Aside from the introduction of the new income-tax regime - (lower rates, fewer exemptions and deduction), the income-tax department has harnessed technology to make the process of tax-filing easier.

For instance, the limit of tax audit for small businesses was raised to a steep Rs 10 crore (Rs 1 crore earlier). Those above 75 years, have been exempted from filing tax returns too.

All this has been possible due to the Income Tax Department’s digital drive, procuring data about individuals and their spends and earnings directly from companies, schools, electricity boards, jewellers, real-estate and car registrations and other vendors.

Due to these efforts, today 7.85 crore returns are filed as against 3.36 crore returns a decade ago. Annual direct tax collections stand at Rs. 12.37 lakh crore (up to November 9, 2023) significantly higher than Rs 6. 38 lakh crore in 2013-14.

The Hits

Using data to widen the tax base

Tax evaders found no escape when tax deduction at source (TDS) was charged on several payments received by an individual, earlier charged on fixed deposits and salary only. Tax collection at source (TCS) was introduced on payments made on rents, art, foreign investments, gold artifacts, commissions and now foreign tours too.

Increased surveillance also ensured that income-tax forms come pre-filled with most details and taxpayers only need to verify them.

Simpler tax forms of ITR-1 Sahaj for salaried and ITR-4 SUGAM for the self-employed were introduced. The tax department has proposed a single form for all in November 2022.

Annual Information Statement (AIS)

The introduction of AIS meant that you could see TDS, TCS, shares, real estate and other high value mutual fund transaction details in one place. This reduced instances of forgotten income from escaping the tax net.

Faster refunds

Faster form filling and confirmation led to faster refunds and less strain of interest on the government. As opposed to earlier when refunds were being sent out to taxpayers by cheque, resulting in frauds at times, refunds are now directly credited to the bank accounts of taxpayers.

Faceless assessment

To kill corruption involved in tax collection, faceless assessment was introduced, which meant only recorded online interaction between taxpayers and tax assessing officers.

Also read: Budget@10: Filing tax returns now easier but capital gains tax rules continue to be a pain point

The Misses

Delay in settlements

Faceless assessment has also led to a delay in settling tax-related cases. Resolution of issues has been a problem under faceless assessments leading to appeals at the Income Tax Appellate Tribunal. The snail’s pace is due to cases being re-opened.

Powers snapped

Due to faceless assessment, the communication with assessing officers has reduced. Earlier, you could approach the joint officer, who would review the file physically and offer a resolution.

“The income tax portal, the regulatory website and the website to pay taxes have all undergone a change. The old website allowed file rectification requests, the new website doesn’t support this. If someone has not received the TDS credit, there is no way to communicate,” says Paras Savla, partner at KPB and Associates.

Hordes of notices

Mismatch of data captured, irrelevant PAN mentions have caused distress in terms of wrong notices being received years later.

Salva says that demand notices are being sent after 10-15 years. “Even when the tax demand has been paid the future refunds of an individual are being adjusted against the taxes erroneously,” he adds.

Many cases of erroneous notices sent have been reported. Karan Batra, founder of CharteredClub.com says that recently they received a notice for a 2017 case where the taxpayer had passed away and her son had moved abroad. “The papers aren’t available and the time offered is not enough to source papers and resolve the case,” says Batra.

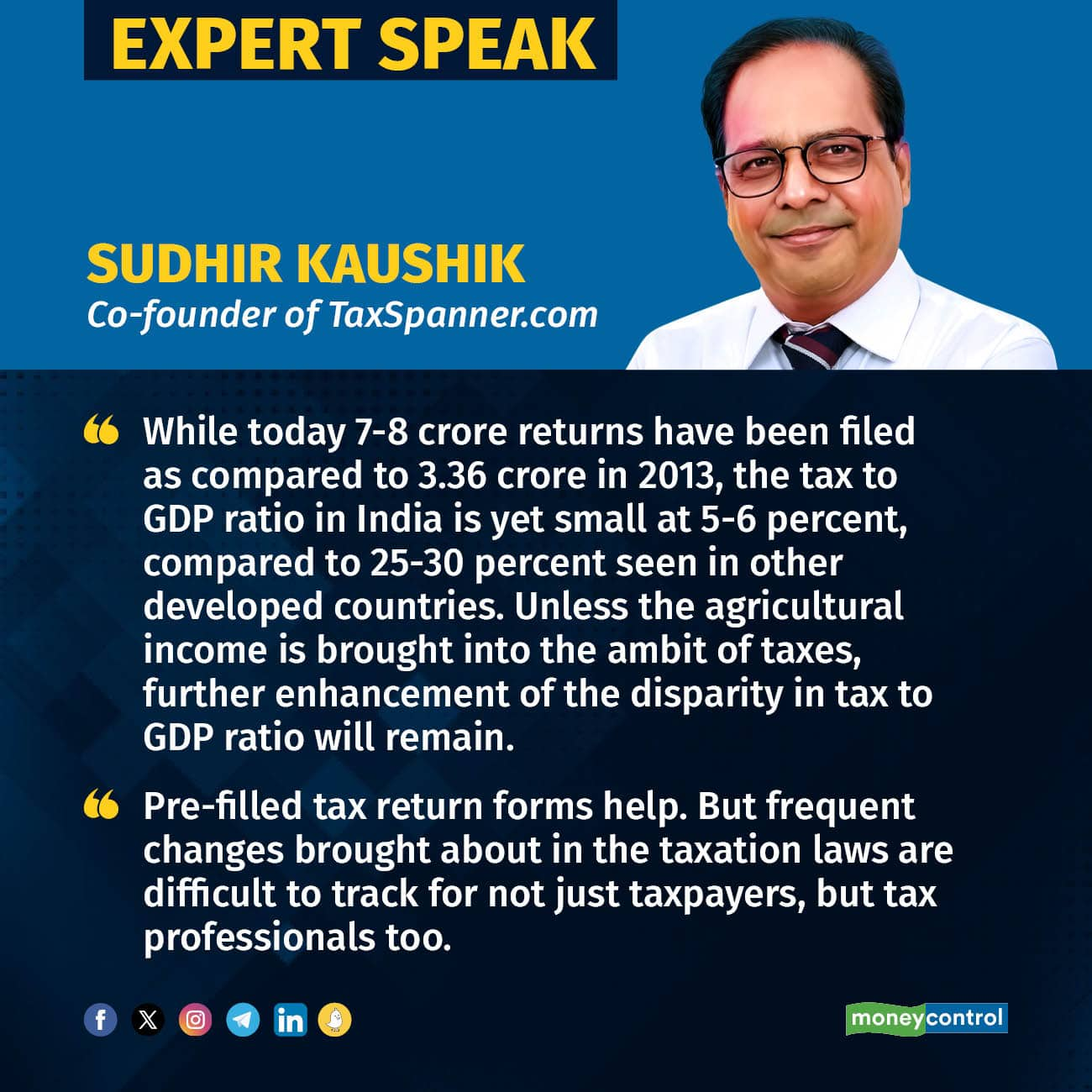

Low tax to GDP ratio

Additional efforts are needed to become a tax compliant country. “While today, seven to eight crore returns have been filed as compared to 3.36 crore in 2013, the tax to GDP ratio in India is yet small at five to six percent, compared to 25-30 percent seen in other developed countries. Unless agricultural income is brought into the ambit of taxes, further enhancement of the disparity in tax to GDP ratio will remain,” says Kaushik.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.