At the ongoing Auto Expo, even though electric vehicles (EVs) and Sports Utility Vehicles (SUVs) remained the talking points, there was also an exhaustive showcase of ‘Gizmos-on-wheels’ or The Internet of Things (IoT)-enabled vehicles by most of the original equipment manufacturers (OEMs). Most of the exhibitors at the Expo, such as MG, Hyundai, Lexus, etc., have unanimously affirmed that ‘Connected Cars’ is the ‘next big thing’ in the passenger vehicle (PV) market in addition to electric mobility.

Industry observers reckon that there is an unprecedented demand for embedded telematics as car buyers seek higher levels of safety, comfort, and convenience while driving their vehicles.

In layman’s terms, a “connected car” refers to any PV, which has embedded software that enables the user to communicate with external gadgets, such as smartphones or smart devices (at home) or other vehicles via wireless communication technologies, such as Bluetooth, Wi-Fi, etc.

Som Kapoor, EY India Automotive, Future of Mobility Leader (Consulting), and Partner, said,“With the advent of the 5G tech, more and more connected features will be launched by OEMs. Most cars will have such products as standard features across car segments. Some of these features make the mobility of the future possible too.”

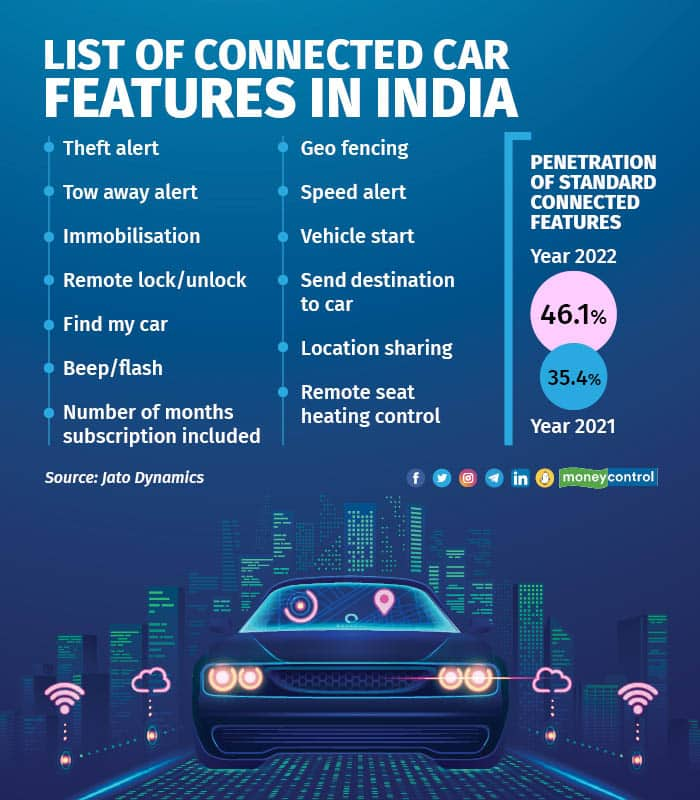

As per data shared by Jato Dynamics, the penetration of connected cars in the Indian PV market was 35 percent in the calendar year 2021, which went up to 46 percent in 2022 and is expected to shoot up further to 63 percent this year.

As Ravi Bhatia, Director, of JATO Dynamics, told Moneycontrol, “The cars are transforming from hardware-driven vehicles to software-driven vehicles. As a result, phenomenal possibilities have opened up. There are possibilities for better user experience in terms of infotainment, safety, and comfort.”

The global connected car market size is projected to reach $191.83 billion by 2028, exhibiting a compounded annual growth rate (CAGR) of 18.1 percent during the forecast period, as per the report titled "Connected Car Market 2021-2028 “ prepared by Fortune Business Insights.

“Connected cars are able to create an opportunity in terms of data gathering for insurance players, e-commerce players to offer customised services, regulatory bodies, OEMs, tech players, etc. The user’s driving behaviour can also be monitored and services offered accordingly added Bhatia.

OEMs jump on the in-car connectivity bandwagon

MG Motor India, which claims to have launched India's first internet SUV Hector in 2019, introduced the model’s new version at the Expo. Positioned as India's most tech-loaded car in its segment, the new Hector is equipped with India’s largest 14” HD portrait infotainment system. Additionally, the company claims to have more than 75 Connected Car Features in the newer version.

Gaurav Gupta, MG Motor India's Chief Commercial Officer, told Moneycontrol, “The way we are seeing the progression and acceptance, we all realised we live in a connected world today, and the vehicle now becomes like your second home. And this transition from home to the vehicle to wherever you're going, whether it's a workplace or play place, etc., we see this all in the continuum. And therefore, the connectivity of the vehicles becomes very, very critical and important.” He also added, “I will not be surprised if, at some point in time, more than 50 percent of customers will like to have a connected car.”

Similarly, Hyundai Motor India offers connected-car technology called Blue Link in several models. It has sold nearly 3.5 lakh connected cars until now and is banking heavily on this technology. At the Auto Expo, a South Korean carmaker, at an introductory price of Rs 44.9 lakh, rolled out the Ioniq5 e-car, which is equipped with 60+ connected features.

“Apart from 60+ features, we have the ADAS Level 2 technology, which makes it a very, very safe car. And these are more than voice-enabled features. Basically, the whole idea is that wherever he is — even if the customer is in the car, he stays connected,” says Tarun Garg, Chief Operating Officer (COO) of Hyundai Motor India. He also revealed, “Last year, we ended up with a penetration of 26 percent in connected cars, which used to be 4 percent in 2019. And in models like Creta and above segments, almost 50-80 percent of vehicles are connected. So, I think the connected penetration is only going to increase going forward.”

Toyota’s luxury arm Lexus, which made its maiden participation at the Expo, has launched its fifth-generation RX SUV, which is equipped with a 14-inch touchscreen and a host of connected features such as remote start etc.

“So, more and more connected cars will come to India in the future. In the future, as the infrastructure and the network grows, more and more cars get connected( these cars will start talking to each other also and that is how the business will grow,” revealed Naveen Soni, President, Lexus India.

PV market leader Maruti Suzuki India Limited (MSIL), which has expanded aggressively in the premium car segment over the last few years, is also anticipating a huge demand for tech-loaded models including the recently-launched Jimny and Fronx SUVs.

“So, connected technologies, which are now standard fitment in most of our vehicles, enable real-time monitoring of many parameters. Nearly 45 percent of our sales from hi-end models, such as the Brezza, Baleno, Ertiga, XL6 and Grand Vitara are generated from variants which are equipped with our ‘Suzuki Connect’ technology,” revealed Shashank Srivastava, ED- Sales and Marketing, MSIL.

However, the advent of smart technologies in a vehicle has its downsides too. As Bhatia from Jato puts it, “As with all technology platforms the developers will need to address the security concerns around hacking. This requires OEMs to make investments in a platform and develop a plan to scale up.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.