BUSINESS

Hefty merchant banking fees: IPO could be a success but stock could well be in doldrums

The current calendar year has seen two mainboard IPOs in which the merchant banking fee was in excess of seven percent of the issue size – significantly higher than the industry average of 2-3%.

BUSINESS

Top ten AIFs give 3-6 percent returns in August; Generational Capital Breakout on the top

Generational Capital Breakout Trust's Breakout Fund 1 gave the highest returns of 6.36 percent in August.

BUSINESS

Creating an impact: Indian family offices up the game on impact investing

Experts add that impact investing and corporate social responsibility serve different purposes even though both aim to create a positive change.

BUSINESS

Top 10 PMS funds in August deliver up to 12% returns: Valcreate leads with digital focus

The top ten Portfolio Management Services (PMS) in August delivered returns between 6 percent and 12 percent.

BUSINESS

Family offices bet big on startups: From burgers to space-tech, here are the top picks

Data from Tracxn shows that start-ups like quick service restaurant chain Burger Singh, eco-friendly footwear brand Neeman’s, non-alcoholic beer brand Coolberg, online-jewellery brand Bluestone and space-tech startup Agnikul Cosmos, which focuses on developing launch vehicles, among others have attracted investments from many family offices

BUSINESS

PMS tax has been blown out of proportion as investors care about net returns, says Alchemy's Alok Agarwal

Quant-based investing helps remove human biases by following predefined rules, offering a distinct advantage over traditional active management, said Agarwal.

BUSINESS

India's IT revolution started with NSE's success: Ashish Kumar Chauhan

NSE has 10 crore unique investors registered with the exchange, with 19 crore trading accounts covering 99.84 percent pincodes in the country, the stock exchange’s MD and CEO said

BUSINESS

India’s family offices boom: 7x growth in six years

The AUM of family offices in India is estimated to be around $30 billion, which is a fraction of the global AUM of family offices, which is around $6 trillion, as per a study by Sundaram Alternates.

BUSINESS

Will ensure FPIs can access funds on T+1, says Sebi member Ananth Narayan

The reason for the delay is a delay in receiving the tax certificate, said Narayan

BUSINESS

Families re-investing money in equities after diluting stakes in their companies: JM Financial’s Vishal Kampani

Kampani also said that domestic investors are adopting a more strategic, long-term perspective, typically taking a 3-4 year view on IPOs rather than a speculative one

BUSINESS

GIFT City focused on tapping NRI segment: K Rajaraman of IFSCA

Rajaraman said that there is a growing retail segment of 4,000 NRIs who have almost $800 million in savings accounts

BUSINESS

Markets are neither cheap nor expensive, investors need to keep return expectations low: Vikas Khemani

Manufacturing in India today is where China was in 2005, and we see a massive wealth creation opportunity, said founder of Carnelian Asset Advisors

MARKETS

Discussion paper on tweaking regulations for SME IPOs expected by year-end: Sebi's Ashwani Bhatia

While speaking to Moneycontrol on the sidelines of the Global Fintech Fest in Mumbai, Bhatia hinted that if there are signs of manipulation in the mainboard IPO segment, the board will take action.

BUSINESS

F&O consultation paper received 6,000 responses: Sebi chief Madhabi Puri Buch

The Working Committee on Futures and Options had proposed tighter F&O regulations to boost market stability and protect small investors

BUSINESS

Compliance should be like low hum in every company's background: Sebi's Madhabi Puri Buch

Compliance should ultimately be just like we are breathing, says Madhabi Puri Buch at Global Fintech Fest 2024

BUSINESS

AIFs likely to become preferred investment vehicle for family offices: Study

Family offices, however, are not going big on startups as their allocation is expected to remain at current levels going ahead. Allocation towards real estate and fixed income is expected to fall by three percent and eight percent respectively.

BUSINESS

Allow IAs & RAs to advise on non-equity asset classes as well, market players' suggestion to Sebi

The consultation paper assumes significance as recently Sebi whole-time member Kamlesh Varshney discussed a framework to bring the large number of unregistered financial advisors – finfluencers – under the regulatory ambit by easing norms for IAs and RAs so that it becomes easier for more people to register themselves.

BUSINESS

Indian markets likely to open positive after rate cut commentary from Jackson Hole Economic Symposium

In the current month till date, FPIs have been net sellers at nearly $2 billion after staying net buyers during the previous two successive months – June and July.

BUSINESS

Interach Building Products to list at 30-40% premium say experts

The company intends to raise Rs 200 crore via fresh issue, and another Rs 400.29 crore through offer-for-sale (OFS), at the upper end of the price band at Rs 850-900 per share.

