The International Monetary Fund raised its outlook for the world economy this year, estimating that risks have eased in recent months after the US averted a default and authorities staved off a banking crisis on both sides of the Atlantic.

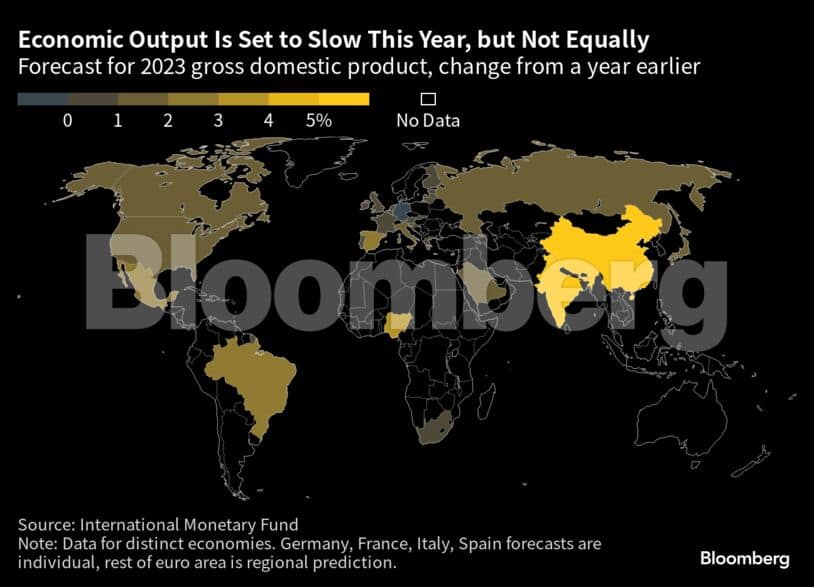

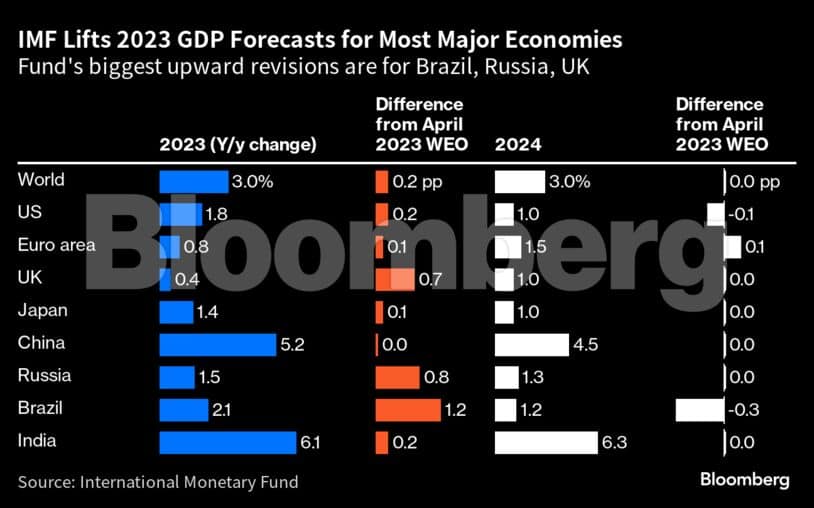

Global gross domestic product will expand 3% in 2023, the IMF said in an update to its World Economic Outlook released Tuesday. While that’s still a slowdown from 3.5% growth last year, it’s faster than its 2.8% projection in April.

“The recent resolution of the US debt ceiling standoff and, earlier this year, strong action by authorities to contain turbulence in US and Swiss banking, reduced the immediate risks of financial sector turmoil,” the IMF said. “This moderated adverse risks to the outlook.”

The Washington-based fund left its global growth expectation for next year unchanged at 3%.

Also Read: IMF raises India's FY24 GDP growth forecast by 20 bps to 6.1%

The fund is among a growing number of voices that see a potential soft landing in the US. Economists in a Bloomberg survey this month boosted estimates for GDP growth in the second and third quarters, although they still say there’s a 60% chance the US will fall into recession in the next 12 months.

Despite the slightly more optimistic global view, the IMF warned that prospects for growth look weak compared with the 3.8% average during the two decades prior to the Covid-19 pandemic and that “the balance of risks to global growth remains tilted to the downside.”

Inflation Focus

Higher interest rates, which are helping to tame inflation, will weigh on activity. Additional shocks like an intensifying of the war in Ukraine and climate disasters could spur even more central-bank tightening.

The IMF also cited continued risks to financial stability amid higher rates, a slower-than-expected recovery in China, debt distress in emerging economies and threats to trade from geoeconomic fragmentation, which has accelerated amid Russia’s invasion of Ukraine and tensions between Washington and Beijing.

Bloomberg Economics’ base case for global growth is 2.8% for this year and 2.7% in 2024 - down from 3.3% in 2022 and below the pre-pandemic trend of 3.4%.

Bloomberg Economics: For Teflon Global Economy, Shocks Are About to Stick

Even as tighter monetary policy bites, the priority in most economies remains achieving sustained disinflation, the IMF said, adding that central banks should stay focused on restoring price stability and strengthening financial supervision and risk monitoring.

That’s expected to play out this week, with the US Federal Reserve and European Central Bank poised to raise interest rates further. Fed Chair Jerome Powell and ECB President Christine Lagarde have both warned that the rate of inflation remains too high.

The IMF sees inflation slowing to 6.8% this year — compared with a 7% forecast in April — from 8.7% in 2022. But the fund also raised its projection for cost-of-living increases in 2024 by 0.3 percentage point to 5.2%, saying that it expects core prices, which exclude food and energy, to cool more gradually than before.

Advanced economies are driving the slowdown in global growth from last year’s 3.5%, the IMF noted, particularly as weaker manufacturing offsets services. Meanwhile, activity in developing and emerging economies is seen stable this year and next, it said.

Among the world’s largest economies, the IMF expects the US to grow 1.8% this year, a 0.2 percentage-point increase from April, before slowing to 1% in 2024.

The IMF sees China expanding 5.2% this year, unchanged from its prior projection. However, it warned that the nation’s recovery following the post-pandemic reopening at the beginning of this year is slowing, in part due to softness in the real estate industry that’s hurting investment, as well as weak foreign demand and rising youth unemployment.

Other 2023 country forecasts include:

UK boosted by 0.7 percentage point to a 0.4% expansion, on better-than-expected consumption, falling energy prices, lower post-Brexit concerns and a resilient financial sector

Russia lifted 0.8 percentage point to 1.5% growth, reflecting a strong first half of the year among retail trade, construction and industrial production, driven by fiscal stimulus

Brazil upgraded 1.2 percentage points to a 2.1% expansion after a surge in agricultural output early in the year, which also helped lift activity in services

Germany is projected to contract 0.3%, compared with a prior forecast for a 0.1% drop, on weak manufacturing output and an economic contraction in the first quarter

Saudi Arabia cut 1.2 percentage points to 1.9% reflecting oil-output cuts announced in April and June

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.