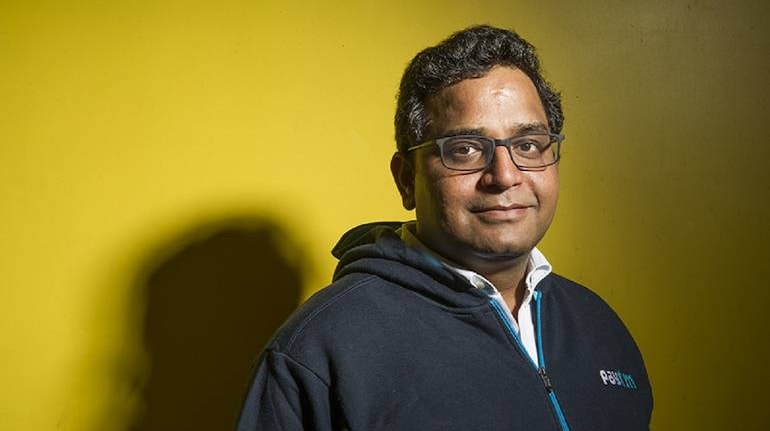

In an attempt to pacify employees in the wake of the ongoing crisis at Paytm, founder Vijay Shekhar Sharma assured that there will be no layoffs as the company continues to engage with RBI and work with other banks for partnership.

“You are a part of the Paytm family, and there is nothing to worry about. Many banks are helping us,” Sharma said during a virtual town hall with employees of Paytm Payment Bank Ltd (PPBL) on Saturday.

Sharma was joined by company's President and Chief Operating Officer (COO) Bhavesh Gupta, and CEO of PPBL, Surinder Chawla.

“We are not completely sure of things…like what exactly went wrong. But we will figure out everything soon. We will reach out to the RBI to see what can be done,” the founder said while addressing about 800-900 employees on the call that went on for almost an hour.

The meet came three days after the RBI restricted PPBL from offering almost all major banking services, including taking deposits, FASTag, and credit transactions.

Since then, the fintech major, who relies on PPBL for several of its products and services, has been looking to forge partnerships with other banks, while grappling with merchant bank account transfers, communication with users, stock price stability among other things.

The stock exchanges have cut the daily trading limits for the digital payments firm to 10% from 20%, after a $2 billion rout in the stock.

One employee said that Sharma took a “confident and assuring tone” to speak to the workforce, in his first direct address with them after the RBI diktat on January 31.

“It was a morale booster call to cut the rumours of layoffs. The majority of the talk was around job security, and bank tie-up. No single name was taken, but we were told that a lot of banks have approached,” a senior employee who was a part of the call, said.

Among the potential bank candidates for partnership, the SBI chairman on Sunday offered to help the troubled fintech customers who are affected by the order, while ruling out to go directly to the company’s rescue. Sources have also named ICICI bank to be in the race for the potential tie-up.

Further, Sharma told employees that the “company will focus on being extremely compliant moving forward.”

Not scared, but concernedIt’s been a hectic week at Paytm, especially the customer services team which has been slacking with continuous customer calls.

“People are not scared. We always expected RBI to say something but not outright ban. Changes have been going on for the past 6 months among teams to comply with norms. Like we separated PPBL and Paytm app logo…,” said an executive working with the product team.

On Feb 1 morning, Paytm shot out its first communication to the employees via a WhatsApp message in group chats, attached with the RBI’s circular.

“This is the original copy. Whatever is happening in the press is not true. More will be communicated tomorrow…,” another employee said, as he shared the message with Moneycontrol.

The next day, respective team heads huddled with their group of employees, to discuss details.

“Friday (Feb 1) was all about closed-door meetings. Every team was asked to pull out every single data and information on current status around users, accounts, transactions, and report to the heads,” he added.

Having said that, many continue to remain unsure of what is to be done next, while the social media and on-ground staff go aggressively out to counter miscommunication spreading among its customers.

Meanwhile, the Confederation of All India Traders (CAIT), a body of physical shops and traders, on Sunday issued an advisory asking brick-and-mortar businesses to switch from Paytm to other payment applications.

“The RBI has imposed certain restrictions, prompting CAIT to recommend that users take proactive measures to protect their funds and ensure uninterrupted financial transactions. Large number of small traders, vendors, Hawkers and women are making payments through Paytm and as such RBI restrictions on Paytm could lead to financial disruptions for these people," the CAIT said on February 4.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.