As oil prices fell to near $70 a barrel levels, in a surprise move, the OPEC+ oil producers group announced a cut of 1.16 million barrels per day or about 1.3 percent of global oil consumption on April 2, 2023, a day before a proposed virtual meeting of OPEC+. The surprise element was the timing and the way the cut was announced. The oil markets are in a VUCA (volatility, uncertainty, complexity and ambiguity) situation - as the world faces inflationary challenges, central banks stepping on the rate pedals, the fallout of the Russia-Ukraine war, fears of global recession, currency volatility, and the anticipated China recovery.

As the surprise cut amounts to about 1.2 percent of OPEC production, analysts forecast a 10 percent jump in oil prices. In the derivative markets, the shorts have disappeared, and longs signalled the return of the bulls for a short period. While the OPEC members’ compliance with quotas has been surprisingly better this time than in the past, the market has no clue about Russian supplies. Despite the long-reigning recessionary fears and a cap on Russian oil sales, the war-ravaged crude supplies and the post-COVID recovery-related boost in demand continued to keep prices much higher than the cost of extraction for the major exporters, unlike the 2008 financial crisis.

Dependence on PetrodollarsEconomic logic says that when the supplies go down in a market with an uptick in demand, the prices will increase. With higher prices, OPEC+ exporters will have higher revenues. While this is what market microeconomics tells us, with multiple factors influencing the macro economy of these nations, one needs to understand what it holds for the oil-exporting economies to enhance supplies in line with anticipated demand.

Most of the oil pumped out of OPEC is sold in the markets priced in dollars. Most of the exporting nations are still dependent on their petrodollars to support their sovereign balance sheet indicating that crude oil prices are critical for the health of their economy. And most of the OPEC economies have pegged their local currency to dollars. As these nations are largely dependent on imported goods and expats paid in local currencies, the currency peg has the potential to create friction between wages and prices. It was for the same reason that many OPEC nations had resorted to wage controls in the past, even when oil revenues were higher.

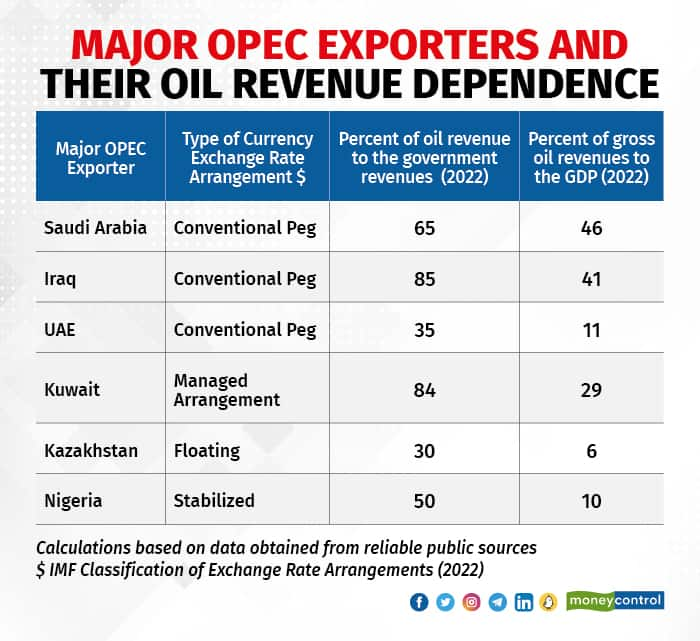

An analysis of the oil revenues of the large OPEC exporters reveals that oil revenues constitute a significant portion of their respective government revenues. Hence, they would be under constant pressure to manage supplies to keep oil prices higher. This has been the case with most significant oil exporters such as Saudi Arabia, Kuwait and Iraq, as evidenced by the share of their oil revenue to their respective gross government revenues and GDP. Being the lender and borrower to the world, concerned about the global economic situation, the United States dared to call the producers to keep oil flows healthier, but the geo-political status of the US has changed now. The US still talks, but no one in OPEC+ seems to be listening.

Need to Diversify RevenuesThe multilateral lenders, on their part, tried to push OPEC nations to diversify their economic activities besides developing a taxation regime on the economic actors and entities. While UAE had followed the advisory of the multilateral lenders, the others have yet to do much as required to open up their socioeconomic boundaries. While oil can be a value-addition opportunity, the revenue would still be linked to the spread between oil and products. Further, the demography in most exporter countries still depends on state giveaways, adding to the burden of the exchequer. As prices of imported commodities go up, inflation finally moves the peg. And energy plays a greater role in this.

The fact that between the 33rd and the 34th meeting in which OPEC announced further supply cuts, the Dollar index – a measure of the dollar’s value vis-vis six significant currencies – went down by 7 percent, indicates that the purchasing power of the dollar they earn was declining. Hence, OPEC must earn more export dollars to manage their balance sheet better. Russia joining the bandwagon with opaque production numbers under the ban will keep the market on a leash. However, their inflationary condition gets into an upward spiral, as energy is a key cost component of most goods and services produced and supplied worldwide.

The declining value of the dollar and the inflationary conditions in the world will continue to keep OPEC worried about the level of their oil export revenues and hence their actions to keep the supplies tight and prices higher. At this point, unless there is a severe recessionary condition shows off in terms of numbers, Russia joins the exporters league with transparent data flow, China’s growth slows down, the central banks signal continued rate actions, or there is significant global momentum towards EV, OPEC has incentives to keep supplies tight and hence hold prices in a range.

V Shunmugam is Adjunct Faculty at National Institute of Securities Markets. Views are personal, and do not represent the stand of this publication.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.