BUSINESS

How to get the best education loan? Here’s a primer

While many banks offer education loans for study in India and abroad, not every student may be able to get one easily and at an attractive interest rate. A lot depends on the pedigree of the institute that you have got admission to. Read on to know more.

BUSINESS

Do you need to redo your mutual fund KYC? It depends on your KYC status

Your mutual fund Know Your Customer (KYC) status may show as ‘validated’ or ‘registered’ or 'on hold'. Read on to find out what that means and what action you need to take

BUSINESS

How much money do you need for your retirement? Simply Save

A vast majority of Indians don’t undertake retirement planning. For the young, it’s not a priority. For the older generation, it is perhaps intimidating. In a conversation with Moneycontrol, Ravi Saraogi, a SEBI RIA and Co-founder of Samasthiti Advisors, talks about how to formulate a basic retirement plan and the key factors to consider. Listen in

BUSINESS

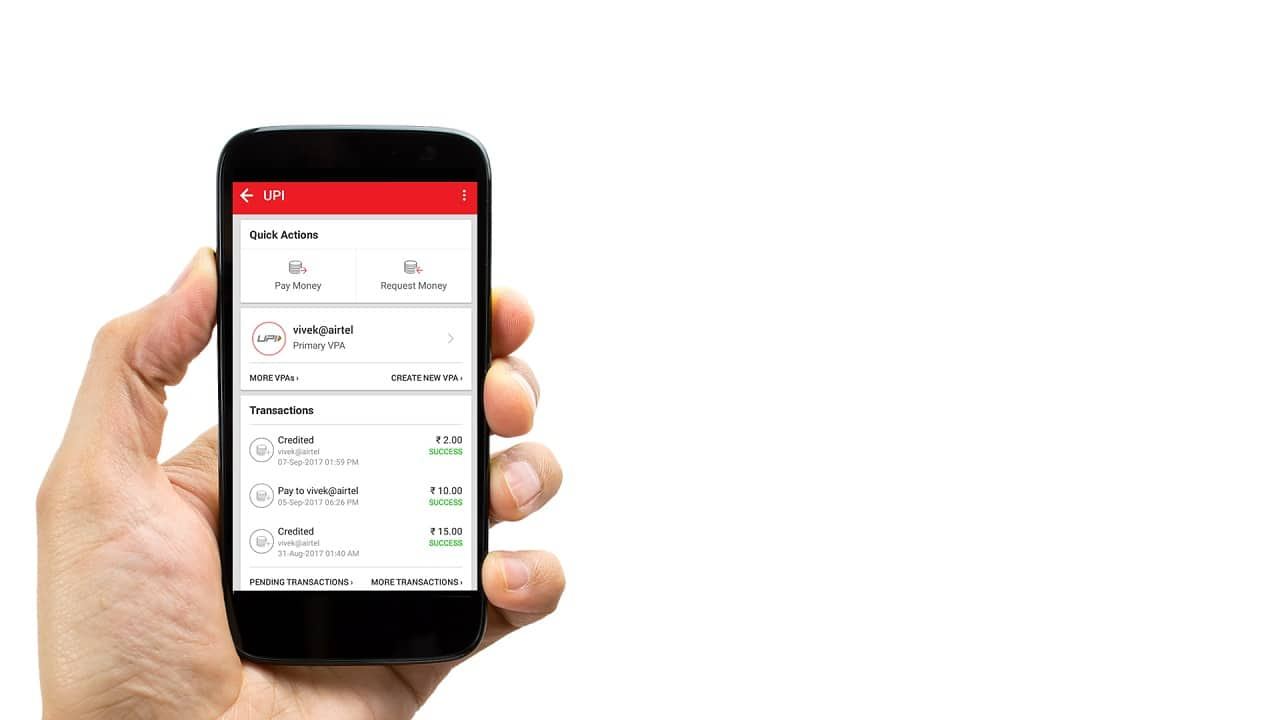

UPI transactions rise in number but average ticket size falls: Worldline India report

The ‘India Digital Payments Report’ (H2 2023) from Worldline India shows there were 65,771 million UPI transactions totalling Rs. 99,678 billion in value during July – December 2023, implying a year-on-year growth of 56 percent and 44 percent, respectively.

BUSINESS

RBI MPC: Prepaid payment instruments to be permitted to use third-party UPI apps for making payments

RBI MPC meeting: PPIs such as prepaid cards will be allowed to be linked to third-party UPI apps to provide greater convenience to users

BUSINESS

Will Vistara flyers get compensated by travel insurance for flight cancellations and delays?

For a traveller to be covered by his travel insurance policy, the reason for flight cancellation or delay must be listed as a peril under the policy. If that’s the case, the insurer will cover the amount that is not refunded by the airline, albeit up to a certain limit.

BUSINESS

The KYC Mutual Fund mess, and how to come out of it

After the 31 March deadline to revalidate one’s KYC expired, a mutual fund investor’s KYC status broadly falls under one of three categories. That determines whether you can continue investing in just your existing funds, or new funds with other AMCs, or you get blocked from all transactions.

