BUSINESS

Outbound funds see low uptick at GIFT City due to regulatory, tax challenges

As of September 2024, there were a total of 128 fund management entities set up in GIFT City with the cumulative number of schemes pegged at 168 with commitments totalling $12.13 billion.

BUSINESS

Five tips from top PMS managers for 2025: Invest in growth sectors and proxy plays

In a similar context, Divam Sharma, founder and fund manager of Green Portfolio Investors says that investors should refine their strategies and focus on growth-oriented sectors and proxy-plays for maximising returns

BUSINESS

Defined stop loss, adapting new strategies; here's what F&O experts are advising for 2025

Considering index and equity options, defining stop losses, proper risk management for smaller contracts is required while trading in derivatives, say experts.

BUSINESS

Importers take Tanzania, Thailand route to bring gold disguised as platinum alloy

According to multiple sources familiar with the development, importers are using a legally available route by importing alloy that has a platinum content of more than two percent – the rest is predominantly gold – and be in complete compliance with the Customs Tariff Act.

BUSINESS

Key themes for 2025: Fund managers betting on insurance, IT, manufacturing, and discretionary sectors amid valuation comfort

The manufacturing sector is poised for growth because of Make-In-India, targeted PLI schemes for electronics, pharmaceuticals, and batteries, Neelesh Surana of Mirae Asset Managers India said.

BUSINESS

SEBI working on 'acceptable' form of much-feared and tough PUSTA regulations

Sources say that there is a consensus within SEBI that ex-parte interim orders should not be allowed under PUSTA as it will be unfair to the alleged wrongdoers.

MARKETS

Clamour for accredited investors regime comes from fund managers, says Sebi's Ananth Narayan

