One of the highlights in Budget 2022 was the increase in capital expenditure on part of the government. In an interview with Network18, Finance Minister Nirmala Sitharaman emphasised that investments in infrastructure will set off a virtuous cycle by crowding in private investment and trigger the multiplier effect. This explainer discusses the multiplier effect and its importance.

What is the ‘multiplier effect’?When the government spends a rupee, it will lead to a multiple rise (more than a rupee) in overall income. This is the multiplier effect.

Why is it so? Because government spending will boost private investment and household consumption as well. Say, the government spends on building a road and decides to appoint private contractors to build the road. In turn, the private contractor appoints workers/supervisors and also buys equipment to build the road. Overtime, the new recruits will get salaries and spend to meet their needs.

This way the government spending leads to rise in spending of both private industry and households.

Economists also call this flow of spending from government to private sector as ‘crowding in’ of private sector investment.

If this is crowding in, then what is crowding out?The origins of the fiscal multiplier can be traced to economist John Maynard Keynes’s prescription to tackle the Great Depression of the 1930s — he advocated massive government spending.

In 1970s, Keynesian economics took a beating the world economy faced a different combination of problems in high unemployment and high inflation. Then government spending was not just able to revive economic activity but also blamed for the ongoing crisis.

Some economists argued that if the government spends, it crowds out or inhibits the private sector from investments. The basis of this argument was that the available savings in an economy are limited and scarce. If government spends, it will be absorbing this available saving and leaving fewer resources for private investment. From the 1980s onwards, crowding out became part of the economics wisdom. There was pressure on governments to spend only on maintenance of the government and leave investment activity to the private sector.

Macroeconomic policy changes with each situation and each crisis. In 2008, the world economy again faced a crisis leading to calls for new thinking on macroeconomics. There were calls for higher government expenditure to boost economic activity. Central banks also pushed interest rates to zero percent levels and pumped a lot of liquidity in markets. There were suggestions that governments should take advantage of these low interest rates and spend on infrastructure and similar projects for raising future productivity.

Parallelly, a new school of economic thought named ‘Modern Monetary Theory’ argued that government spending leads to crowding in of private sector.

The call for higher government spending became even louder as the pandemic struck in 2020. We saw governments across the world spend aggressively to counter falling economic during the pandemic.

In several ways, new thinking in macroeconomics usually means going back to old ideas!

Where does India figure in these changes in macroeconomic thinking?Indian macroeconomic policy has also changed in line with this change in thinking on global macroeconomic policy. Post-independence, India made 5 years plans that relied extensively on government spending and multipliers to push Indian economic growth. However, the approach did not work as expected leading to the 1991 crisis. Post-1991 reforms, Indian government did not really withdraw from government spending but became more conscious of its earlier ‘free-spending’ approach.

In 2003, the government adopted Fiscal Responsibility and Budget Maintenance Act. Under FRBM Act, the government was to reduce its fiscal deficit to 3 percent of GDP and revenue deficit to 0 percent within the next 5 years. However, due to the 2008 global financial crisis, the targets were not just missed but the government also ended up spending aggressively. The Indian government has been trying to get back to FRBM targets but did not succeed. The pandemic worsened the fiscal outlook even more as fiscal deficit have been upwards of 6 percent of GDP in the last 2 years and projected at 6.4 percent for 2022-23.

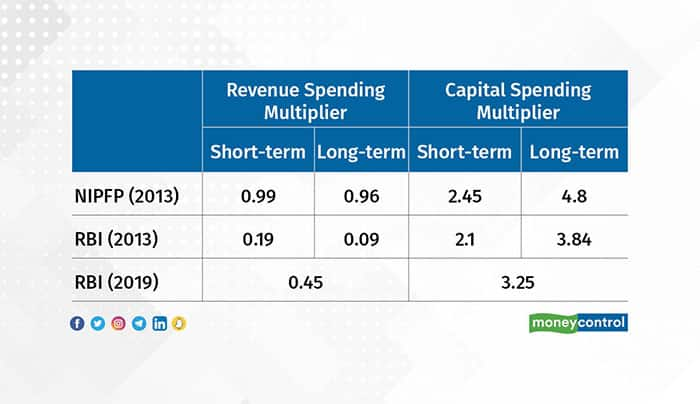

What do we make of the FM announcement on fiscal multiplier?In her interview, the FM pointed out that the multiplier on capital expenditure was Rs 2.95 on every rupee spent while that on consumption expenditure was less than a rupee.

In the last few years, a series of research papers argued that one must analyse fiscal multipliers differently. There is a case that fiscal multiplier of revenue spending or transfer payments is below 1 but fiscal multiplier of capital spending is much greater (see table).

These studies and policy discussions within the government have led to this conclusion that if it gets more back for the buck when it spends on capital creation.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.