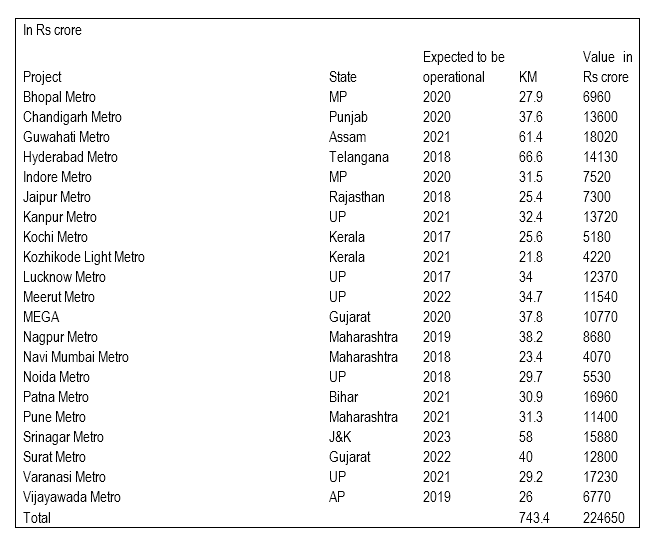

It is no longer Delhi and Mumbai, metro projects are now making headlines in small cities and towns as well. The Urban Development Ministry is already flooded with requests from cities like Patna, Bhopal, Indore, Chandigarh, Guwahati, Varanasi, Kanpur and others. Estimates (see table) reveal close to Rs 2.24 lakh crore could be spent on metro projects that are either under construction or are at a planning stage. This still does not cover the entire list. Recently, while inaugurating the Rs 5,182-crore Kochi Metro project, Prime Minister Narendra Modi said that about 50 cities are ready to implement metro projects.

Amongst markets, Mumbai is supposed to be the fastest growing market with 9-10 metro projects (under implementation or planning stage) measuring about 200 km with the total estimated close of close to Rs 80600 crore.

"While Mumbai is quite late compared to other global major cities as far as development of a metro rail network is concerned, the scale and speed of the network envisaged is astonishing. Over the next 4-5 years, construction of 125 km metro lines is being targeted in Mumbai. This is amongst the fastest rate of metro network development compared with other major cities across the globe. It is, in fact, at par with the pace witnessed in some major cities in China, reputed for tremendous execution speed," said Parvez Akhtar Qazi, Analyst, Edelweiss Securities.

Considering that civil construction is the largest part of the overall costs, construction companies like J Kumar and Simplex Infrastructures, which are dominant players in Mumbai region, are best placed to take advantage. Amongst the national players, ITD Cementation and NCC are considered to be strong contenders having relative experience and capabilities. Thankfully, today, the competition is less as most of the players in the construction space are struggling to reduce debt and lack backing of a strong balance sheet.

On Fast LaneBesides the quantum of spending, what has changed is the ease of execution. The government is framing the metro rail policy under which projects will go straight to Finance Ministry for approval. The government has standardised the specifications or requirements for the rolling stocks and signaling systems to speed up implementation.

For instance, the recently completed 13 km Kochi Metro was executed in record 45 months as against 75 months taken for the 11 km Mumbai Metro. It took 56 months for the 9 km Jaipur Metro and close to 50 months for the Bangalore Metro project.

A typical city metro project could be in the range of about 20-50 km. Every KM of a line could cost close to Rs 200-300 crore of capex in the form of civil construction, electronics, laying of tracks and rolling stocks. While civil work accounts for a majority of the project cost, this also opens up a huge opportunity for other companies in the value chain. It takes about 12 months after the starting of civil work for the rolling stocks to get awarded. In a typical metro project, the cost of rolling stocks is estimated to be around 15-20 percent of the total cost.

Since the government has prioritised domestic procurement, it will be an equally good opportunity for companies like Titagarh Wagons and BEML.

To put the numbers in perspective, 15-20 percent or Rs 34,000-45000 crore of the estimated amount of Rs 2.24 lakh crore to be spent on metro projects, will be deployed for rolling stocks. This is a sizeable amount for the industry where companies like BEML and Titagarh have annual sales turnover in the region of Rs 1000-2000 crore.

BEML claims to have close to 60 percent share in Delhi Metro and is the largest supplier of rolling stocks in Jaipur and Bangalore metro projects.

Similarly, there is an equally large opportunity for electric, systems, safety, signaling and communication products and services where players like Siemens have an edge. Recently, Siemens India along with German counterpart Siemens AG bid for the Rs 23,000 crore 33.5 km Colaba-Bandra-Seepz Mumbai metro project for the traction systems, signaling, train control, telecommunication and other parts of the total project.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.