Adani Enterprises’ debt has more than doubled year on year in FY22, despite its revenue going up by more than 75 percent.

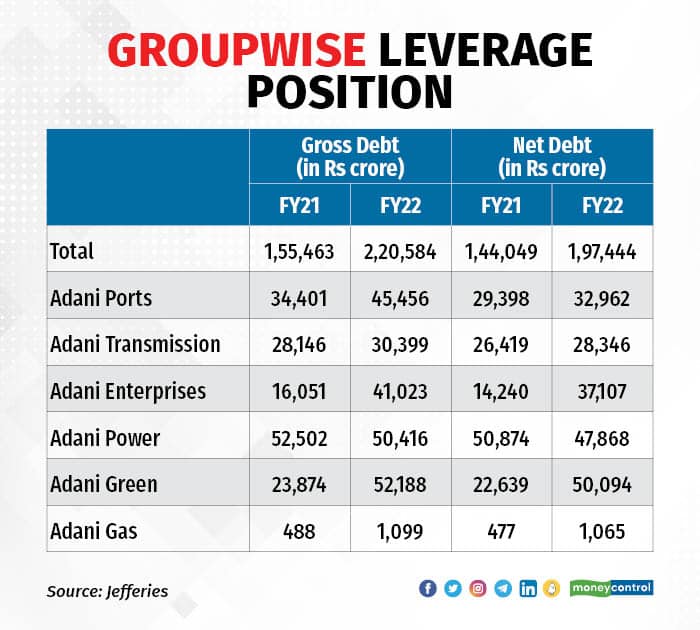

Its debt rose to Rs 41,023 crore in FY22 from Rs 16,051 crore in FY21, while its revenue increased to Rs 69,420 crore from Rs 39,537 crore over the same period, according to a Jefferies report.

The company’s PAT (excluding exceptionals) fell to Rs 787.7 crore from Rs 1,304.7 crore over the same period.

According to the report, Adani Enterprises (AEL) functions as a business incubator for the group by conceiving and investing in new ideas; helping the new business mature; and then demerging the business. Its holding in key businesses incorporated via subsidiaries and JVs vary between 44 percent and 100 percent -- 44 percent in Adani Wilmar, 50 percent in AdaniConnex, 100 percent Adani New Industries, 100 percent in Adani Road Transport, 100 percent in Adani Digital Labs, 100 percent in Adani Airports Holdings and 100 percent in other businesses such as in defence, mining services, copper and petrochem.

The Adani Group’s gross debt went up by 41 percent to Rs 2.2 trillion as of March 31, 2022, from Rs 1.55 trillion a year ago.

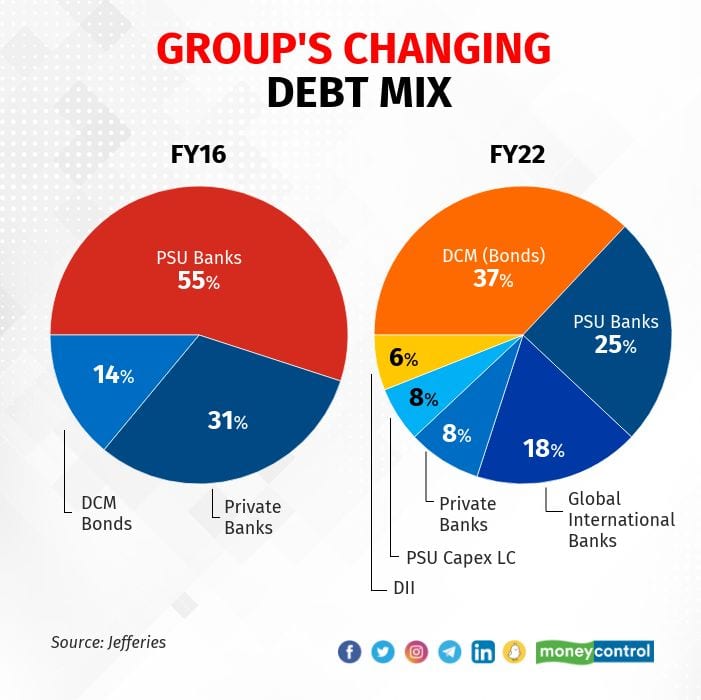

Interestingly, the group’s debt mix has changed to include more bonds.

Coal-shortage powered

Adani Enterprises (AEL) is the largest coal supplier in India and the largest importer of coal from Indonesia. In FY22, it saw its largest revenue vertical (Integrated Resources Management or IRM) more than doubling its revenue–to Rs 48,871 crore from Rs 23,950 crore–on higher coal prices.

Also read: Coal price likely to average $215/MT in FY23: ICRA's Jayanta Roy

IRM revenue saw such a significant increase despite volumes handled by the vertical rising only by 0.01 percent.

AEL is now a B2B business but its investments in a new set of businesses –airports, digital through its super app and food FMCG – is aimed at transforming the company into a B2C business, according to the report.

AEL’s wholly-owned subsidiary Adani Digital Labs (ADL) is a large part of the group’s consumer play. ADL is working on a super app, which is to drive engagement between the group businesses and consumers across these business segments. “The super-app will combine apps of multiple business units that are built individually and will be merged by 2023,” according to the report. The company hopes to connect with 120 million users through the super app by 2025 and with 400 million people by 2030, it added.

Despite the stated B2C ambition, the company’s next set of strategic investments still seem to be in the B2B space. These investments will be “centred on green hydrogen, airport management, roads, data centers, copper, aerospace and defence, PVC and water infrastructure,” said the report.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.