BUSINESS

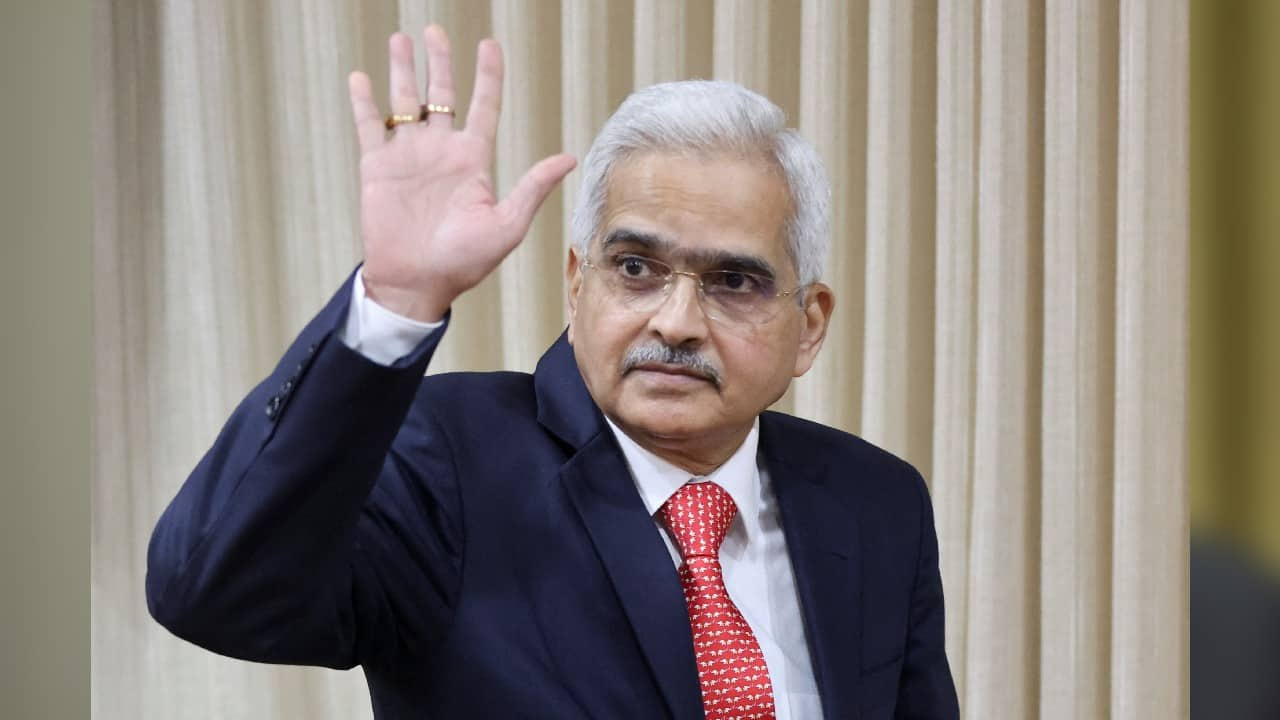

Shaktikanta Das Q&A| RBI’s endeavour is to bring inflation closer to 4 percent

Also, how the central bank governor perceives India’s economic growth, his outlook on liquidity management, and more

BUSINESS

Bond yields likely to stay in a range till September post RBI cues, say experts

RBI today kept the cash reserve ratio unchanged at 4.50 percent, a move that led to a drop in government bond yields. The benchmark 10-year yield closed at 7.49 percent today, 3 bps below yesterday’s closing level. The shorter five-year bond yields dropped 10 bps.

BUSINESS

Supreme Court’s decision on Siva Industries may set a good precedent for IBC cases, experts say

The court’s June 3 order will give more power to lenders and ensure speedy recovery in cases under the bankruptcy court, according to bankers and legal experts

BUSINESS

NCLT to hear Amazon’s petition not to initiate IBC proceedings against Future Retail

This is the third time that the court delayed admission of insolvency proceedings against the debt-laden retailer. The case is adjourned for June 10.

BUSINESS

47% of IBC cases ended in liquidation till FY22, shows IBBI data

Indian lenders are left with no choice except liquidation of stressed assets under the bankruptcy code, thanks to a mismatch between the quoted value of the asset and the bid price, experts said.

