China’s deflation pressures are likely to continue for at least another six months on weak demand and as the property crisis continues to sap confidence within the economy.

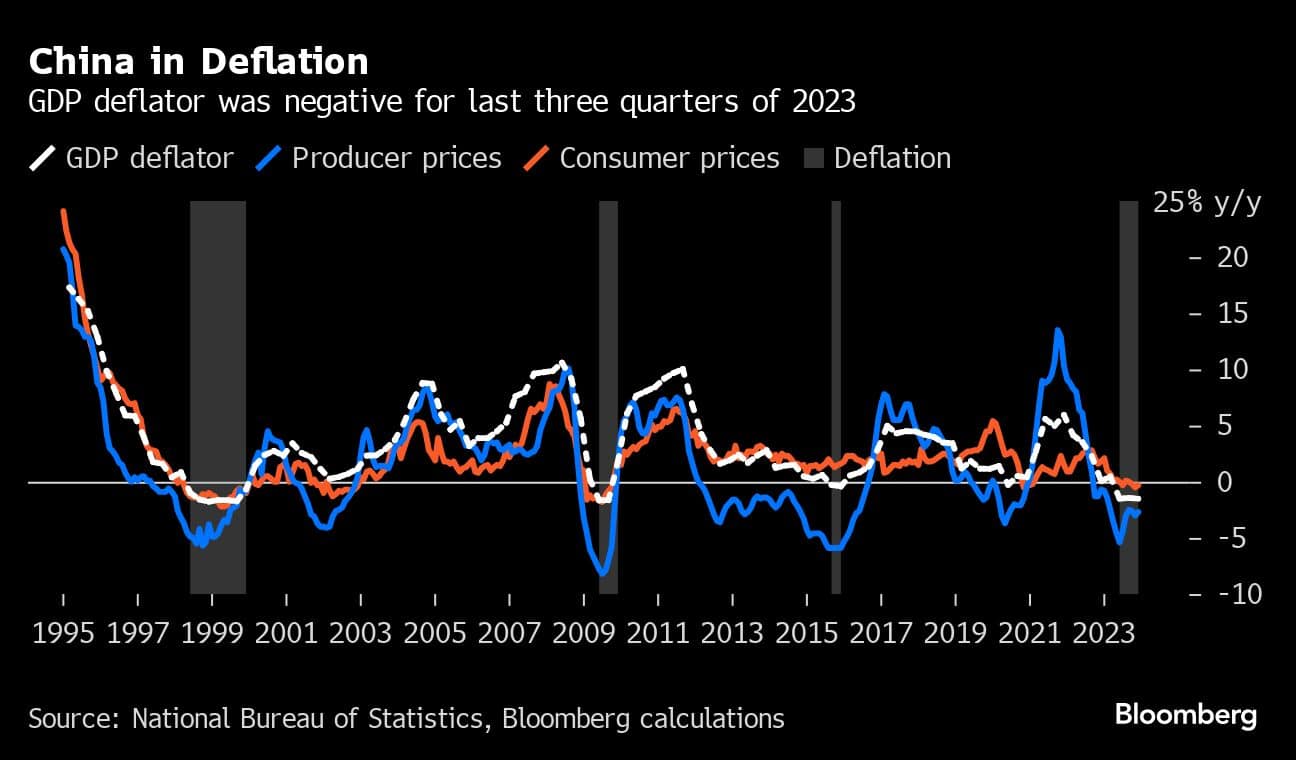

A measure of economy-wide prices called the gross domestic product deflator is expected to decline for at least two more quarters, according to 12 of 19 economists in a new Bloomberg survey. That gauge — which measures the difference between nominal and real GDP growth — has already fallen for the last three quarters, and a continued drop through June would mark the longest streak since 1999.

“The culprit is the property downturn,” said Raymond Yeung, chief economist for Greater China at Australia & New Zealand Banking Group Ltd. He projected another two quarters of declines in the gauge. “Households lack confidence in real estate. They are not sure whether property is wealth-preserving. They need an assurance by the authorities.”

Entrenched deflation and declining house prices are two of the most serious problems faced by the world’s second-largest economy this year as it tries to regain and sustain momentum. While China was able to reach an official growth goal of “around 5%” in 2023, repeating a similar performance may be difficult.

Economists in a separate Bloomberg survey upgraded their growth forecasts slightly for the next couple of years. GDP in 2024 is now seen expanding 4.6% from the prior year, according to a poll of 66 economists, up slightly from an earlier projection of 4.5%. The median estimate among 51 economists for growth in 2025 was raised to 4.5% from 4.3%.

Still, those figures track below the 5% growth rate that several economists — including some linked to the government — have speculated Beijing may target this year.

Consumer prices are seen remaining depressed to start the year, with economists projecting the consumer price index rising 0.2% this quarter before gradually speeding up. The median estimate for annual CPI was 1.1%, slightly lower than the 1.4% gain in the last survey.

“A key risk to watch out for is that of deflationary expectations setting in among households and businesses,” said Erica Tay, economist at Maybank Securities. “At this juncture, the urgency of fiscal support has intensified.”

All but one of 17 economists surveyed forecast home prices will continue dropping month-on-month until the third quarter of this year. The price of newly built homes has fallen every month since April 2022. Second-hand home prices have declined for even longer.

“It’s hard to see a quick turnaround soon,” said Allan von Mehren, chief China economist at Danske Bank A/S. “More aggressive monetary stimulus and further easing of housing policies should lead to stabilization in prices in the second half of 2024.”

Other key highlights from the survey:Economists still see the People’s Bank of China cutting the rate on its medium-term lending facility by 10 basis points in the first quarter. They also now expect the PBOC to trim that rate again in the third quarter

Both the one- and five-year loan prime rates are seen being lowered by 10 basis points in the January-to-March period

Exports are likely to drop 2% in the first quarter, worse than an earlier expectation for a 1.4% decline. Overseas shipments are then seen returning to growth from the second quarter

Imports are expected to rise 1% in the first quarter, weaker than an earlier estimate of a 1.6% increase

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.