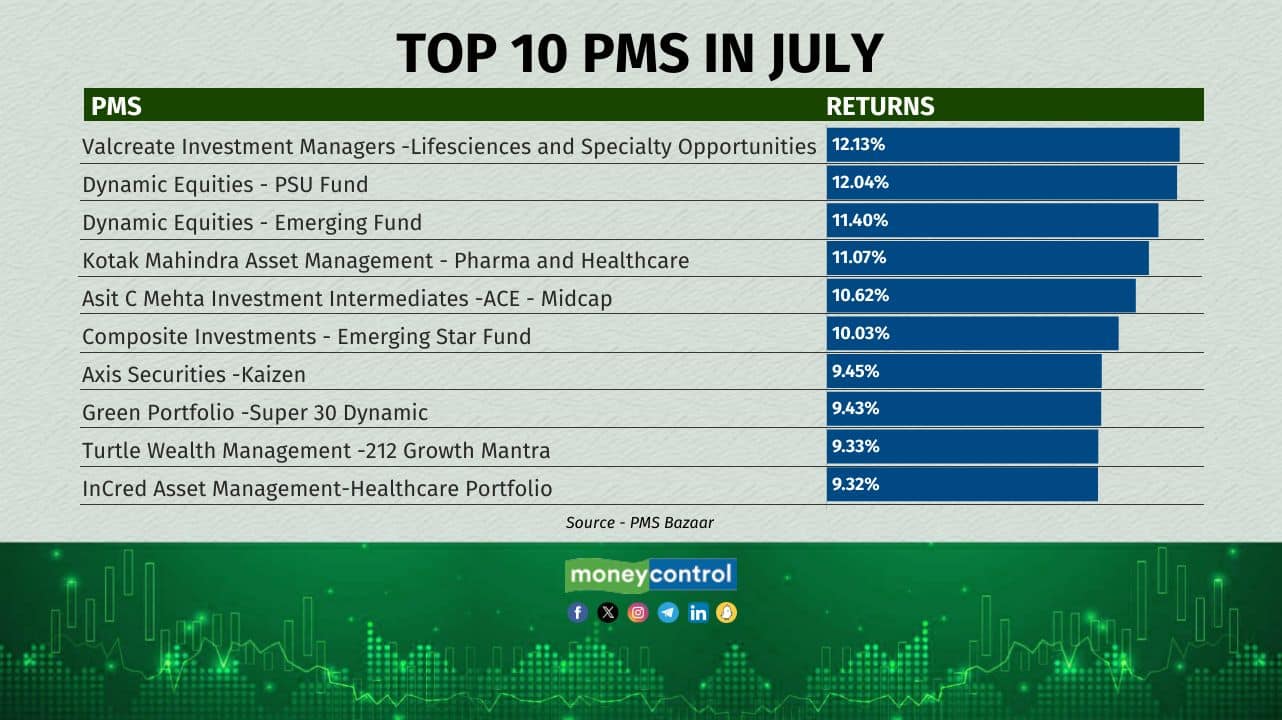

Top 10 PMS in July: Valcreate Investment Managers takes the first position

According to data from PMS Bazaar, Valcreate Investment Managers - Lifesciences and Specialty Opportunity Fund ranked first, with a return of 12.13 percent in July. It was followed by Dynamic Equities - PSU Fund and Dynamic Equities - Emerging Fund, which secured the second and third positions with returns of 12.04 percent and 11.4 percent, respectively.

1/11

The top 10 Portfolio Management Services (PMS) in July in terms of returns delivered between 9-12 percent. According to data from PMS Bazaar, Valcreate Investment Managers - Lifesciences and Specialty Opportunity Fund ranked first, with a return of 12.13 percent in July.

It was followed by Dynamic Equities - PSU Fund and Dynamic Equities - Emerging Fund, which secured the second and third positions with returns of 12.04 percent and 11.4 percent, respectively.

It was followed by Dynamic Equities - PSU Fund and Dynamic Equities - Emerging Fund, which secured the second and third positions with returns of 12.04 percent and 11.4 percent, respectively.

2/11

Valcreate Investment Managers - Lifesciences and Specialty Opportunity Fund is managed by Rajesh Pherwani. The fund has exposure to sectors such as agrochemicals, pharmaceuticals, and specialty chemicals. It has a 54 percent exposure to small-caps and a 27 percent exposure to large-caps. The PMS focuses on companies with technocrat promoters, extensive product pipelines, and low competition.

