The report on the much-awaited internal review of the Reserve Bank of India’s liquidity management framework was out last week. There have been concerns about tight liquidity in financial markets since October last year despite RBI’s efforts to set the house in order over the past three quarters.

At the outset, it is important to understand that this framework pertains only to the market for bank reserves (deposits of banks with the RBI to meet reserve requirements) – the call money market. In other words, the apex bank’s interventions through various instruments mainly aim to modulate the level of liquidity in the banking system.

The chief objective is the repo rate, as set by the MPC (monetary policy committee), is operationalised by ensuring that the weighted average call money rate (WACR) remains aligned. Thus, the policy changes are transmitted to other rates in the economy through the call money rate, which is the target rate of the framework.

Therefore, depending on the size, the source and the nature of a liquidity deficit or surplus, the central bank decides its response while ensuring policy consistency. Since these operations also involve the RBI absorbing excess money at the reverse repo rate from time to time, that becomes the floor rate for the WACR.

The liquidity management framework is thus governed by the need to keep the WACR within the policy rate corridor, which is set at 25 bps around the repo rate. This is also called the corridor system.

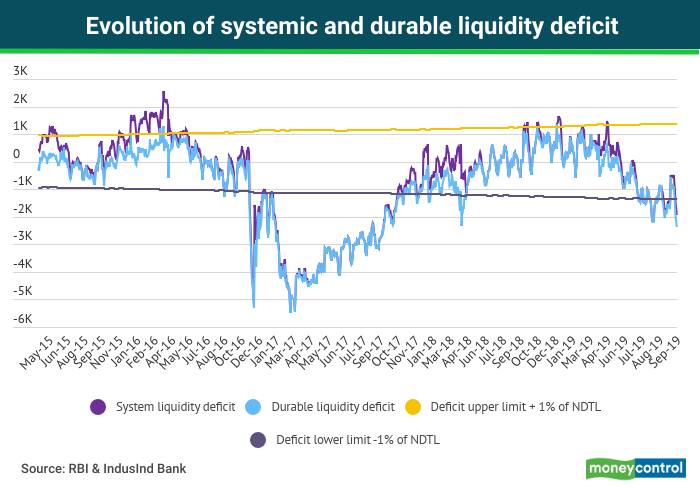

The liquidity management framework also defines a threshold of the acceptable liquidity deficit or surplus, which in turn determines the instruments to be used to inject or remove money from the banking system. In the current framework, that threshold is +/-1 percent of the banks’ net demand and time liabilities (NDTL) though the RBI shifted to maintaining an average liquidity deficit closer to neutral since April 2016.

