State Bank of India (SBI) Chairman Dinesh Khara earned Rs 34.42 lakh rupees in annual salary for the financial year ending 2021-22 (FY22), 13.4% higher than what his predecessor Rajnish Kumar drew during FY21, as per the bank's FY22 annual report.

Khara joined SBI as a probationary officer in 1984 and took over as the bank Chairman in October 2020. He previously served as MD of the bank in charge of global banking and SBI subsidiaries, among others.

Former SBI Chairman Rajnish Kumar received a total of Rs 30.34 lakh from the bank of which Rs 14.04 lakh was in form of leave encashment paid on retirement in October 2020.

For FY22, SBI Chairman Khara earned Rs 27 lakh in basic pay and Rs 742,500 as dearness allowance. Of the total Rs 38.12 lakh SBI Chairman earned in FY21, Rs 400,000 were in form of incentives.

In comparison, Canara Bank MD and Chief Executive Officer (MD & CEO) LV Prabhakar drew Rs 36.89 lakh annual salary in FY22, while Bank of Baroda paid a remuneration of Rs 40.46 lakh to its MD & CEO Sanjiv Chadha during the same period.

SBI engaged an external consulting company in FY22 which assisted the bank in laying down parameters for performance evaluation of Directors, Chairman, Board Level Committees, and Central Board as a whole and also assisted in facilitating the overall evaluation process, the report said.

“The evaluation process has validated the Board of Directors’ confidence in the governance values of the Bank, the synergy that exists amongst the Board of Directors, and the collaboration between the Chairman, the Board, and the Management,” it added.

In accordance with the Reserve Bank of India (RBI) and Central government directions in 2019, SBI has formed a nomination and remuneration committee (NRC) led by Chairman B Venugopal to conduct due diligence and arrive at the ‘fit and proper’ status of candidates filing nominations for election as Directors by shareholders, the annual report said, adding that during FY 2022, the NRC met once.

Further, SBI offers compensation of Rs 70,000 as ‘sitting fees’ for the Non-Executive Director attending the Meetings of the Central Board and Rs 30,000 for attending the meetings of other Board level Committees.

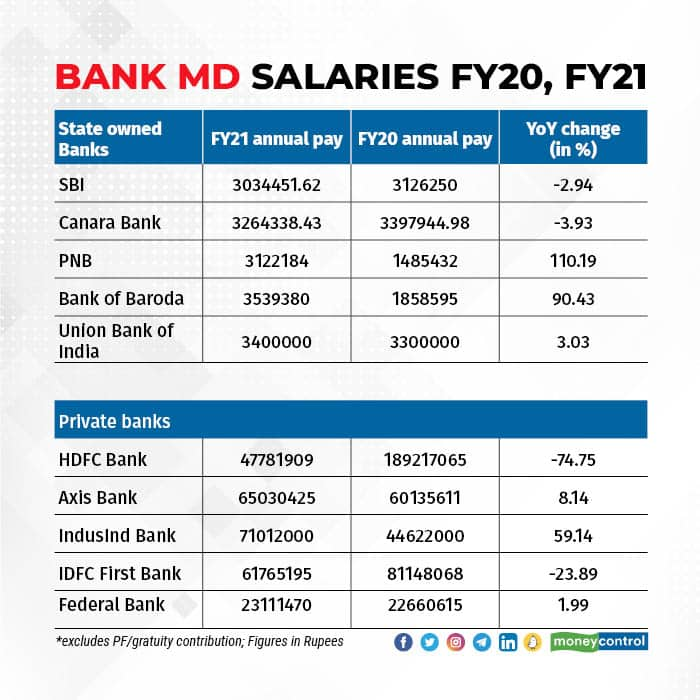

The annual compensation granted by the central government to public sector banks is significantly lower compared to how much private bank leaders make in a year.

For example, during FY21, HDFC Bank MD & CEO Sashidhar Jagdishan drew Rs 4.77 crore in annual salary, while Axis Bank MD Amitabh Chaudhry drew upwards of Rs 6 crore during the same period.

ICICI Bank MD & CEO Sandeep Bakhshi voluntarily relinquished his fixed compensation of basic, supplementary allowances and retirals for fiscal 2021 in view of COVID-19 related impact on the bank and was paid an honorarium fee of Re 1.

The pay gap between private and public sector banks' heads has been a long-standing issue that needs a solution in order to attract top talent, bankers said. The salary of a private bank leadership team is competitive due to better employee stock ownership plans (ESOPs).

“The respective banks’ boards must be authorised to decide compensation based on composite performance parameters of the individual and the Bank,” a senior banker with a private sector bank said.

“The talent crunch can be solved if the Board is also permitted to recruit Whole time directors from the market. Today these are selected only from public sector banks,” they add.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.