BUSINESS

Mutual fund KYC March 31 deadline: Existing investors get some relief

Mutual fund investors no longer need to re-do the KYC for their existing MF investments. Earlier, failure to do so would have blocked them from transactions from April 1, 2024.

BUSINESS

March 31 deadline: MF investors must re-do KYC or be blocked from all transactions

If your mutual fund KYC is not based on an officially valid document as specified by CAMS and KFintech, you will have to re-do your KYC by March 31, 2024. Failure to do this will mean you will not be allowed to do any MF transactions from April 1, 2024.

BUSINESS

Interoperability in net banking won't hurt payment aggregators like Worldline India: CEO

Very few countries across the world are in a situation where both the government and the regulator are pushing for digital payments, as in India, says Ramesh Narasimhan, CEO, Worldline India. This has not only offered payments convenience, but also helped in financial inclusion

BUSINESS

Tax-saving: Exemptions you can claim under the new and old tax regimes

The new tax regime has done away with over 70 exemptions under the old tax regime. However, this does not mean that the new regime does not offer any benefit. Here are some key tax breaks that you can claim even under the new regime, which is the default system 2023-24 onwards.

BUSINESS

CA Ambar Dalal absconds with investors' money: Here’s how to spot a fraud investment scheme

Before you invest your money, make sure the person / entity you are dealing with is authorised to handle your money. It also helps not to get carried away by the promise of high returns, especially over a very short period of time.

BUSINESS

Narayana Murthy's Rs 240-crore gift of Infosys shares to 4-month-old grandson: Find out the tax implications here

Under the Income Tax Act, gifts from relatives are not taxed. Gifts received from one’s marriage or from a will are also not taxed, nor one’s inheritance. But gifts from non-relatives are taxed if the aggregate value exceeds Rs 50,000 annually. The limit is applicable separately on money and movable properties

BUSINESS

Where should you park Rs 10 lakh today? Swarup Mohanty of Mirae Asset has the answer

He suggests that medium-risk investors allocate 40 percent each to large cap funds and mid cap or multi cap funds (core portfolio), and the remaining 20 percent to good stories (investment themes).

BUSINESS

Investors can use MF Central for transmission of a deceased person’s mutual fund investments | Simply Save

Updating nomination for singly-held mutual fund (MF) investments can be easily done online. Apart from that, transmission of MF investments to the surviving family after an investor’s demise, too, can be completed online via MF Central, reveals Mario Sylvester Roche, COO of Domestic Fund Services at K KFin Technologies in a conversation with Moneycontrol.

BUSINESS

I-T dept flags financial reporting error after sending advance tax notices; asks tax-payers to wait for updates

The Income Tax department has clarified that due to a data reporting error by a yet-unnamed entity, taxpayers have received notices for paying higher advance tax for financial year 2023-24. The I-T department has now asked such taxpayers to wait for updated data.

BUSINESS

Breaking the glass ceiling: How women CAs have become their own bosses

International Women’s Day: Starting their own practice has given these women chartered accountants an opportunity to balance their professional and personal commitments. But running their own firm has had its own challenges ranging from getting clients in the initial stages to juggling multiple areas of specialisation and more.

BUSINESS

Credit card users can now choose between Visa, Mastercard, RuPay and Amex. Here’s what you need to know

Credit card users will now have the freedom to choose between card networks. Until now, your bank decided the networks the card you were issued was based on. The RBI's latest directive gives more choice to card customers

BUSINESS

Coming soon: March 15 is last deadline to pay advance tax

If you are anticipating a tax liability of Rs 10,000 or more in a year, get ready to pay advance tax. Failure to do so will attract 1 percent penal interest per month. But if you miss the March 15 deadline, you can still pay your advance tax by March 31, albeit with one month’s interest. So, don't wait until July 31 to do this.

BUSINESS

Credit Card Alert: Here are the charges you should be aware of

Many credit cards waive the joining and annual fees if you cross a certain annual spend. But there are many other charges that may be levied unless you pay off your credit card bill on time.

BUSINESS

Received an income tax SMS or email for mismatch of income? Respond to it on the I-T portal

Unless a taxpayer can provide a satisfactory explanation for the mismatch of income, he may have to consider filing an updated tax return. While failure to provide a response on the I-T portal will attract no penalty now, ignoring to resolve this matter can result in future litigation.

BUSINESS

Is your credit card application getting rejected? Try an FD-backed card

Opting for a fixed deposit-backed card could mitigate issues of a poor credit score or an uneven income flow that would otherwise stymie a credit card application

BUSINESS

AUM Sweet AUM: MF industry’s assets to double to Rs 100 lakh crore by 2030, says Axis Capital

The company says that the Indian MF industry’s assets are expected to grow at a CAGR of 14 percent between now and 2030. Retail investors will play a key role in driving this growth

BUSINESS

MF industry AUM to double to Rs 100 lakh crore by 2030, bite-size SIPs to drive growth

With 42 million unique investors, MF penetration in India is less than 5 percent of the working-age population. Monthly SIPs average at Rs 2,300, offering a significant room for growth, an Axis Capital report has said