One quick thing: Garena’s Free Fire is back, with a catch

In today’s newsletter:

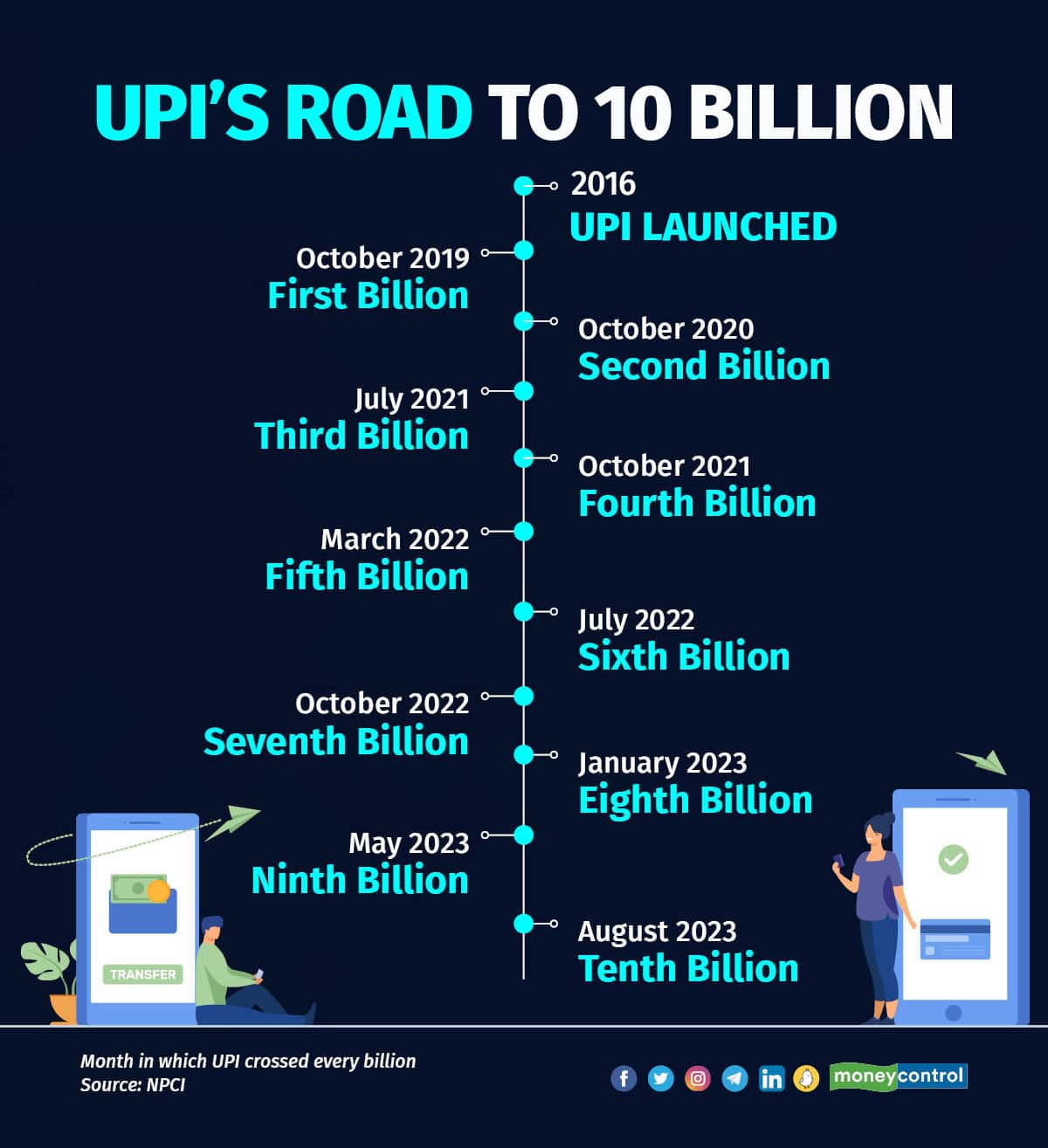

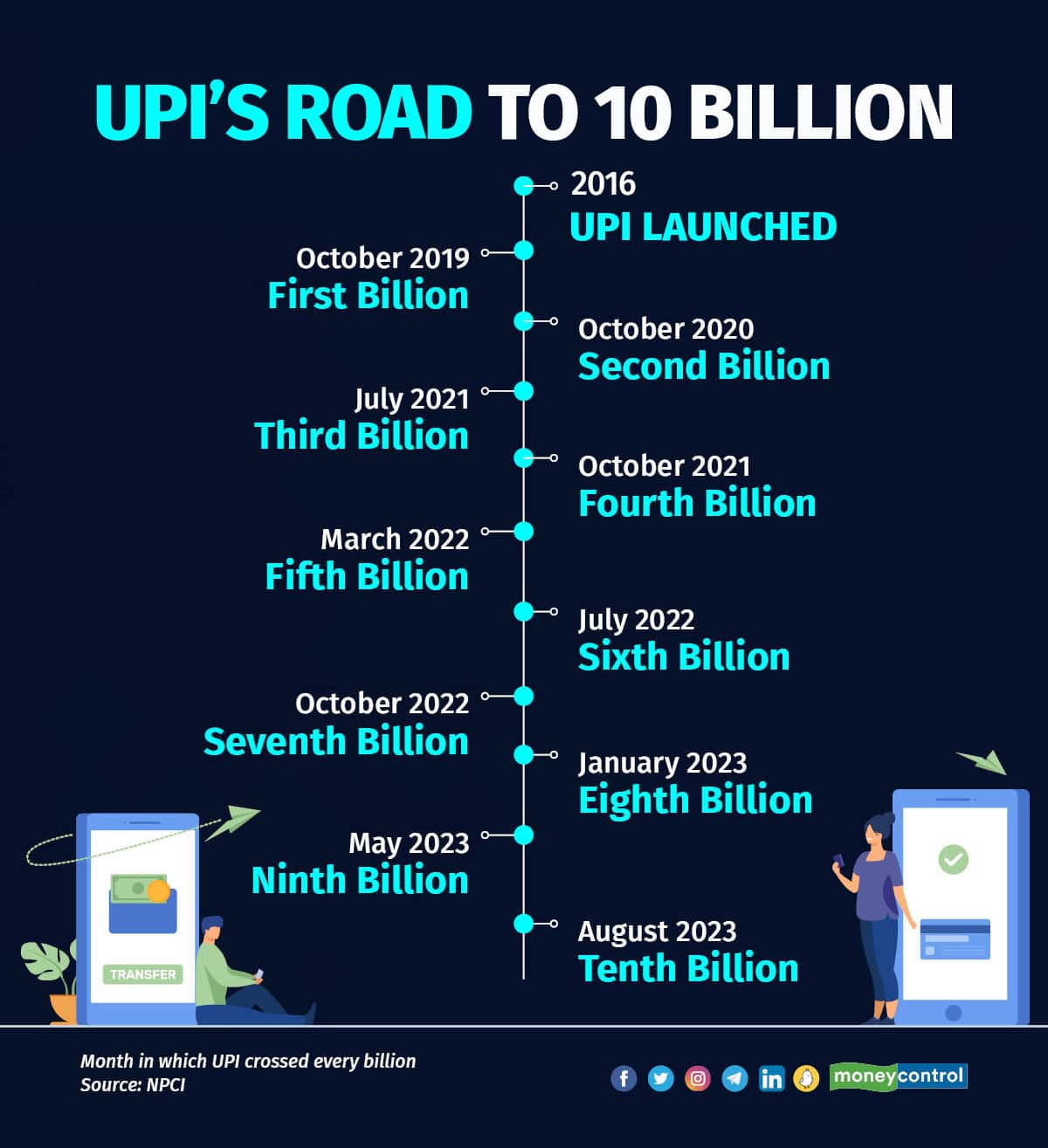

- UPI tops 10B transactions in a month for the first time

- Why SoftBank wants to check out of Zomato

- Amazon banks on India Post & Indian Railways

Was this newsletter forwarded to you? You can sign up for Tech3 here

Top 3 stories

Top 3 stories

UPI tops 10B transactions in a month for the first time

Hold onto your seats, because history has been made. The heart of digital transactions in India, the Unified Payments Interface (UPI), has crossed a historic milestone of 10 billion transactions in a month for the first time.

