Janet Yellen, secretary of the US Treasury, wrote to the Congressional leadership last week to say that the government will reach the statutory debt limit of $31.381 trillion on January 19, 2023.

“Once the limit is reached, Treasury will need to start taking certain extraordinary measures to prevent the United States from defaulting on its obligations,” she said in the letter.

This explainer will help you understand the debt ceiling crisis and the way forward for the US government.

What is a debt ceiling?

Like all economic entities, governments also need to manage their income and expenditure. The government’s income are tax and non-tax receipts, whereas expenses are payments for several public goods and services.

Generally, the government’s expenditure exceeds its income, leading to what is called the budget deficit. The government manages the budget deficit by borrowing from the financial markets through the issue of bonds. If the government continues to run deficits over the years, it accumulates and becomes known as the debt of the government.

In terms of borrowings and debt, governments have an advantage over other economic entities. While households and businesses cannot increase their debt levels beyond a threshold, governments do not face a similar constraint.

Economists have estimated threshold debt levels for governments, too, but it is not as if the government becomes bankrupt on reaching the threshold. This is not to say that governments need not worry about debt, but just that borrowing constraints are much lower for governments than for businesses and households.

The founders of the US wished to limit the borrowing power of the Federal government. In the foundation years from 1788 to 1917, the US Congress authorised each bond issue required to fund expenditure.

During the First World War, the government found it difficult to work under these restrictions because large-scale spending was required. In 1917, the government was allowed to raise money via bonds as long as it was within a limit or ceiling. This was the first instance of the debt ceiling.

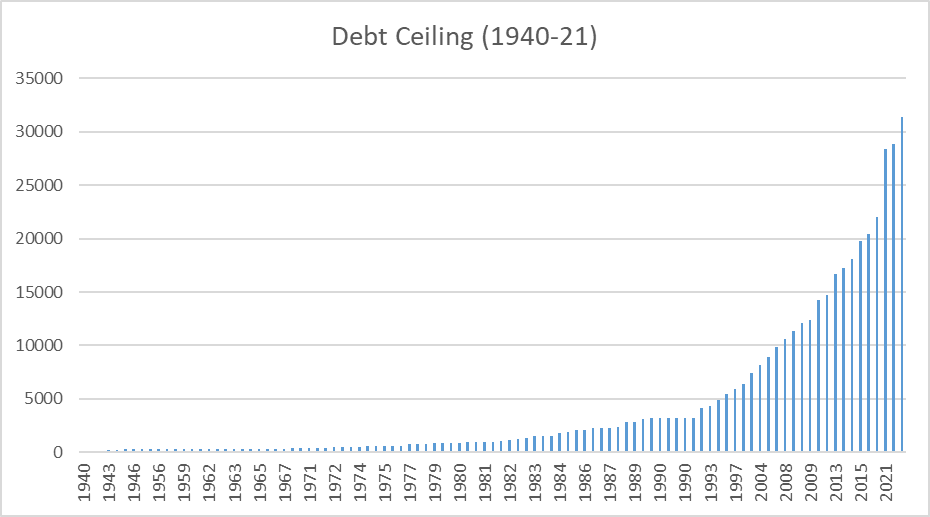

In 1939, an aggregate debt limit was made applicable to all federal government borrowing. The first debt ceiling was fixed at $49 billion, which has been raised 103 times to the current limit of about $31.4 trillion (see graph).

Source: Office of Management and Budget

Source: Office of Management and Budget

Why has the debt ceiling become a crisis?

Since the 1940s, Congress has revised the debt ceiling without much problem. In the 1980s, the debt limit was revised 24 times. However, from 2011, the debt ceiling has become a highly contentious issue due to friction between the ruling party and the opposition. Congress has to vote collectively to increase the debt ceiling, but with a divided house, it is allowed to lapse.

The purpose behind not revising the debt ceiling is to embarrass the government. Technically, any government that is not able to honour its commitments is under default status and the same principle applies to the US government too. The US government needs to borrow to honour the commitments and if Congress does not revise the debt ceiling, it means the government has defaulted, which is a victory for the opposition.

What happens when Congress does not revise the debt ceiling?