BUSINESS

Banks struggle to make Jan-Dhan accounts cost-effective and viable, eight years on

The Pradhan Mantri Jan-Dhan Yojana has largely met its objective of providing every adult a bank account. Yet, banks are still trying to figure out how to make the accounts cost-effective

BUSINESS

State-run banks’ net profit almost equals reported frauds in banking sector in FY22

According to the Reserve Bank of India’s annual report released on May 27, banks reported 9,103 frauds in FY22, involving Rs 60,414 crore. Interestingly, the total net profit of 12 state-run banks during FY22 stood at Rs 66,541 crore

BUSINESS

As yields soar, NABARD scraps Rs 5,000-crore bond issue, HDFC gets tepid response

Bond issuances are likely to stay subdued at least till the June 8 monetary policy for bond yield spreads to adjust and as clarity on interest rates emerges, a majority of money market participants have said

BUSINESS

Banks may not cut lending to steel sector despite export duty hike, say rating agencies

The government, on May 21, increased the duty on exports of iron ore to 50 percent from 30 percent and imposed 45 percent duty on pellets. It also imposed a 15 percent export duty on hot-rolled and cold-rolled steel products from nil earlier

BUSINESS

Bank of India aims to recover bad loans worth Rs 12,000 crore in FY23, says MD

The lender seeks to bring down government’s stake in the bank to 75 percent from 81 percent currently, and plans to raise funds through a qualified institutional placement of shares and follow-on public offer for the same in FY23, Atanu Kumar Das said

BUSINESS

G-Sec yield may harden to near 8% as market gears up for additional govt borrowing, say experts

The government over the weekend announced a slew of measures to fight inflation including a cut in excise duty cut on petrol that can have revenue implications

BUSINESS

Illegal loan sharks return in the guise of digital lenders

Instant loan providers are thriving, luring gullible consumers looking for easy loans only to harass them later using recovery agents, pushing many to commit suicide. Moneycontrol tracked a few such cases. Here’s what we found

BUSINESS

Global stagflation fears point to more pain for Indian rupee, say experts

The rupee has been depreciating against the dollar on worries of stagflation and aggressive interest rate hikes by the US Federal Reserve. In May alone, the rupee has dropped to a record low five times

BUSINESS

REPCO Bank may appeal RBI’s decision to reject universal bank permit application; others undecided

The RBI said six of 11 applicants were not suitable for permits of small finance bank and universal bank licences.

BUSINESS

India’s inflation heat : As prices skyrocket, poor households face a double whammy, cut spending

Expensive food and fuel have burnt a deep hole in the pockets of consumers; the poor have been particularly badly hit

BUSINESS

RBI Governor meets bank chiefs to discuss credit growth, asset quality

The meeting comes almost two weeks after the Monetary Policy Committee, in an off-cycle meeting on May 4, hiked the repo rate by 40 basis points to 4.4 percent, citing inflationary pressures

BUSINESS

Rising interest rates to positively impact net interest margin: SBI chairman

Also, why Dinesh Kumar Khara sees inflation as positive to some extent for economy, and more

BUSINESS

SBI plans to go big on co-lending partnerships, says Chairman Dinesh Khara

Co-lending refers to partnerships between two lenders, typically a bank and a non-bank, to offer loans to the economically weaker sections or borrowers under the so-called priority sector lending (PSL) programme. Banks are embracing co-lending to scale up business and tap credit growth.

BUSINESS

RBI may have to tolerate high yields, prioritise inflation, experts say

The RBI’s limitation in intervening heavily in the debt market signals that bond yields are likely to rise further as the banking regulator continues with the removal of policy accommodation, economists and money market experts say.

BUSINESS

NCLT delays admission of insolvency proceedings against Future Retail

This is the second time that the court delayed admission of insolvency proceedings against the debt-laden retailer. The court will now hear the case next on June 6.

BUSINESS

High interest rates may not dent housing loan demand in India, say experts

Despite the probability of continued rate hikes in the coming months, home loan rates are expected to be cheaper compared to pre-Covid levels and could be attractive for borrowers

BUSINESS

Personal guarantees can speed up bank loan recovery in default cases, say experts

The Supreme Court has said creditors can invoke personal guarantees to recover corporate loans, even if the insolvency process hasn’t been triggered

BUSINESS

Axis Bank plans to scale up credit card business, says slippages under control

The likelihood of non-banking financial companies (NBFCs) entering the credit card market will not lead to an incremental business disruption at Axis Bank, says Sanjeev Moghe, president and head, cards and payments at Axis Bank

BUSINESS

Explained | How does RBI intervene in the bond market? 5 key points

The RBI is walking a tightrope when it comes to debt market management as it drains surplus liquidity from the system in an effort to tame inflation