BUSINESS

Rising compliance costs, processes stifling smaller PMS funds, say portfolio managers

Smaller PMS players are finding cumbersome compliance processes and related costs stifling growth and skewing the playing field in favour of larger players.

BUSINESS

AIF fund managers seek higher F&O exposure, separate category of high risk funds

Market experts said the main reason for SEBI capping derivatives exposure for AIFs and MFs is that they handle public money. But some AIF money managers counter that saying there should be a level playing field between AIFs and FPIs, because both are regulated by Sebi and both raise money from sophisticated investors.

BUSINESS

Five stocks Saurabh Mukherjea is betting on

Mukherjea is betting on stocks that are gaining market share from the unorganised segment and those diversifying smartly.

BUSINESS

Andar ki baat: Saurabh Mukherjea swaps Jockey's Rs 200 innerwear for Zudio's Rs 100 ones, confident of making millions from the emerging trend

Trent, which owns the Zudio brand, is a play on a nimble-footed innovative challenger brand that is taking away market share from local players.

BUSINESS

Identify mischiefs and tell us, Sebi chief Buch tells PMS players

The banker-turned-regulator made it clear that such reporting of those indulging in wrongful conduct is in the "self-interest" of the market participant.

BUSINESS

Get ready for higher brokerage charges under Sebi's new diktat

On July 1, the Securities and Exchange Board of India issued a circular, stating that market infrastructure institutions, which include stock exchanges, depositories and clearing corporations, should charge a uniform fee from their members and not offer any rebate for bringing more volume.

BUSINESS

Defence component supplier TechEra Engineering to raise Rs 35 crore via IPO

The price band is estimated to be in the range of Rs 75-80 and the company is looking to list by the second half of July, according to a person familiar with the process.

BUSINESS

Family offices betting big on unlisted space

Their exposure to listed companies is decreasing, largely due to the compelling opportunities in the tech sector that have emerged in private markets post-COVID-19.

BUSINESS

Budget 2024: AIFs seek tax parity with FPIs

BUSINESS

Many PEs waiting to get an exit, banking and auto to be in focus: Hitesh Zaveri of Axis

Zaveri is of the view that while valuations in defence companies are rich, the substantial and increasing order books justify these valuations.

BUSINESS

AIF body seeks tax parity with FPIs in pre-budget meeting

The Indian Venture and Alternate Capital Association (IVCA) also suggested measures to encourage large domestic capital pools of insurance and pension funds to participate in the AIF industry to finance infrastructure, credit and start-ups.

BUSINESS

Top 10 Category III AIFs in May: ICICI Prudential's Growth Leaders Fund and Emerging Leaders Fund on top spots

ICICI Prudential's Growth Leaders Fund received the highest returns of 4.07 percent in May, followed by ICICI Prudential's Emerging Leaders Fund with 3.96 percent.

BUSINESS

Family offices await clarity from RBI before firming up GIFT City plans

A person familiar with the matter said on the condition of anonymity that the central bank may not be comfortable with family offices transferring significant sum out of India.

BUSINESS

Prabhudas Lilladher Advisory plans fund-raise through preferential allotment, IPO in two years

Funds raised through preferential allotment to be used to expand margin funding book, and growing the asset management business.

BUSINESS

ASK, Marcellus, Motilal Oswal PMS schemes witness largest net outflows in May

ASK's Indian Entrepreneurship Portfolio, Marcellus' Consistent Compounders, and ASK's India Select Portfolio, which saw outflows in the previous month, once again featured in the list of top ten PMS schemes in terms of monthly outflows in May.

BUSINESS

Here are top 10 PMS schemes that saw the largest net inflows in May

ICICI Prudential PMS's Contra Strategy attracted the highest inflows of Rs 464 crore in May, which pushed the AUM of the scheme to Rs 6,844 crore. The scheme’s May return was pegged at 3.50 percent.

BUSINESS

Block deals on the rise as institutional investors look to book profits

Market participants attribute this trend to private equity players who have been consistently selling blocks of shares on which they have been sitting on significant notional gains.

