BUSINESS

E20 rollout sparks insurance worries over mileage, engine damage; insurers say cover could be denied

Older E10 cars most at risk as insurers warn claims could be rejected over E20-related damage, industry executive says most existing fleet is E10-compliant

EXPLAINERS

How Aadhaar is emerging as a soft target for insurance fraud

Multiple police investigations conducted in several parts of the country over the past week have reportedly uncovered organised scam networks manipulating Aadhaar data to make bogus claims

BUSINESS

Health loss ratios up between 200-300 bps for general insurers in Q1FY26 amid claims spike

ICICI Lombard, Star Health, Niva Bupa, and New India Assurance were among the insurers that reported a deterioration in claims metrics

BUSINESS

Group non-single premiums plunge over 50% for second consecutive year

Sustained drop in group non-single premiums highlights challenges in corporate renewal business

BUSINESS

IndusInd Bank Chairman Sunil Mehta says bank’s focus to be on retail growth, secured lending, home loans after lapses

Mehta says that tensions between the US and China could have a cascading impact on India despite its largely domestic economic orientation

BUSINESS

PSU general insurers gain ground as private peers retreat from loss-heavy segments

If PSUs can keep combined ratios stable while sustaining higher premium mobilisation, the shift could become structural; if not, it will likely revert as private capital re-enters at repriced levels, analysts point out

BUSINESS

SBI regains home loan crown, outpaces HDFC Bank by Rs 8,000 crore to top the housing segment

SBI’s home loan portfolio for Q1 FY26 stood at Rs 8.51 lakh crore as of June 30, 2025, marking a robust 15.05 percent year-on-year growth

BUSINESS

No deal signed for health insurance yet, says LIC CEO R Doraiswamy

There is a delay in the deal, as we would like to observe the evolving health insurance market closely before making any definitive move, says Doraiswamy

BUSINESS

Banks may turn more cautious lending to the textiles sector after tariffs

While signs of stress in the textile sector had begun surfacing even before the tariff announcement, the tariff hikes could further dent order books, compress margins and put jobs at risk, leading to tightening of bank credit to the industry.

BUSINESS

Average daily surplus liquidity under RBI’s LAF doubled to Rs 3 lakh crore in four months

The sharp increase in the liquidity can be attributed to the durable liquidity infusion since start of this year by the RBI through various instruments such as open market operations (OMOs) purchases of governments securities and USD/INR buy-sell swap auctions.

