Jitendra Kumar Gupta Moneycontrol Research

For an MD of a high-tech defence-system company, Apollo Micro Systems' 55-year-old chief Karunakar Reddy Baddam strangely does not seem to have a voter identification number and driving licence -- at least it hasn't disclosed in the company's red herring prospectus filed with SEBI, as is practice.

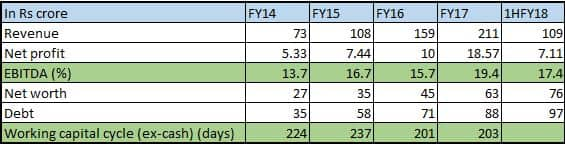

But that's the least of the concerns here. Apollo, whose IPO opened yesterday, has created a net worth (equity capital) of mere Rs 63 crore over the last two decades. On this net worth, company is seeking to raise Rs 156 crore for a mere 24.7 percent stake.

Working capital funding

The other big concern is the purpose of fundraising. Out of the total issue size of Rs 156 crore, Rs 118 crore will be used for working capital. The rest Rs 38 crore will be used for general corporate purpose, which is on the higher side.

Two, even from working capital, only Rs 29 crore or 18% of the issue will be used in the current fiscal. The majority will be used in FY19.

Three, Apollo's working capital requirements itself are a concern as it has to constantly depend on borrowings.

In FY17, its inventory and debtors put together were 88 percent of its sales. Even after adjusting for payables, this ratio stands at 55 percent, which is very high. This is precisely a reason that interest coverage stood at a low 2.6 times in first half of fiscal 2018, indicating very little margin of safety in the business.

IPO proceeds could certainly assist in working capital and help reduce interest cost pressure, but the cost of the same will be paid by shareholders. After the IPO, its networth will jump from Rs 76 crore in the first half of current fiscal to Rs 240 crore (including annualised profit).

To maintain the same kind of return on equity (average 24.3% last three years), it will have to earn a net profit of close to Rs 60 crore -- 4.3 times its annualised profit for this fiscal. It remains to be seen how remunerative the induction of huge equity capital in the business, particularly for working capital, will be.

Opportunities for growth

The company is operating in an exciting defence market with huge opportunities as a result of increasing indigenous procurements. However one needs to see if the large capital infusion that company is doing through IPO is used judiciously, which can spur higher growth.

It manufactures and assembles electronic hardware and software solutions that find their applications in missiles, electronic warfare, nuclear missiles, submarine, ships and space programmes.

Defence electronics is a huge market considering there are several components that are required for the main assembly. Larger players like BEL and others source these components from the suppliers like Apollo, which have to go through strict product and technology approvals as per the Defence Research and Development Organisation (DRDO) requirements.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.