Taiwan Semiconductor Manufacturing Co. has reclaimed a spot among the world’s 10 most-valuable companies as continued optimism in artificial intelligence thrusts the stock to record levels.

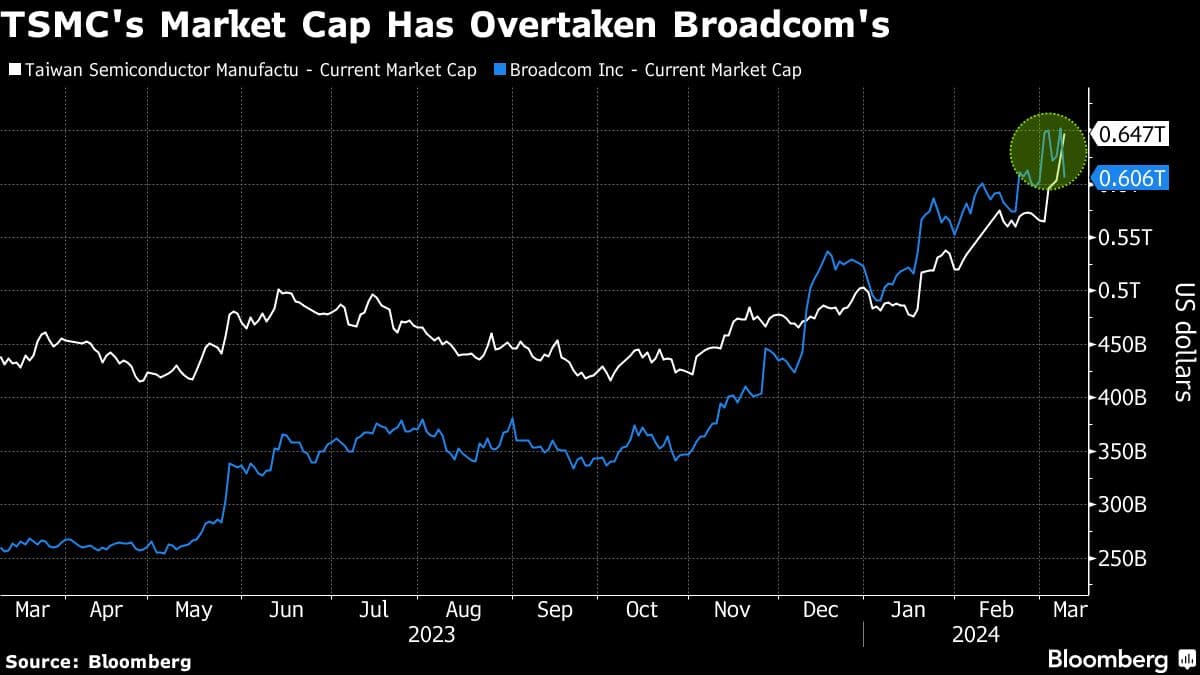

A 14% rally last week has elevated the chipmaker’s market capitalization to a record, before a 2% decline in early trading Monday pared it to $634 billion. That’s still higher than that of Broadcom Inc., bringing its primary listing in Taipei back to the top 10 club for the first time since 2020.

Analysts from Morgan Stanley and JPMorgan Chase & Co. expect the semiconductor giant to advance further amid surging AI-related revenue and strong pricing power. Investor frenzy around generative AI has supercharged a rally in global chip stocks recently, before Nvidia Corp. capped its biggest decline in nine months on Friday amid profit-taking.

“Generative AI semi is an obvious growth driver for TSMC,” Morgan Stanley analysts including Charlie Chan wrote in a note dated March 7. The company’s overseas expansion also helps mitigate geopolitical concerns, they said.

TSMC’s revenue gained 9.4% in January-February as demand for high-end chips from a wave of activity in artificial intelligence offset potential fallout due to slowing iPhone sales. Some brokerages including Morgan Stanley and JPMorgan have recently lifted their price targets for the stock by about 10%.

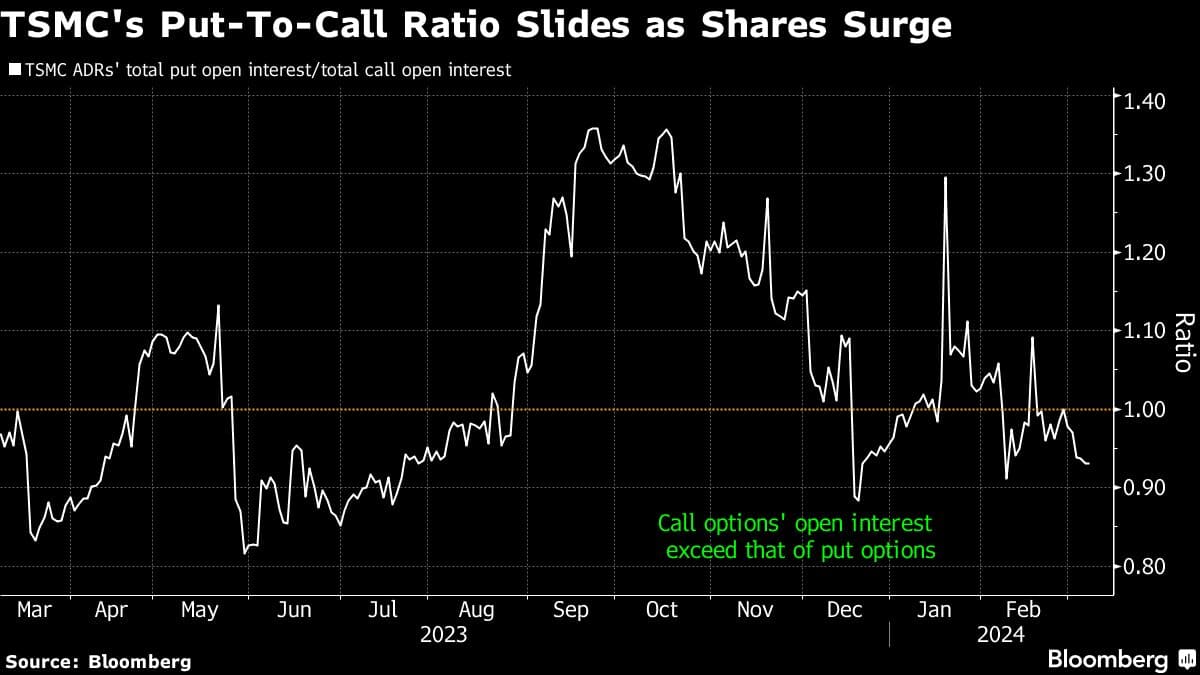

The options market showed that investors remain bullish over TSMC’s American Depository Receipts. The put-to-call ratio dropped to a one-month low, suggesting options traders have been buying more bullish contracts than bearish ones even as its shares kept hitting fresh highs, according to Bloomberg-compiled data based on open interest.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.