BUSINESS

Micro SIPs can play a role in MF growth story, but needs to be well thought over: Mutual Fund CEOs

Most fund houses require a minimum monthly investment of Rs 1,000 for SIPs, with only a few permitting SIPs as low as Rs 500, and even fewer allowing investments of just Rs 100 per month

BUSINESS

Debt PMSes could outshine debt MFs if equities see profit booking, say experts

A debt PMS usually gives higher returns than a debt mutual fund because the former has a concentrated portfolio and no limit on weightage to one particular bond or commercial paper, says an expert

BUSINESS

Top 10 Category III AIFs in July: InCred's Emerging Business Fund leads with 11.46% return

At the top was InCred Asset Management's Emerging Business Fund with a return of 11.46 percent in July.

BUSINESS

Sebi wants advisory body ISF to evolve sector-specific, standard KPIs for IPO prospectus

The ISF, which has representations from ASSOCHAM, FICCI and CII, will decide what true KPIs are while not limiting the list only to financial and operational metrics, said a person familiar with the development.

BUSINESS

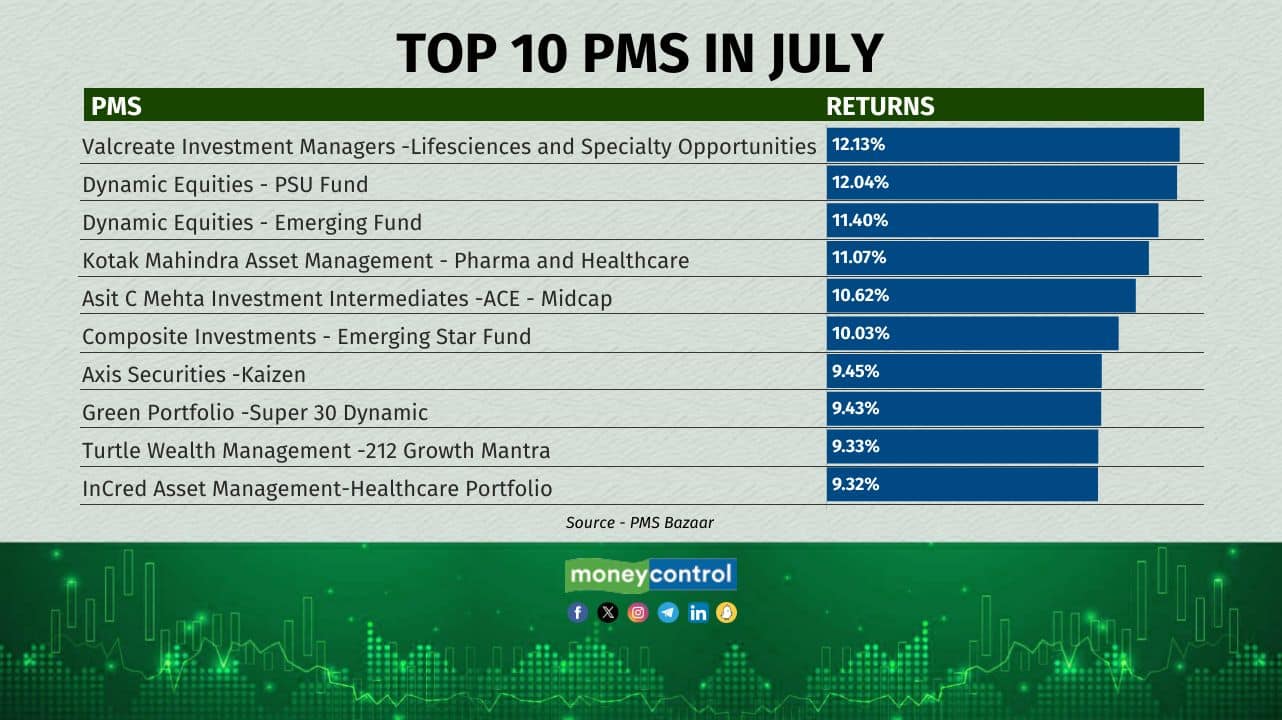

Top 10 PMS in July: Valcreate Investment Managers takes the first position

According to data from PMS Bazaar, Valcreate Investment Managers - Lifesciences and Specialty Opportunity Fund ranked first, with a return of 12.13 percent in July. It was followed by Dynamic Equities - PSU Fund and Dynamic Equities - Emerging Fund, which secured the second and third positions with returns of 12.04 percent and 11.4 percent, respectively.