In case the US Congress does not revise the debt ceiling and the time period lapses, the US Treasury manages the crisis and avoids default by using extraordinary measures. In the past, the Treasury has used the following extraordinary measures:

Premature redemption of Treasury bonds held in federal employee retirement savings accounts

Halting of contributions to certain government pension funds

Suspension of state and local government series securities, and

Borrowing from money set aside to manage exchange rate fluctuations

The Treasury also declares what is called “debt issuance suspension period” or DISP. Congress permits the Treasury to suspend issuing securities for two funds, thereby limiting the growth in debt. The two funds are the Civil Service Retirement and Disability Fund and the Government Securities Investment Fund.

Once the DISP is over, Congress increases the debt ceiling, which includes the debt incurred in the suspension period. Debt ceilings were suspended regularly from 2013 to 2019, and they were raised after the suspension period lapsed.

The extraordinary measures are only temporary in nature.

In 2021, Yellen wrote to Congress that the extraordinary options will eventually be exhausted and “failure to act promptly could also result in substantial disruptions to financial markets, as heightened uncertainty can exacerbate volatility and erode investor confidence.”

What is the nature of the crisis this time?

Yellen has reiterated her concerns of 2021. She informed Congress that once the government reaches the debt limit on January 19, 2023, “Treasury will need to start taking certain extraordinary measures to prevent the United States from defaulting on its obligations.”

The extraordinary measures will last till June 2023 and are at best a temporary solution.

She had warned similarly in 2021: “Failure to meet the government’s obligations would cause irreparable harm to the US economy, the livelihoods of all Americans, and global financial stability. Indeed, in the past, even threats that the US government might fail to meet its obligations have caused real harms, including the only credit rating downgrade in the history of our nation in 2011.”

She urged “Congress to act promptly to protect the full faith and credit of the United States.”

What do we make of the US debt ceiling crisis?

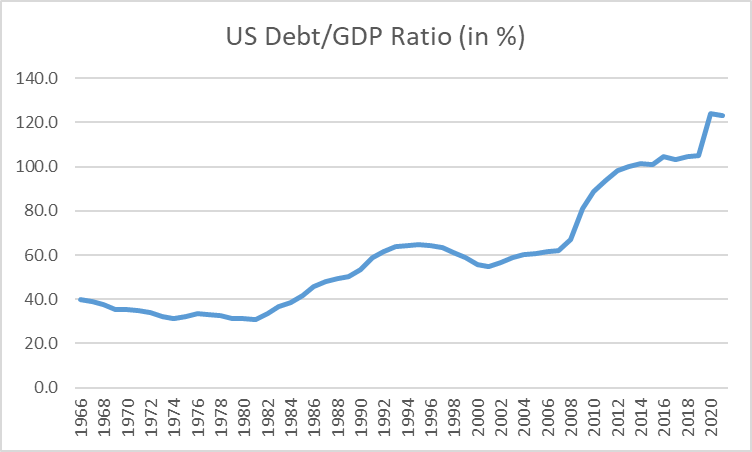

The crisis is not due to the debt ceiling, but due to the US government’s rising debt levels. US debt as a percentage of GDP has increased significantly since the 2008 crisis.

As a percentage of GDP, it was 62 percent in 2007 and it increased to 100-plus percent in the period from 2010 to 2019. In the pandemic, the debt levels surged to 120-plus percent.

As debt surged, so has the need for constantly asking Congress to revise the ceiling. The highly factionalised Congress has, in turn, made the debt ceiling a crisis by not revising it as the limit is breached.

Source: St Louis Fed

Source: St Louis Fed

In several ways, the debt ceiling has served its purpose of not allowing subsequent governments to raise debt without any pressure. However, instead of finding measures to reduce high debt, the ceiling has become a political instrument to check the ruling party. This is a highly myopic way of looking at what is a deeper problem.

The US did not get a credit downgrade due to the inability to raise the debt ceiling but because its high debt levels were questioned by investors. Interest rates were low from 2008 to 2019, which helped the government tide over the crisis. As interest rates rose, the debt problems have only become worse.

The US Congress should debate the issue of debt ceiling more meaningfully, and more importantly, find a solution to this endless crisis.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.