As new-age companies seek access to venture capital, private equity capital and then transition to larger listed companies, the founders’ shareholding in the company will get significantly reduced. The issuance of employee stock ownership plans (ESOPs) to founder-promoters who have now transitioned to single-digit shareholdings should not be separately regulated, as current regulations sufficiently empower the board and shareholders to approve such issuances. ESOPs can be an important tool to keep the company headed in the right direction under the leadership of its founders who became executive directors. SEBI should not have differentiated regulations for new-age companies, and ESOPs should be allowed to be granted to promoters of late-stage promoter-led or promoter-less companies.

The SEBI Issue of Capital and Disclosure Requirements (ICDR) Regulations define a ‘promoter’ as a person who has been named as such in the offer document or in the annual return of the issuer or a person who has control over the issuer (directly or indirectly) or on whose advice, directions or instructions the board of directors of the issuer is accustomed to act. Thus, the definition of promoter is wide-ranging and goes beyond persons in control of company (issuer).

The Companies Act, 2013 prohibits the grant of ESOPs to promoters as they are explicitly excluded from the definition of an 'employee'. This restriction is enumerated under Rule 12 (i) explanation of the Companies (Share Capital and Debentures) Rules, 2014 (Share Capital Rules) (relevant extract reproduced below):

“an employee as defined in clauses (a) or (b) of a subsidiary, in India or outside India, or of a holding company of the company but does not include-(i) an employee who is a promoter or a person belonging to the promoter group; or(ii) a director who either himself or through his relative or through anybody corporate, directly, or indirectly, holds more than ten percent of the outstanding equity shares of the company."The said prohibition is not applicable to startups registered with the Department for Promotion of Industry and Internal Trade (DPIIT). In its February 2016 report, the Companies Law Committee recommended the issuance of ESOPs to promoters who may be working as employees or employee directors or whole-time directors, which would help the promoters to gain from increase in future valuation of the company without in any way impacting cash of the company during its initial years. The committee recommended certain changes to the Companies Act that included: (a) allowing start-ups to raise deposits for their initial five years without any upper limits, and (b) allowing startups to issue ESOPs to promoters working as employees.

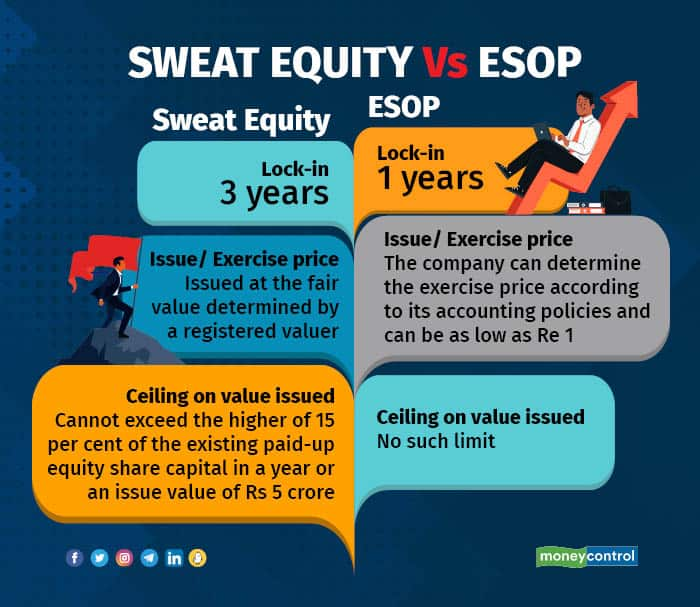

Win-win for shareholders, companyFor listed companies, any ESOPs issued to whole-time directors (WTDs) can be a win-win for all shareholders. This is because WTD can draw less cash compensation as salary in the initial years and be given ESOPs instead. Further, issue of share incentives prevents founders, who were the initial vision for the company, from losing interest in scaling up the business following their equity dilution after raising capital from private equity investors and public market investors. Also, it will help attract talent who are given ESOPs and thereby ensuring future growth.Other forms of compensation like sweat equity and performance-linked plans are open for being allotted to WTDs, irrespective of them being promoters. However, they are not as attractive as the grant of ESOP. Sweat Equity vs ESOPPractices in other countriesIn the US, unless a promoter is acting in the dual capacity of promoter and a director/officer/employee, employees’ stock options cannot be granted to that person. Also, ESOPS cannot be granted to highly compensated employees (HCEs). HCE will include employees who (a) have owned five per cent or more of the company (during the year or preceding year), (b) have received compensation in excess of $80,000, and (c) were in the top-paid group of employees in the previous year. In Singapore, public companies require the approval of independent shareholders when ESOPs are granted to (a) individuals who hold 15 percent or more of the voting rights and (b) to an employee and it will result in the employee holding more than five percent of the total options available In Germany, share options can be granted to all employees except to supervisory board or external consultants (who are not employees).Musk’s ESOP compensation

Sweat Equity vs ESOPPractices in other countriesIn the US, unless a promoter is acting in the dual capacity of promoter and a director/officer/employee, employees’ stock options cannot be granted to that person. Also, ESOPS cannot be granted to highly compensated employees (HCEs). HCE will include employees who (a) have owned five per cent or more of the company (during the year or preceding year), (b) have received compensation in excess of $80,000, and (c) were in the top-paid group of employees in the previous year. In Singapore, public companies require the approval of independent shareholders when ESOPs are granted to (a) individuals who hold 15 percent or more of the voting rights and (b) to an employee and it will result in the employee holding more than five percent of the total options available In Germany, share options can be granted to all employees except to supervisory board or external consultants (who are not employees).Musk’s ESOP compensationTesla promoter and CEO Elon Musk does not receive any cash salary but is entirely paid in terms of options. He receives his billions-worth compensation as options in his capacity as the CEO of Tesla Inc., not as its promoter. This does not discount the fact that he is a promoter of Tesla Inc. too, as he co-founded the company. In 2018, as per the remuneration agreement between him and the company, options would be granted to him as the CEO, depending on certain performance milestones achieved by the company in terms of market value, revenues and profits of the company. He has since received options at a set exercise price in tranches. Having such a long-term remuneration programme for the top management is beneficial, as it aligns 100 percent of the pay with stakeholders’ interest in the company’s performance.

In India, all widely-held promoter-less companies need to incentivise the founder-MD and any other executives to perform, and giving up a couple of percentages of shareholding vesting over 3-5 years means a win-win for shareholders. Also, after a founder/promoter-led company transitions to a wider board-led company, any ESOPs issued by the company to the founder should be viewed as that given to the role of managing director, and not to the role of founder. All ESOP issuances are approved by the board and shareholders by special resolution, thus current SEBI regulations and Companies Act provisions are already robust.Shriram Subramanian is Founder and MD, and Amrita Agarwal is Analyst, InGovern Research Services. Views are personal, and do not represent the stand of this publication.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.