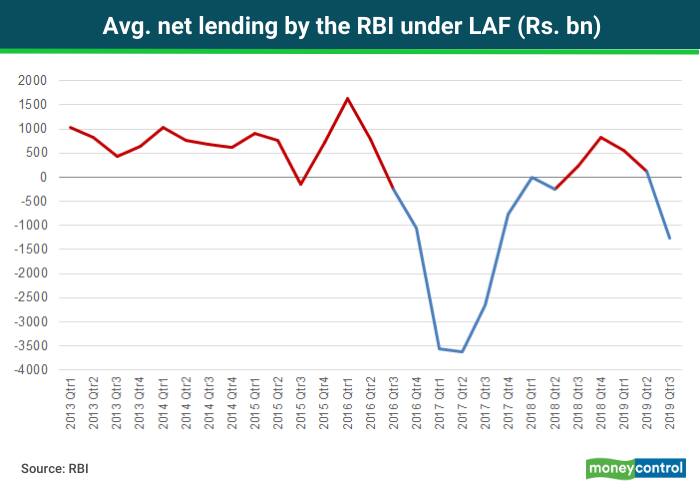

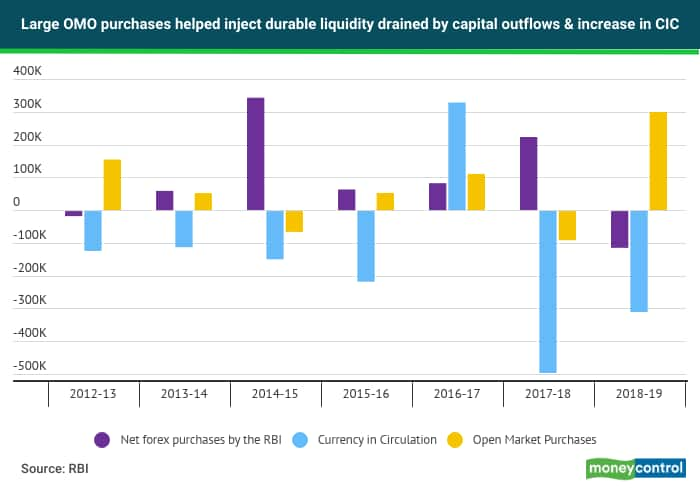

For transient or short-term mismatches that occur mostly because of changes in government balances with the RBI, repo operations of various maturities under liquidity adjustment facility (LAF) are used. For durable or lasting liquidity changes, which are driven mainly by capital flows and RBI’s interventions in the forex market as a result of an increase or decrease in currency-in-circulation (CIC), the central bank uses open market operations (OMOs) in the government bond market, in conjunction with LAF.

For instance, during 2018-19, as liquidity deficit widened due to net capital outflows and a larger-than-expected increase in CIC, the RBI purchased government bonds worth Rs 2,99,200 crore through OMOs and also introduced a new instrument to inject liquidity in the form of long-tenor forex swaps.

In the new proposed framework, some key changes have been suggested by the working group, while keeping the main elements same. For one, the desirable level of liquidity deficit in the banking system has been proposed at 0.25-0.5 percent of NDTL. Any persistent deficit beyond this level would require market operations to inject durable liquidity.

The new framework also proposes that liquidity surplus may be warranted based on prevailing financial conditions, without getting into specifics. Considering that the systemic liquidity in the banking system is in surplus and in excess of 1 percent of NDTL, the current macro-economic setting of weak demand-driven below-potential growth, inflation well within the target range and financial market conditions characterised by risk aversion and poor sentiment can therefore be a ground for surplus to be maintained. Surplus liquidity allows for a better transmission of monetary policy rates and helps in bringing down rates across market segments, including government bonds and corporate credit.

Another related change proposed is the assured liquidity provision of 1 percent of NDTL under LAF is deemed no longer necessary. Under the current framework, banks have access to fixed rate repo up to 0.25 percent of their NDTL and up to 0.75 percent of the banking system NDTL through four 14-day variable rate term repo auctions.

Even if the liquidity conditions are in surplus, banks can still borrow from the RBI under this assured provision. That, in turn, inhibits the activity in the inter-bank call money market and increases the frequency of operations under LAF.

In the revised framework, the RBI will provide liquidity to support the needs of the entire banking system and only conduct one variable rate operation on a daily basis, leaving the short-term liquidity demand and supply mismatches to be managed through the call money market. This is seen as making the system more efficient and will help increase the activity in the call money market, helping in greater volumes.

For managing durable liquidity changes caused by persistent capital inflows or outflows or large drains due to an increase in CIC, the working group has proposed that long-term repos be developed as an alternative tool to OMO purchases or sales. These repos will have a tenure from 14 days to up to 1 year and the rate will be market determined.

Considering that open market purchase of bonds by the RBI is seen as an important source of demand for government bonds, any shift away to long-term repos and the resulting reduction in the quantum of OMOs can have a potentially negative effect of pushing up bond yields.

However, the objective of liquidity management is to ensure provision of adequate money to meet credit requirements of the economy, without influencing the bond market in any permanent manner. For instance, the large open market purchase of bonds last fiscal year was necessitated by very large autonomous drains on liquidity through capital outflows and a larger than anticipated increase in CIC.

In the six years prior to that, open market operations added liquidity in four years, with an average size of Rs 92,000 crore. In 2018-19, net addition through open market purchases was more than 3 times that size. However, that cannot be seen as a regular behaviour on the part of the RBI to manage durable liquidity squeeze and hence, the need to develop another tool to provide assured funding over a longer term and one without any significant rollover risk. A liquidity injection through a long-term repo, however, may not be helpful from an LCR management perspective as compared to OMOs.

Overall, the broad contours of the liquidity management remain unchanged under the proposals with a corridor system around the repo rate, WACR as the target rate and the default position on liquidity being one of small deficit.

However, the endeavour is to make the system more efficient in terms of daily operations while ensuring the activity in the inter-bank call money market improves and develop a new instrument in order to avoid large OMOs. Importantly, the framework makes a provision for a surplus liquidity, which would aid monetary transmission, especially under the current macro-economic setting.

Gaurav Kapur is the chief economist of IndusInd Bank. Views are personal.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.