Shubham Agarwal

This sounds interesting and impressive when we say a simple table of instruments that shows the market activity of a set of instruments of a symbol can talk so much about its movement. Yes, we are talking about the famous Option Chain. Option Chain holds data of all the Options, Calls as well as Puts with all available strikes of a particular expiry.

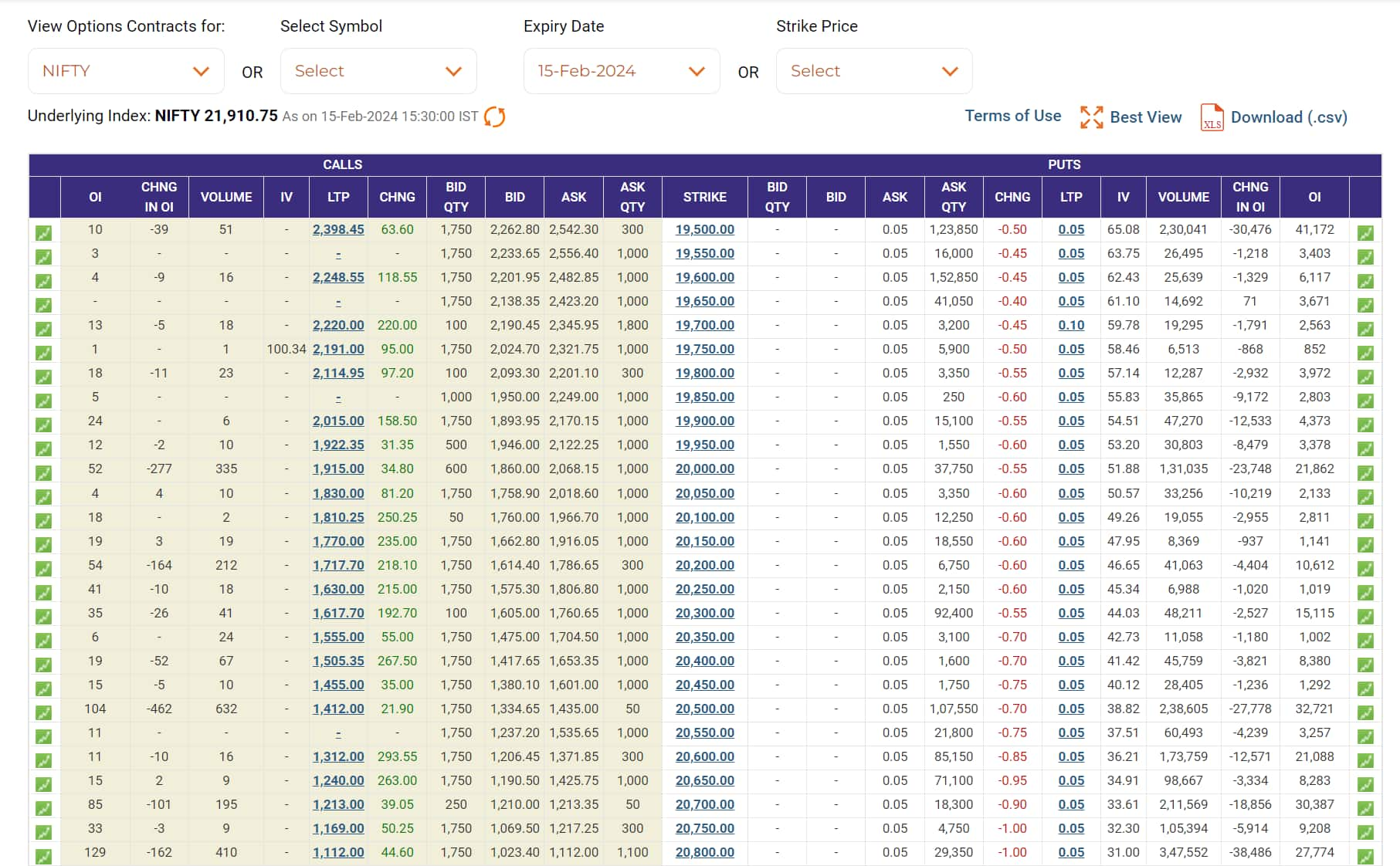

The following picture shows a snip from NSE’s Option chain portrayal on their website which is publicly available.

We can look at many prices of information along with the price movement of all the options. Volume, IV & OI are predominantly subjects in themselves. They all have the capacity to create a fairly reasonable predictive indicator. However, just by looking at the overall price movement also, we can figure out so much about the symbol (in this case Nifty).

Simple combinations of both Call and Put Options prices can help us identify the move or in particular the mood of the symbol. 3 such Combinations are listed below.

Combination #1 Simple Price Action

We all know Call and Put Options move in opposite directions reacting to any movement in the symbol’s price. So, they behave also in opposite directions. A simple combination will let us know the direction of the underlying.

Call prices Up + Put Prices Down = Underlying is meaningfully Up for Today

Put Prices Up + Call Prices Down = Underling is meaningfully Down Today

One might say this can be found out by looking at the stock’s future also. Yes, it can be found. However, the price of options is also affected by the passage of time. Now, the word meaningfully up or meaningfully down is explained by this combination of price movements of both Call & Put Options. The change in the price of Up in Call means that there is enough upward price action that has overtaken the impact of the fall in premium due to the passage of time. Hence, it is meaningfully up or down.

Combination #2: Both Call & Put Options start rising.

Call Price Up + Put Price Up = Getting Ready of Big Move (on either side).

Both Call and Put Prices can be up not just due to price but also due to expected volatility. The sellers of options demand higher prices in such situations. This is to cover themselves in case of a big move due to an unforeseen outcome from a known event in any direction.

The best examples are Results for stocks, Monetary policy for Banks etc. Option Chain analysis tells you of any such event beforehand just by checking prices.

This helps us identify the possible unreliability of trends due to the upcoming event and one should avoid taking aggressive single-direction trades.

Combination #3: Both Call & Put Options start rising.

Call Price Down + Put Price Down = An Event is Over without much Price action

This combination of Call & Put prices can tell us that there is the expectation of a low volatility period. Typically, after the announcement of the “In line with expectation” result, the options do go through such price reduction.

This helps us in building the expectation that it may not be wise to buy options now due to low expectations of movement.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.