Breaking: Embattled crypto exchange FTX said it will initiate bankruptcy proceedings in the United States while its Chief Executive Sam Bankman-Fried has resigned, triggering what could be one of the biggest meltdowns in the industry.

- In an earlier series of tweets, Sam Bankman-Fried had blamed himself for the fiasco.

In today’s newsletter:

- Chaos at Twitter

- SoftBank Masa Son’s sayonara to earnings calls

- A giant leap for Indian space

Was this newsletter forwarded to you? You can sign up for Tech3 here

Top 3 Stories

Top 3 Stories

Chaos at Twitter

Twitter, everyone's favorite public town square, will likely soon be a cautionary example on what all can go wrong in a hurried and chaotic acquisition.

The situation seems to be just getting worse by the day. Mind you, it's been only two weeks since Elon Musk bought the social media firm.

What’s happening now?

In his first address to Twitter employees, Musk painted a grim picture of the company, claiming that Twitter could even go bankrupt if it doesn't start making more money soon.

These warnings come amid a tumultuous period for the company, wherein the mercurial billionaire has pushed out almost all of Twitter's top executives including CEO Parag Agrawal while eliminating nearly half of the company's workforce or about 3,700 jobs across the world.

Exits continue

Meanwhile, the social media firm continues to see a churn among its senior executives. This includes its global head of safety and integrity Yoel Roth, Chief compliance officer Marianne Fogarty, Chief information security officer Lea Kissner, and Chief privacy officer Damien Kieran.

- The company's top sales executive Robin Wheeler had also resigned from the company but Musk was able to persuade her to stay, according to Bloomberg.

Fake account chaos

That said, Musk’s plan to give the blue checkmark on Twitter to anyone who shells out $8/month, has quickly allowed imposters of prominent brands and prominent personalities to flourish on the platform (So much for the promise of brand safety!)

Fake profiles for brands such as Nintendo, Lockheed Martin and even Musk’s own Tesla have emerged along with accounts impersonating former US President George W. Bush and NBA star LeBron James. Oh! Not to forget even Jesus Christ!

Another example of the ongoing chaos at the company? Some people in the United States are no longer seeing the option to sign up for Twitter’s subscription service, even as it has started popping up for users in India at an atrocious pricing of Rs 719 per month.