BUSINESS

Top PMS in May: Unifi Capital and ASK Investment Managers take the lead

The top 10 PMSes gave between 6-17 percent returns in May as per data by PMS Bazaar.

BUSINESS

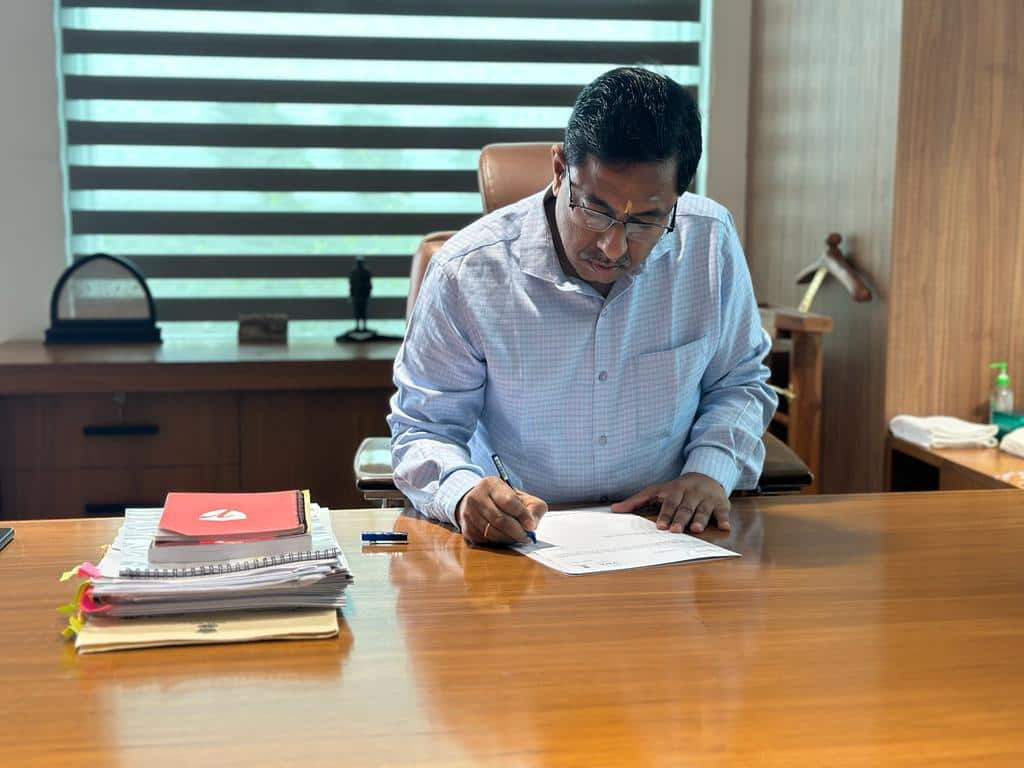

Active outreach initiatives are on to attract global players to GIFT City, says IFSCA chairman

According to IFSCA Chairman K Rajaraman, GIFT City offers a lot of benefits to companies across sectors and hence the policy makers are continuously carrying out outreach programmes with various overseas companies.

BUSINESS

Rules for direct listing in GIFT City to be out in June, says IFSCA chairman

Once the regulations are in place, companies are expected to file their applications with the regulator in the next two months.

BUSINESS

PMS distributor test is a hard nut to crack, say market players

Market participants attribute the lower pass rate in PMS exam to the structure of the test, which many find difficult to clear.

BUSINESS

HFT Scan: Nova Agritech and National Fertilizers in focus

Likhitha Infrastructure touched a 52-week high on June 10.

BUSINESS

Trading Plan: Will Nifty, Bank Nifty continue to consolidate ahead of US Fed meet?

Analysts expect the Nifty to consolidate and prepare for the next leg of growth, with key resistance anticipated at 23,500.

BUSINESS

Analyst Tracker: Kotak Mahindra Bank stock gets most brokerage rating upgrades in May

Kotak Bank's cheap valuations and a fall in gross NPAs have prompted brokerages to upgrade their ratings on the stock. Although RBI restrictions could affect the growth, the stock price correction has factored in the impact, say analysts.