India’s largest cash-for-gold lender by market value plans to repay a $450 million bond later this month, but it isn’t in any rush to tap the offshore market again after yields surged this year.

Muthoot Finance Ltd. is extending a trend in emerging Asia that’s dragged down bond issuance in the US currency to its lowest since 2015. Debt offerings from Asia ex-Japan in the greenback have almost halved to about $158 billion so far in 2022 compared with the year-earlier-period, while an Indian company hasn’t issued in the market since April.

The Indian currency fell to a record low against the dollar Thursday, which is also making servicing overseas debt unattractive for issuers there.

“We are not planning to rollover the bonds,” according to George ALexander Muthoot, managing director at Muthoot Finance, in emailed comments. “We would need to hedge the bonds to counter adverse price movements. This in turn will incur additional costs as well.”

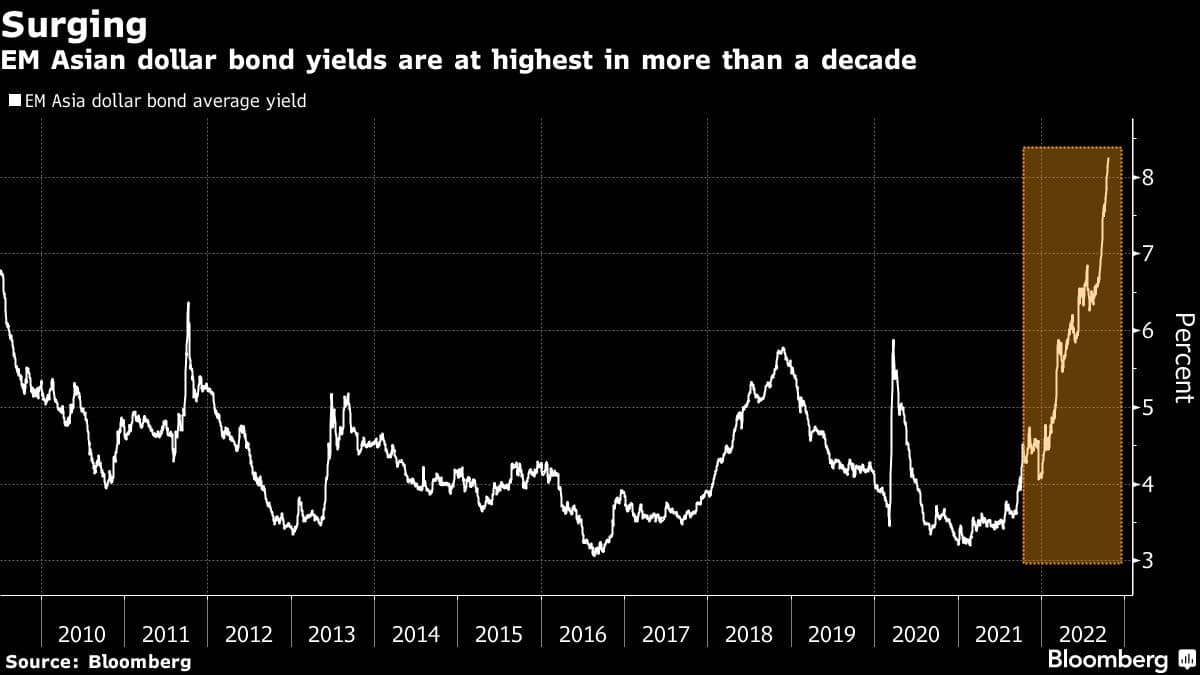

Inflation-triggered Fed hikes have pushed dollar borrowing costs in Asia to their highest in more than a decade at 8.25%, according to a Bloomberg index, spurring issuers to boost local funding and shelve dollar bond plans in some cases. Muthoot Finance intends to repay its note due Oct. 31 with existing liquidity, and has been regularly raising funds at home through loans and local debentures, according to Muthoot.

Still, the offshore market is good for long-term and large-scale funding, and the company will tap it as and when needed, he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.