Also read: Twitter's India unit swings to loss in FY22; Revenue jumps 82%

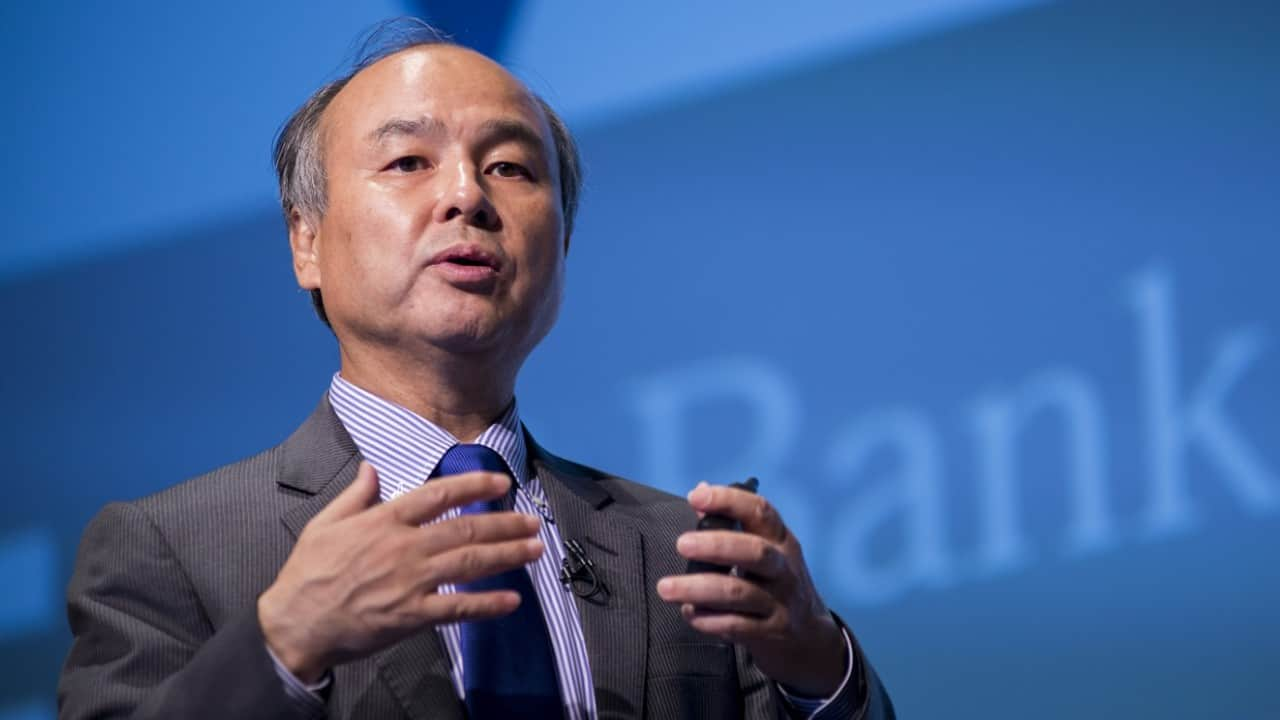

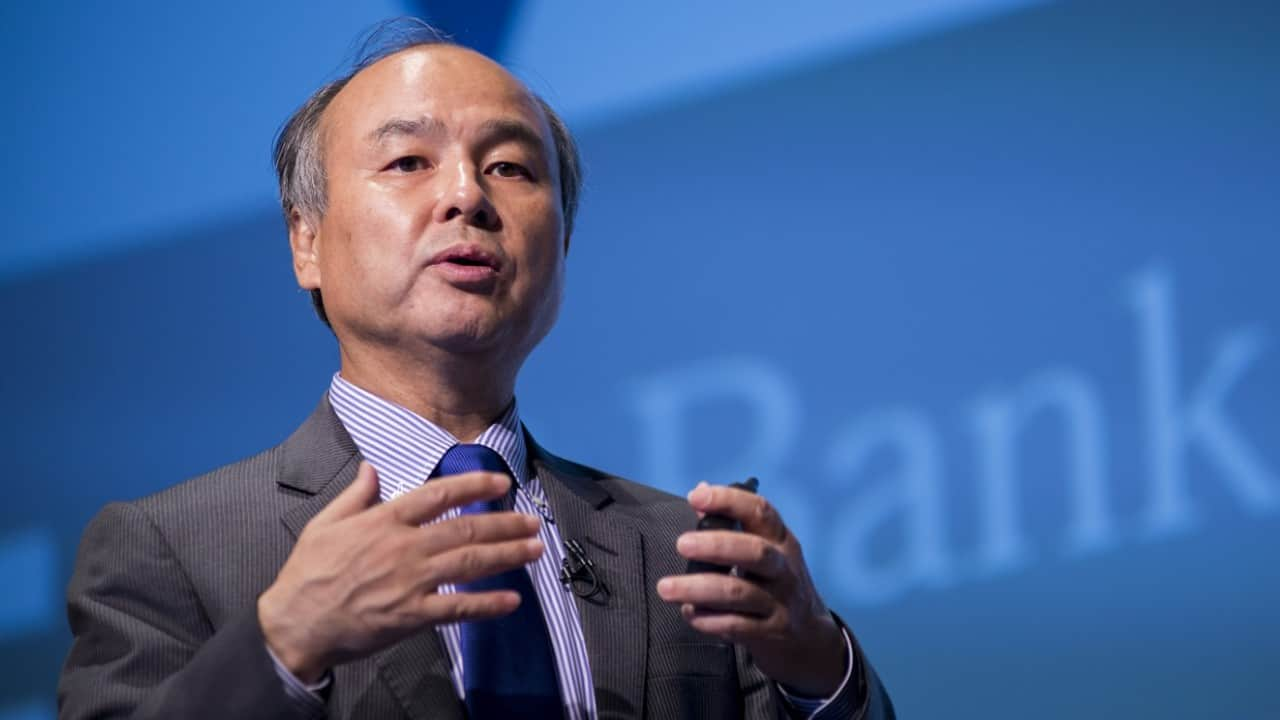

Masa Son’s sayonara to earnings calls

After two straight quarters of losses, SoftBank finally reported a profit in the July-September quarter.

Yes, but: The profit was primarily on account of gains on sale of a significant stake in its crown jewel--Alibaba Group.

The investment conglomerate has thus very little to celebrate as it continues losing billions of dollars on its other investments amid a global tech rout.

By the numbers

SoftBank reported a net profit of $21.8 billion, with a $37.9 billion gain coming from the early settlement of prepaid forward contracts using Alibaba’s shares.

- SoftBank’s stake in Alibaba is now down to 15 percent from over 20 percent in the previous quarter

- The Vision Fund investment units lost $9.75 billion in July-September

- In 2022, the Vision Fund investment units have now lost close to $60 billion

The fair value of the Vision Funds’ investments in 36 public companies is down to $24.8 billion from investment value of $40.5 billion, while that of its 312 unlisted companies is down to $68.4 billion from its investment value of $75.6 billion.

Masa calls for monetisation

SoftBank founder Masayoshi Son, in a shorter than usual presentation, also talked about the need of monetising its assets.

- Son however mentioned this would be his last earnings presentation for the ‘foreseeable future’, thereby ending a long run of quirky slide presentations that featured imagery such as flying unicorns and golden geese laying eggs among others.

What next?

SoftBank has cut its investments sharply this year. Son and Chief Financial Officer Yoshimitsu Goto said that they would be very selective with investments going forward. Goto also said that investment firms such as Tiger Global and Sequoia Capital also share a similar view on investments.

The caution on investments hints at a longer funding winter for Indian startups as SoftBank, Tiger Global and Sequoia Capital have been among the most aggressive investors in India over the years.

A giant leap for Indian space

It has been a momentous week for the Indian space ecosystem and there is now more reason to rejoice.

Driving the news

Chennai-based space tech startup Agnikul Cosmos, which recently successfully test fired its engine at an ISRO facility, is planning to go for a commercial launch of its rocket Agnibaan by March 2023, CEO Srinath Ravichandran told us.

However, before that, the IIT Madras-incubated startup will first conduct a test launch of the rocket in December, which will validate other necessary technologies such as avionics. It has already received a flight termination system for Agnibaan from ISRO on this front.

- This was the first time for a system used for ISRO's vehicles to be supplied for a private launch vehicle built in India.

- Based on the results of the test launch, the full-scale, commercial launch carrying customer payloads may take place in March or April next year.

Ravichandran also spoke about the importance of the recent engine test, the role played by regulator In-SPACE and more. Do read his interview.

In a separate development, Hyderabad-based space tech startup Skyroot Aerospace, slated to become India’s first private player to launch in space, also confirmed November 15 as the launch date for its rocket Vikram-S.

Also read: What history tells us about 'first launches' of rockets