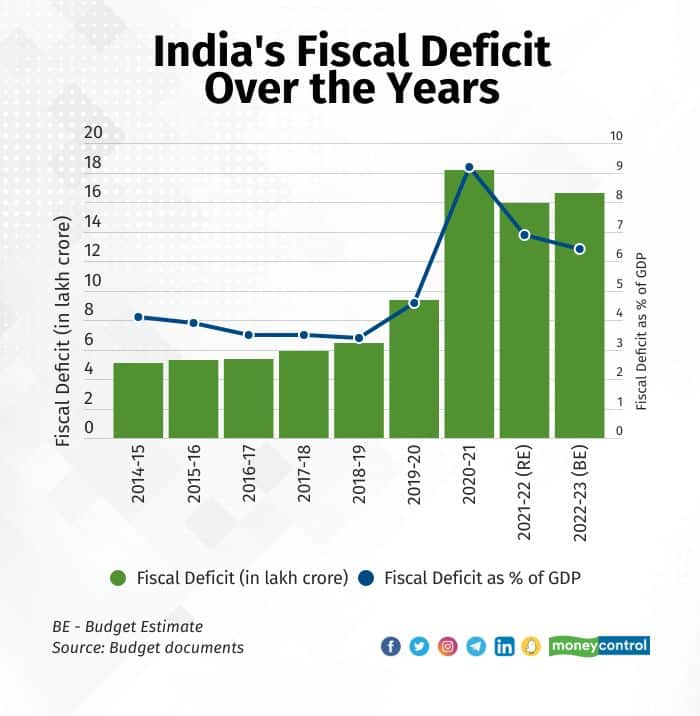

Finance minister Nirmala Sitharaman on February 1 pegged the government’s fiscal deficit for 2023-24 at 5.9 percent of gross domestic product (GDP), demonstrating the government’s intent to walk the talk on fiscal rectitude.

This would represent a reduction of 50 basis points from this year’s fiscal deficit target of 6.4 percent, which Finance Minister Nirmala Sitharaman said would be met.

Next year’s target is in line with economists’ expectations of 5.9 percent. However, some questions have been raised – particularly by global ratings agencies like Moody’s Investors Service and Fitch Ratings – about how the medium-term target of 4.5 percent will be met by 2025-26.

The central government's fiscal deficit widened to Rs 9.78 lakh crore in the April-November period, accounting for 58.9 percent of the full-year target, data released on December 30 by the Controller General of Accounts showed.

The fiscal deficit in the first eight months of the last financial year was 46.2 percent of last year’s target.

The Centre had targeted a fiscal deficit of Rs 16.61 lakh crore for the current financial year, or 6.4 percent of the GDP in 2022-23.

The total receipts during April-November stood at Rs 14.64 lakh crore or 64.1 percent of the current year's budget estimate. In the comparable year-ago period, total receipts had hit 69.8 percent of the budget estimate.

India is slated to be the fastest-growing G20 economy this year but could face headwinds from tight monetary conditions amid a slowing global economy.

The Reserve Bank of India (RBI) is widely expected to end its rate hike cycle early next year after sharp rate hikes since early May to curb red-hot inflation.

The Fiscal Responsibility and Budget Management (FRBM) Act, 2003, was enacted to provide a legislative framework for reducing the deficit and debt of the central government to a sustainable level so as to ensure intergenerational equity in fiscal management and long-term macroeconomic stability.

The FRBM Act and the FRBM Rules, 2004, made under the act are in force from July 5, 2004. The FRBM framework mandated the central government to limit the fiscal deficit up to 3 percent of GDP by March 31, 2021.

It further provides that the central government shall endeavour to limit the general (Centre plus states) government debt to 60 percent of GDP and the central government debt to 40 percent of GDP by March 31, 2025.

However, due to the unprecedented nature of the COVID-19 shock, the fiscal deficit increased from 3.5 percent of GDP in the budget estimate 2020-21 to 9.5 percent of GDP in the revised estimates for the same year.

As the pandemic lingered into 2022 and with increased welfare-related spending, the fiscal deficit for 2021-22 stayed elevated at 6.9 percent of GDP. The government expects the deficit to ease to 6.4 percent of GDP and wants to continue with fiscal consolidation to attain a level of fiscal deficit lower than 4.5 percent of GDP by 2025-26.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.