3/11

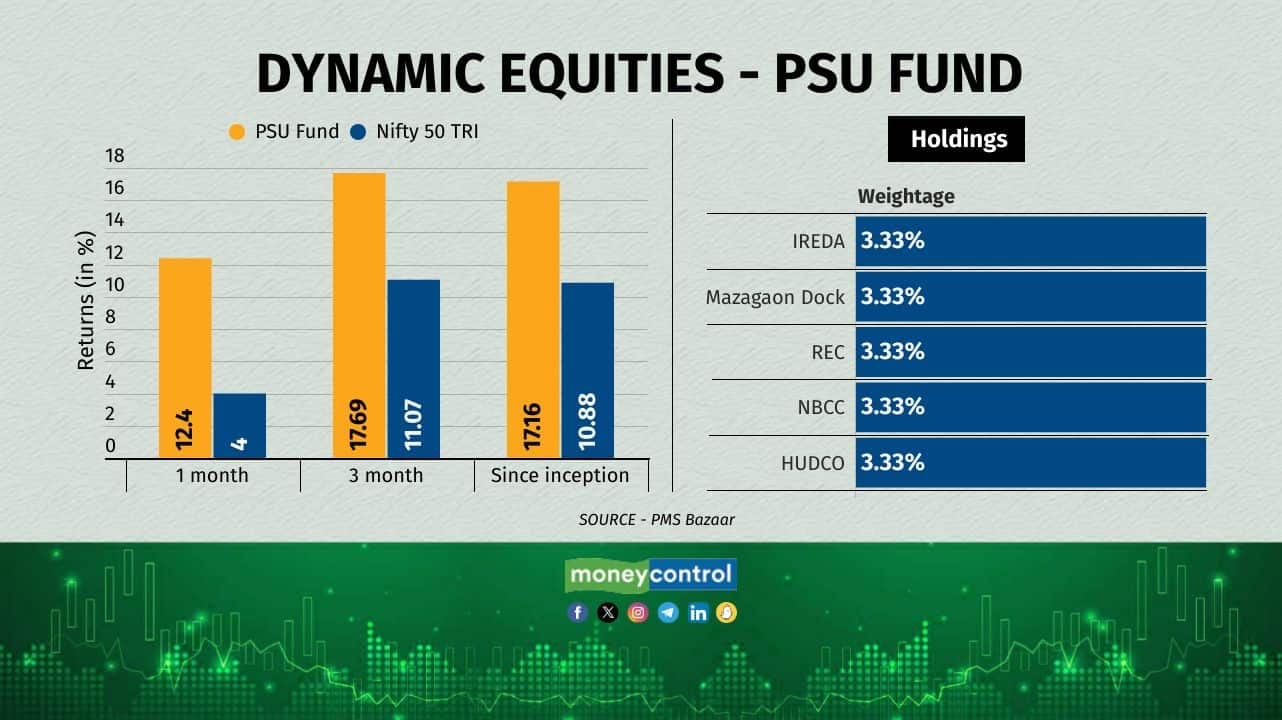

Dynamic Equities - PSU Fund is managed by Shailesh Saraf. The stocks in this portfolio are selected based on criteria of high growth and low valuation. The portfolio is heavily weighted toward aerospace, defence, and railways sectors.

4/11

Dynamic Equities - Emerging Fund is also managed by Shailesh Saraf. The portfolio has exposure to sectors such as civil construction infrastructure, auto components, industrial products, and stock broking.

5/11

Kotak Mahindra Asset Management - Pharma and Healthcare Portfolio has an AUM of Rs 29.11 crore. The fund has a 52 percent exposure to large-caps, 33 percent to mid-caps, and 11 percent to small-caps. The strategy believes that global pharmaceutical companies are increasingly outsourcing from India to reduce R&D costs. Additionally, it projects that the Indian API industry has the potential to more than double to $24 billion in the next six years, driven by rising domestic demand and a boost to exports due to the China Plus 1 strategy.

6/11

Asit C Mehta - ACE Midcap is managed by Deepak Makwana. The portfolio has an exposure towards sectors like financial services, capital goods, oil and gas, and power.

7/11

Composite Investments - Emerging Star Fund is managed by Vinod Jayaram. The portfolio has exposure to healthcare, consumer durables, financial services, automobiles, and IT. It has a 72 percent exposure to small-caps, 16 percent to large-caps, and 11 percent to mid-caps.

8/11

Axis Securities - Kaizen is managed by Naveen Kulkarni and has an AUM of Rs 254 crore. The fund has an exposure to sectors such as capital goods, automobiles, healthcare, construction, and oil and gas. The portfolio selects stocks based on criteria such as lean production, innovation capabilities, and prudent capital allocation policies.

9/11

Green Portfolio - Super Dynamic 30 is managed by Divam Sharma and has an AUM of Rs 168 crore. The portfolio has an exposure to sectors such as capital goods, healthcare, telecommunications, and construction.

10/11

Turtle Wealth Management - Growth Mantra is managed by Rohan Mehta. The fund has an exposure to sectors such as capital goods, construction, metals, oil and gas, and automobiles.

11/11

Incred Asset Management - Healthcare Portfolio is managed by Aditya Khemka. Within the healthcare sector, the portfolio selects companies involved in hospitals, APIs, branded generics, unbranded generics, and diagnostics.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!