BUSINESS

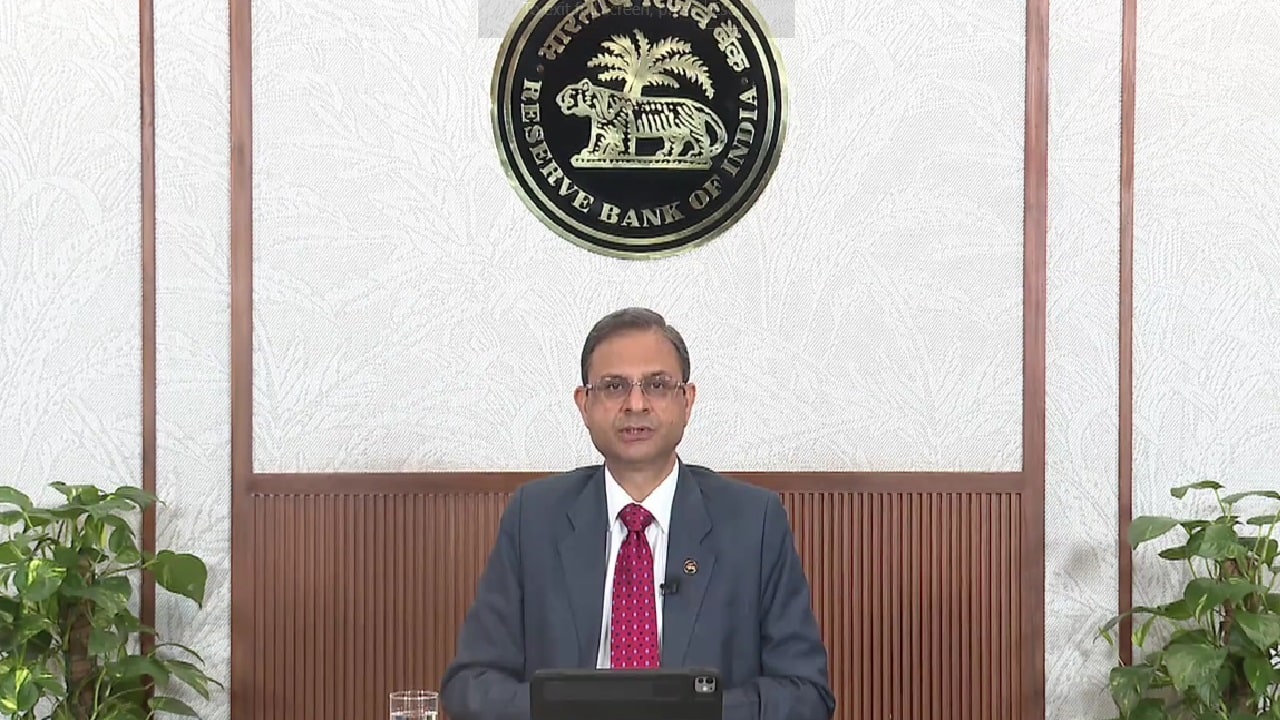

No major inflation risk seen if Russian oil imports fall, says RBI Guv Sanjay Malhotra

Crude oil is a key factor in inflation, but impact depends on sourcing mix, global prices and government response, says Deputy Governor Poonam Gupta

BUSINESS

RBI Governor clarifies UPI stance: Costs exist but who pays remains unclear

RBI Governor Sanjay Malhotra clarified, "I never said UPI cannot be free forever. The question, I believe, was whether charges like MDR would be passed on to consumers. I responded by saying that there are costs involved."

BUSINESS

Surplus liquidity helps better transmission of rate cuts in bond, credit market, says RBI governor

Between February and June 2025, the weighted average lending rate of scheduled commercial banks fell by 71 basis points for fresh rupee loans, of which 55 bps was directly due to the repo rate cut

BUSINESS

Gross FDI rises 5% in April-May but net inflows slip on $0.8 billion outflow

Foreign portfolio investment inflows into emerging market economies remained strong in May and June, amid improved global risk sentiment

BUSINESS

What led to the selloff in PB Fintech shares: IRDAI's regulatory action explained

IRDAI's action dates back to June 2020 when it conducted a remote inspection of PolicyBazaar’s operations during its IWA tenure and found irregularities in how it managed the sales processes, disclosures, partnerships, and premium flows.

BUSINESS

Future Generali is now Generali Central after Central Bank stake buy, with focus on serving SME borrowers

Despite Central Bank’s recent stake acquisition, Generali Central Insurance does not expect a significant near-term boost in business from bancassurance business, or insurance policies sold through the banking channel.

BUSINESS

Banks likely to re-evaluate corporate, SME lending plans as US tariffs hit exports

While credit demand from corporates has already been sluggish over the past two quarters, bankers say the new trade headwinds could further delay recovery in the segment.

BUSINESS

Motor stumbles, health surges as general insurers prioritise margin over growth in Q1

Motor insurance saw a pull back, fire made a comeback and health continued to grow in the June quarter as ICICI Lombard, SBI General, Shriram General and Niva Bupa adapted to pricing and policy shifts

BUSINESS

ICICI Lombard scaled down motor, fire insurance coverage over pricing pressure: CFO Gopal Balachandran

ICICI Lombard CFO Balachandran told Moneycontrol growing those segments may not make financial sense, citing stagnant third-party premium rates over the past 4-5 years.

BUSINESS

Distributors opting for short-term health plans over long term post commission rule change: Niva Bupa CEO

Krishnan Ramachandran, CEO, says the health insurer’s internal goal is to grow 5-10 percentage points faster than the overall health insurance industry

BUSINESS

If I were Allianz, I’d be more worried about retaining Go Digit than the other way around: Chairman Kamesh Goyal

Addressing concerns over the Allianz-Jio reinsurance JV, Goyal said Allianz intends to continue its partnership with Go Digit, and the existing contract allows no mid-term changes, Goyal says

BUSINESS

IDFC First shareholders grant Warburg affiliate board seat, reversing earlier decision

While Currant Sea’s board nominee has not yet been disclosed, this marks a significant change in shareholder sentiment from May 2025, when a similar resolution was voted down.

BUSINESS

PSU lenders’ average valuation surged 225% over five years on improved financials and asset quality

According to data compiled from 11 major PSU banks, their average price-to-book (P/B) ratio has jumped from 0.35 in March 2020 to 1.14 in July 2025.

BUSINESS

Not in a hurry to burn our fingers, says CEO Aggarwal after Shriram General gives crop tender bids a miss

Anil Kumar Aggarwal says the insurer is targeting a full-year premium of Rs 4,600 crore and could reach Rs 5,000 crore if demand picks up during the upcoming festival season