In the last 15 years, most year-end opinion articles made two broad points. First, how the year that went by was not a good one for the economy. Second, how the sentiment was balanced between caution and optimism in the new year. However, as the new year starts, the sentiment of optimism is quickly reversed as the outlook increasingly turns gloomy.

It is no different this time. As the world economy entered 2023 with hope, Kristalina Georgieva, the Managing Director of the International Monetary Fund (IMF), remarked that one-third of the world will be in recession this year. Her comments have impacted oil and financial markets worldwide.

In a way, Georgieva has not said anything new. She is merely stating IMF’s official view on the world economy. In October 2022, IMF chief economist Pierre-Olivier Gourinchas presented the Fund’s bi-annual World Economic Outlook. He said that “The 2023 slowdown will be broad-based, with countries accounting for about one-third of the global economy poised to contract this year or next”.

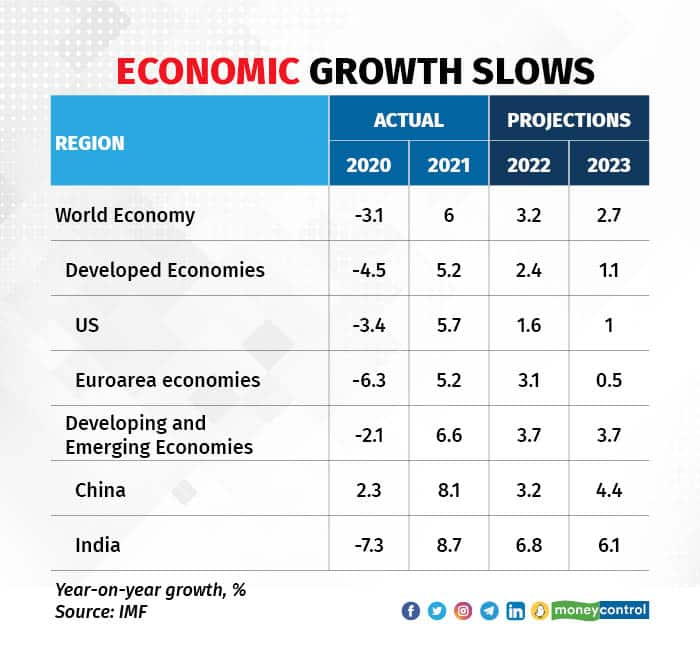

The IMF’s projections show how economic growth has slowed down over the years. Growth rates climbed in 2021 after a sharp contraction in 2020 due to the pandemic. In 2022, growth rates slowed down in both developed and developing countries, and it will only become worse in 2023. Within developed economies, growth in the euro area economies declined from 5.2 percent in 2021 to an expected 0.5 percent. In France and Germany, the largest euro area economies, growth rates are expected to be negative, implying a straightforward recession.

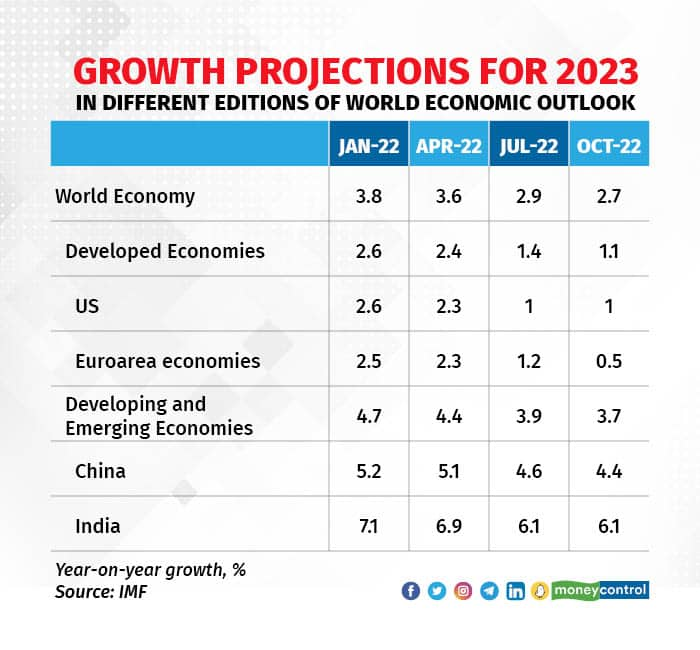

The IMF has also been lowering the growth forecasts for 2023 with each passing quarter. In January, it had estimated world growth at 3.8 percent, which has been revised down to 2.7 percent. Growth projections of developed economies were halved whereas those for developing and emerging economies were lowered by one percent.

Gourinchas added that the three largest economies - the United States, China, and the euro area – will continue to stall and that is apparent from the above analysis. The US economy has stalled mainly due to the significant tightening of policy rates by the Federal Reserve. The euro area will also slow down not just due to higher interest rates but also because of the Russia-Ukraine war. The war has disrupted the supply chains in Europe and also created shortages in natural gas which is supplied by Russia. The slowdown in China was caused by the stringent lockdowns imposed by the government to prevent an outbreak of disease. Any slowdown in China disrupts the world economy as it is a leading player in global supply chains and most economies are dependent on Chinese trade.

The IMF has also highlighted additional risks that could worsen the economic outlook. First, high uncertainty and rising global fragility will continue to put pressure on fiscal and monetary policy. There are already concerns that central banks have tightened policy very aggressively. Second, the financial conditions could decline tracking a worsening economic outlook which will further feed into a weaker outlook. Third, inflation could continue to be persistent leading to tighter monetary policy which will also impact the economy and financial markets. Fourth, if the war continues, the energy and commodity crisis will also continue.

How will India be placed amidst the global gloom? We can see IMF has also lowered the growth projections of India along with other countries. The Indian economy is not an island but a part of the global economy. If the global economy slows down, the Indian economy will be impacted too. However, as the Indian economy is driven by local consumption, the impact of the external environment will be limited compared to other countries. Having said that, there is no room for complacency. The National Statistical Office has projected growth for 2022-23 at 7 percent, sharply lower from 8.7 percent in 2021-22.

To sum up, it is interesting how global sentiments have changed so quickly in the last four years. We have seen pandemic concerns followed by war and high inflation. The concerns in 2023 are over the recession and the depth of the recession. Gourinchas’s summary for 2023 is pessimistic: “In short, the worst is yet to come and, for many people, 2023 will feel like a recession”. Gita Gopinath, the First Deputy Managing Director of IMF summarised her global economic outlook for 2023 at World Economic Forum in a more optimistic fashion: "We have a tough year ahead but there are signs of resilience". We will have to wait and see which of these views pans out in 2023.

Amol Agrawalis faculty at Ahmedabad University. Views are personal and do not represent the stand of this publication.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.