Anubhav Sahu Moneycontrol Research

In recent months, headwinds ranging from cost inflation to demonetisation and GST implementation forced fast-moving consumer goods (FMCG) companies to defer product launches and cut promotional spends. Now, with these factors largely out of the way, companies are looking at a promising second half, likely heralding better days for media companies.

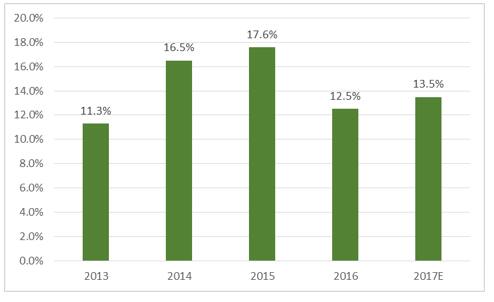

In CY 2016, the Indian advertising market growth had slowed down to 12.5 percent growth from 17.6 percent the previous year, largely on account of demonetisation and moderate end-market demand in some sectors. As per a report from the Madison group, in 2017, the ad market is expected to witness a moderate uptick (13.5 percent growth) mainly on the back of growth during the festive period (November-December 2017: 24 percent YoY).

Chart: Indian advertising market growth rate

FMCG: largest contributor but advertising spending growth tapered recently

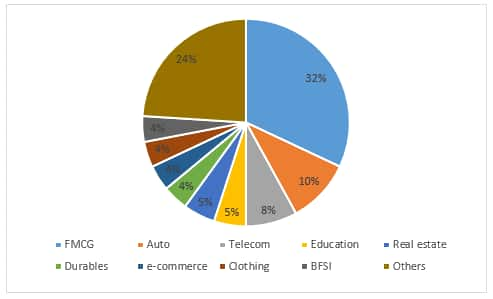

Looking at the advertising spending trend in TV, print and radio media, the FMCG sector has the largest contribution (32 percent in CY 2016). This is especially true for the TV industry, where the contribution of FMCG advertising spending is even higher at 51 percent in 2016. Other media segments, like print and radio have a limited FMCG contribution of 15 percent and 9 percent, respectively.

In CY 2016, the FMCG sector’s ad spend growth was a moderate 7 percent YoY, lower than the overall ad spend growth. In fact, other consumption-oriented sectors like e-commerce reported a steeper decline in ad spending (-26 percent) on account of prevalent sales sluggishness due to competition and demonetization. It is estimated that there was a decline in ad spending by FMCG players, to the tune of Rs 500 crore during November-December 2016 compared to the previous year.

Chart: Indian advertising spending contribution

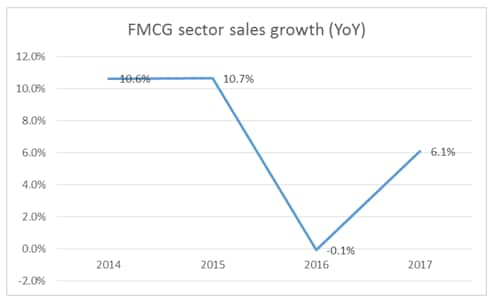

FMCG sales and ad spend trend/management outlook

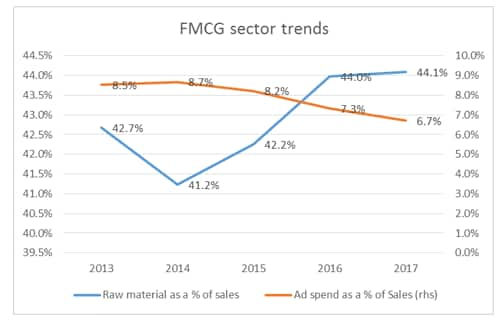

The Indian FMCG sector posted an improved sales growth performance in FY17. However, it is still way off the low double-digit growth rate witnessed before. As we have highlighted in our earlier articles, a slowdown in sales growth can be partially attributed to competition from unlisted manufacturers.

Intense competition had a bearing on margins and led to a slugfest to maintain market share. Additionally, there was a rise in raw material costs, particularly crude oil prices, which led to higher packaging costs. In a bid to protect profitability, a few of the FMCG companies had resorted to spending cuts, and ad spending was one of the areas affected.

Media companies recent earnings impacted

Media companies have been impacted by the reduced spending by the FMCG sector. In the broadcasting industry, advertisement revenue constitutes 65 percent of total revenue. Though the industry has been a net beneficiary of digitization leading to higher subscription growth, advertisement revenue have lagged a bit in recent times.

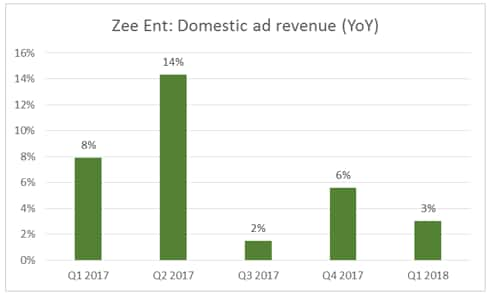

For instance, Zee Entertainment witnessed a moderate 7 percent advertising revenue growth in 2017. Domestic advertising revenue growth in the past few quarters was weak, particularly in Q3 2017 (demonetization) and Q1 2018 (GST destocking by end markets). Sun TV Network also faced a decline in advertisement revenue by 4 percent in FY17.

In the recent quarterly earnings calls, media companies mentioned that advertisers had reduced ad spends on the current portfolio and launched fewer products, on account of GST transition, as the distribution chain was not fully prepared.

Optimistic management outlook of FMCG companies

While the current quarter is witnessing a speeding up of GST transition and restocking, improved ad spending is expected only in Q3 2017. FMCG companies are positioning for the festive season in the next quarter, a period which is also likely to benefit from a lower base leading to higher growth numbers.

Factoring this in, media agency Madison expects 24 percent advertising spending growth during November-December 2017.

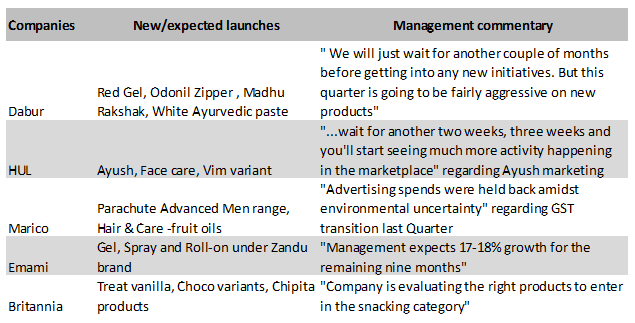

Further, FMCG companies in the earnings calls have highlighted that ad spending would improve in the coming months. Some have cited GST-related transition as the reason to hold back ad spending and delay new launches. However, this is likely to change.

In addition, responding to the Patanjali challenge, a few have revamped their strategies to come up with new products in the herbal theme (Red Gel, Vedshakti, White ayurvedic paste, Ayush etc.). On account of this change as well, a pickup in promotional spending is expected.

Companies are also hopeful of a recovery in rural demand post two consecutive normal monsoon seasons.

Against this backdrop, should ad spend revive, it is likely to benefit industry participants in the broadcasting industry like Zee and Sun TV.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.