the non-life insurance business will be demerged from Bharti AXA into ICICI Lombard. However, Bharti AXA Life Insurance business remains intact.

Bharti Enterprises and French multinational insurer AXA hold 51 percent and 49 percent stake respectively in Bharti AXA General. There are no special rights being granted to Bharti or AXA, post the merger. Both Bharti and AXA will be categorised as public shareholders.

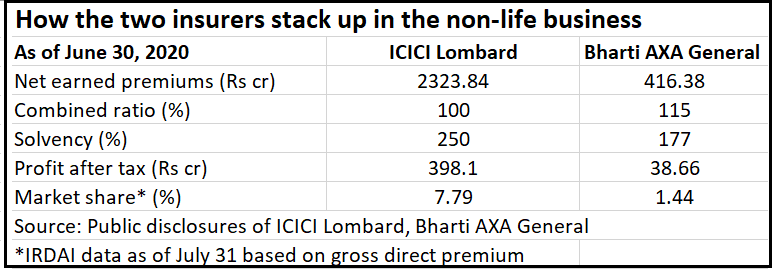

As of Q1 FY21, Bharti AXA General's solvency or minimum capital requirement stood at 1.77 as against the regulatory requirement of 1.5. The combined ratio stood at 115 percent.

EY acted as the exclusive M&A advisor to ICICI Lombard and AZB & Partners acted as its legal advisor.

Cyril Amarchand Mangaldas acted as legal advisor to Bharti and Talwar Thakore & Associates acted as legal advisor to AXA.

Further, BDO Valuation Advisory LLP and MKSA & Associates recommended the share exchange ratio for the de-merger of Bharti AXA into ICICI Lombard.

Company viewsThe companies said in a statement that the proposed transaction would provide a meaningful opportunity for ICICI Lombard to consolidate its market leading position in the non-life insurance sector, becoming the third largest non-life insurer. The combined entity shall have a market share of 8.7 percent on pro-forma basis.

Bhargav Dasgupta, MD & CEO of ICICI Lombard General Insurance, said, “This is a landmark step in the journey of ICICI Lombard and we are confident that this transaction would be value accretive for our shareholders. We are excited by the capabilities and strengths that Bharti AXA will add to our franchise. The company has a talented employee base with a strong cultural fit, and we look forward to welcoming them to the ICICI Lombard family.”

The companies also said in a statement that the proposed transaction was expected to result in value creation for all stakeholders through meaningful revenue and operational synergies. Policyholders are also expected to gain from an enhanced product suite and deeper customer connect touch points.

Rakesh Bharti Mittal, Chairman of Bharti AXA General Insurance said, "Over the past few years, our business demonstrated consistent growth, forged productive partnerships and increased the distribution footprint significantly. We are confident that the proposed amalgamation of our business with ICICI Lombard will bring greater business synergies and create value for all stakeholders.”

Business synergiesBharti Enterprises had been looking for a buyer for its general insurance business for the last seven to eight years.

In 2011, Bharti was in talks with Reliance Industries to sell its stake (which then stood at 74 percent) in its life and general insurance ventures to the latter.

AXA and RIL had said in June 2011 that they had reached an understanding where the latter, along with its associate Reliance Industrial Infrastructure (RIIL), will acquire Bharti’s 74 percent stake in both the ventures. While RIL was to acquire 57 percent, RIIL was to buy the remaining 17 per cent of Bharti's stake in the two insurance companies.

However, this deal was called off in November 2011 by AXA, Bharti, RIL and RIIL. In a separate statement, RIL had said the talks were terminated as parties had failed to 'reach agreement on long-term vision and joint governance of the ventures'.

How do Bharti AXA General and ICICI Lombard stack up?As of July 31, Bharti AXA General had a market share of 1.44 percent in the non-life sector based on gross direct premium of Rs 810.85 crore.

ICICI Lombard had a market share of 7.79 percent in the general insurance sector with gross direct premium of Rs 4,391.29 crore.

This makes the combined entity the largest private non-life insurer and the third largest in the general insurance industry after New India Assurance and United India Insurance. The closing of the proposed transaction is subject to various conditions precedent, including regulatory approvals from the Insurance Regulatory and Development Authority of India, Competition Commission of India, Securities and Exchange Board of India, stock exchanges, Reserve Bank of India, NCLT and approval of shareholders of both ICICI Lombard and Bharti AXA, amongst others. This is the third merger deal in the insurance sector after HDFC ERGO's acquisition of L&T General Insurance in August 2017 and HDFC ERGO completing acquisition of Apollo Munich Health Insurance in January 2020. Disclaimer: Reliance Industries (RIL), which also controls Jio Platforms, is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments which publishes Moneycontrol.

This makes the combined entity the largest private non-life insurer and the third largest in the general insurance industry after New India Assurance and United India Insurance. The closing of the proposed transaction is subject to various conditions precedent, including regulatory approvals from the Insurance Regulatory and Development Authority of India, Competition Commission of India, Securities and Exchange Board of India, stock exchanges, Reserve Bank of India, NCLT and approval of shareholders of both ICICI Lombard and Bharti AXA, amongst others. This is the third merger deal in the insurance sector after HDFC ERGO's acquisition of L&T General Insurance in August 2017 and HDFC ERGO completing acquisition of Apollo Munich Health Insurance in January 2020. Disclaimer: Reliance Industries (RIL), which also controls Jio Platforms, is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments which publishes Moneycontrol. Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.