And guess what?

- With one more day to go in August, it is likely to touch 10.5 billion

Rewind to last month when the excitement was palpable. UPI came this close to hitting the 10 billion mark in July, recording 9.96 billion transactions.

The rise of UPI

UPI vs Card networks

Within the next three to four months, UPI is expected to surpass Mastercard's daily transaction volume of 440 million.

- Visa, the world's largest card network, processes an average of 750 million transactions per day

These companies operate in over 200 countries, many of which are much wealthier than India, and they have been around for over 60 years. On the other hand, UPI has achieved this scale in less than eight years.

Future goals

Looking ahead, the National Payments Corporation of India (NPCI) has set its sights on a much bigger target.

Find out more

Why SoftBank wants to check out of Zomato

In June, we reported that Zomato had become a profitable bet for SoftBank, thanks to a sharp rally in the food tech company's shares.

- Since then, the Japanese investor has been looking for opportunities to sell and book profits

Yesterday, SoftBank finally did so, selling 10 crore shares in a block deal and booking gains of more than Rs 100 crore. SoftBank now seeks to exit Zomato completely.

Tell me more

SoftBank is looking to sell its remaining 2.18% stake in Zomato through open market transactions or block deals in the coming months.

- On August 30, it sold a 1.17% stake, or 10 million shares, of Zomato via a block deal, making a profit of Rs 10-12 per share

SoftBank also has a large stake in Swiggy, Zomato's biggest rival. The Japanese investor would want to exit Zomato as soon as possible to avoid any conflict of interest.

To be fair, SoftBank did not directly invest in Zomato. It got the stake in the company after Zomato acquired Blinkit (formerly Grofers), which was a portfolio company of SoftBank.

However, SoftBank is less enthusiastic about exiting its investments in other ventures like Delhivery and PB Fintech, where it has directly injected substantial funds.

SoftBank’s monetisation push

SoftBank, one of India's largest startup investors, has not cut a cheque in India for more than 15 months.

- However, the Japanese investor has been actively monetising some of its bets in both the public and private markets

So far this year, SoftBank has sold part of its stake in Paytm through open market operations, generating over $300 million. It also sold some shares in Lenskart to Chrys Capital in June.

Amazon banks on India Post & Indian Railways

E-commerce companies have constantly been on the lookout for newer ways to deliver orders quickly and over long distances.

- Online retail giant Amazon is now partnering with two of India's oldest institutions to make its deliveries

What happened?

Tell me more

Of its announcements, the company's multi-channel fulfillment puts it in competition with logistics players such as Delhivery, Shadowfax, and Xpressbees.

- It is also following in the footsteps of its biggest Indian competitor, Flipkart

Ekart is Flipkart's standalone logistics arm, offering services to businesses.

Past and the future

So far, Amazon has invested $11 billion in India since it started operations a decade ago. By 2030, it plans to invest an additional $15 billion in India, its key market, taking its total investment to $26 billion. By 2025, Amazon plans to:

- Create 2 million jobs

- Achieve $20 billion worth of exports

- Digitise 10 million small businesses

That's not all. It's the season for generative AI, and Amazon isn't going to be left behind.

“We think in the next 10 years, there won't be any aspect of our business that won't be transformed in some meaningful way by this (generative AI). There won't be any way that we do our business today that AI won’t transform,” said Russell Grandinetti, SVP - International Consumer at Amazon.

Go deeper