Sebi yet to come across investors who say "go easy on regulations", said Narayan

BUSINESS

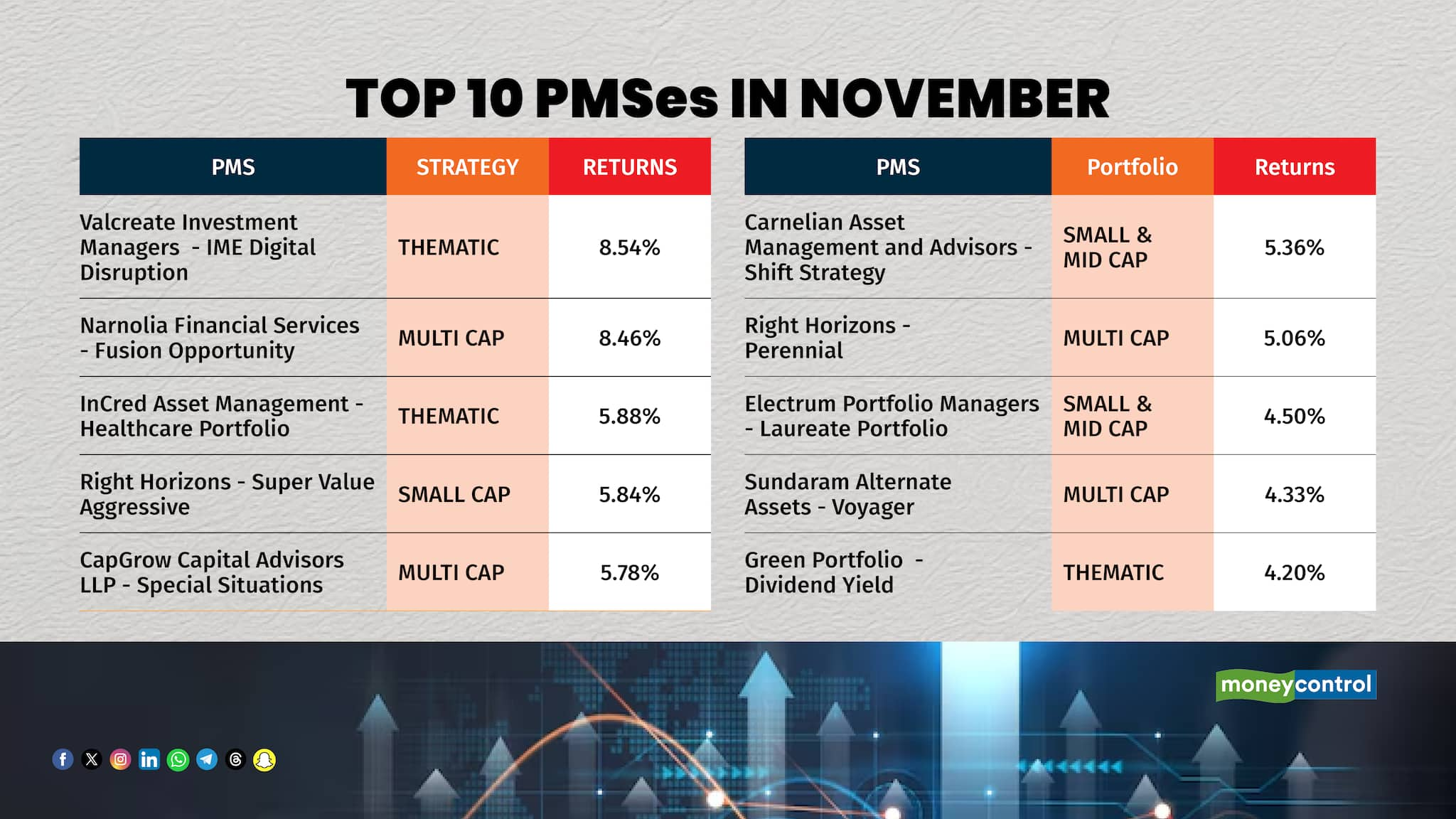

Top 10 PMSes in November: Valcreate Investment Managers and Narnolia Financial Services at the top

Among the top names were Carnellian, Incred Asset Management, Right Horizons, and others.

BUSINESS

MC Exclusive: Expiry day volatility: SEBI’s Ananth Narayan says watching if more steps need to be taken

Depending on the outcomes, we will consider and consult on any further regulatory or developmental steps required to be taken, Narayan said.

BUSINESS

Consumption stocks crowd pessimism list in November; Asian Paints, Titan, Britannia among top ten

As of November, Asian Paints had 18 sell calls, Nestle 7 sell calls, while Titan and Britannia Industries had 5 sell calls each.

BUSINESS

MC Exclusive: Brokerages, APs facilitates dabba-trading to make up for business lost to SEBI's new F&O norms

With the new index-derivatives norms rolled out from the end of November, brokerages and their distributors are finding alternative sources of revenue.

BUSINESS

Zero brokerage isn’t free as brokers earn from float, says Sebi's Ananth Narayan

Total amount of cash-equivalent collateral that investors put in the ecosystem in an average day is around Rs 4.5 lakh crore, the SEBI whole-time director said

BUSINESS

Ambit retains Zomato as its core holding in Dec, says business model only partly imitable by Swiggy, Zepto

Zomato has a high average order value in food delivery as well as quick commerce. Competitors who try to copy the business model of Zomato can only partially imitate this, says the asset manager

BUSINESS

IPO-bound Vishal Mega Mart says discounted products helped retain customer base, fend off e-commerce rivals

In the FMCG segment, more than 50 percent of Vishal Mega Mart's revenue comes from its in-house brands, which CEO Gunendar Kapur highlighted as a key differentiator.

BUSINESS

Mobikwik cuts IPO size from Rs 1,900 cr to Rs 572 cr; founder Bipin Singh explains why

The company is also planning to expand its distribution arm which is selling loans and mutual funds. 'The aim is to lead with payments, get the users engaged, and then cross-sell other products like loans and mutual funds,' Singh said.

BUSINESS

Indus Towers promoters sells Rs 2800 crore worth shares in a block deal

As of September 30, Usha Martin Telematics Limited had a 0.74 percent stake and Omega Telecom Holdings Private Limited had a 2.26 percent stake in Indus Towers.

BUSINESS

70% chance that RBI will cut rates by 25 bps in upcoming MPC; says Deepak Agrawal of Kotak Mahindra MF

The weak GDP growth in Q2FY24, at 5.4%, compared to 6.7% in Q1FY24, results in an average first-half growth of around 6 percent, Agrawal said

BUSINESS

Strong IPO pipeline making Indian markets more vulnerable to FII flows, says Axis MF

In the second half of the year, the supply of new stocks in the market is expected to be much higher than in the first half, the report said.

BUSINESS

IPO frenzy cools down in November as subscription levels take a hit

Data from Prime Database shows that the average subscription level for mainboard IPOs in November fell to 1.9 times, a sharp decline from 16 times in October and 76 times in September.

BUSINESS

Polls over, earnings growth should recover as government spending, festive consumption improves, says Anand Shah of ICICI Prudential

As government spending picks up after the elections and festive consumption improves, we should see earnings growth recover, Shah says.

BUSINESS

Easy credit fueled India’s spending surge from iPhones to washing machines. But the party may be over

Experts suggest that India’s consumption demand hinges on jobs growth accompanies by rate cuts

MARKETS

Stocks of quality firms at any price doesn't work, says Sunil Singhania of Abakkus

Singhania said valuations must align with the growth in revenue, operating profit and net profit

BUSINESS

Consumption isn't slowing, but market share is shifting, says Vikas Khemani of Carnelian

Khemani says that the landscape has changed, with capex now being funded more through equity than borrowing.

BUSINESS

BSE's new F&O expiry cycle will help ease volatility and free capital, say experts

Market participants say that since the expiries were concentrated on consecutive days -- Thursday and Friday -- capital of traders was tied up for longer periods, limiting their ability to reinvest or trade on other days. Nifty50 weekly contracts expire every Thursday.