Finance Minister Nirmala Sitharaman presented her record seventh successive budget on July 23. The 2024–25 (FY 25) budget size was Rs 48.2 lakh crore, which is 7.03 percent higher than the budget estimates for FY 24. The nominal growth rate projected for 2024–25 is 10.5 percent which seems like a conservative figure given the real GDP growth projected at around 7 percent and the likely GDP deflator between 4.5 and 5 percent.

However, the budget estimates the revenue deficit to be 1.8 percent of GDP in FY 25. The good news is that it has declined by 80 basis points from 2.6 percent in FY24, but still, the long-standing but crucial query remains: should we not be aiming for a revenue surplus at this point?

Revenue deficit is fiscal profligacy

A revenue deficit means borrowing to cover current expenditures like salaries and pensions, which don’t enhance economic capacity and indicate living beyond one's means. Meanwhile, the deficit incurred for capital outlays is justified as it builds productive capacity that pays for the cost of borrowing. A revenue deficit can be seen as fiscal profligacy, where we continuously spend more than we earn and effectively borrow to repay the interest on earlier borrowings. This has become an integral feature of our fiscal management but needs revisiting. Shifting to a revenue surplus is essential for long-term stability and budget health.

India's government revenue as a percentage of GDP is currently 20.1 percent, consistent over the past 20 years but lower than the norm for emerging and middle-income Asian nations. In contrast, China's revenue to GDP ratio increased by 13 percentage points between 2002 and 2017. This suggests that the Indian government must swiftly increase revenue and shift from a revenue deficit to a surplus.

Irrational confidence in dividends and profits

The Reserve Bank of India (RBI) has given a record dividend of Rs 2.1 trillion to the central government, helping it in its fiscal management for FY25. This was higher than the government’s budget estimate and analysts' expectation of near Rs1 trillion, as the central bank reported a 23 percent increase in its income for the fiscal year 2023–24. The surge was driven by higher earnings from foreign investments and increased interest income from domestic operations. These factors collectively enabled the RBI to declare a larger dividend to the government. Moreover, for FY 25, the budget estimates mention a staggering 2.89 lakh crore rupees as dividends and profits, tripling the FY 24 figure of 91,000 crore rupees (BE). It is not certain that the extraordinary contributions from the RBI will actually materialize in FY25.

Heavy burden of interest payments

The government’s largest expenditure is interest payments, making up for whopping 37 percent of total receipts and 24 percent of total expenditure. In 2024–25, this is estimated to be Rs 11.6 lakh crores, 7.6 percent higher than FY 24’s BE. This is notably high compared to the global average of 5.6 percent, the USA’s 11.5 percent, and OECD’s 3.5 percent, and needs to be reduced. The high interest payments do not leave much scope for increasing outlays on sectors like education, health and skill development, which are crucial for taking full advantage of our demographic dividend.

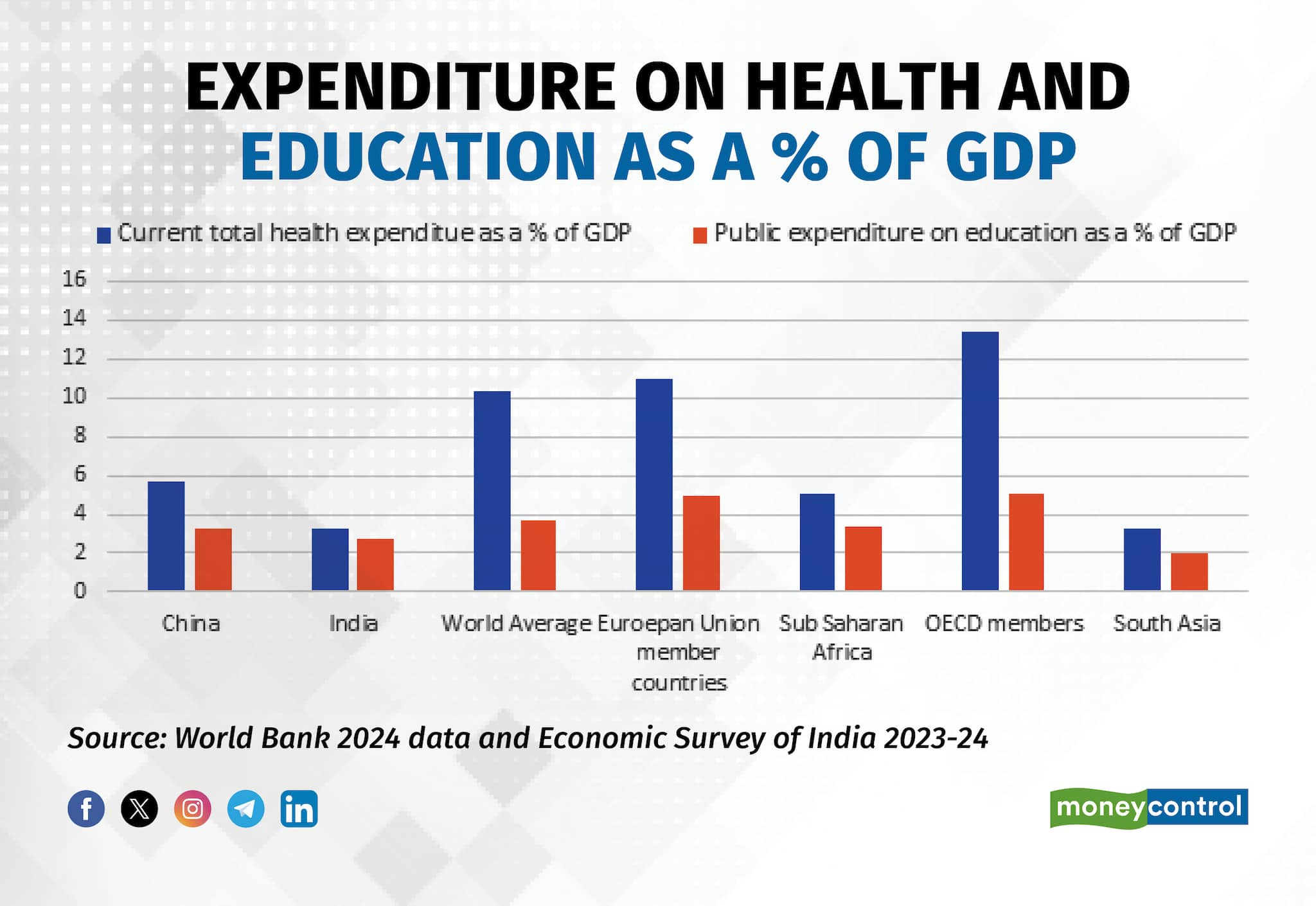

The graph shows that OECD members invest significantly more in health and education as a percentage of GDP than the world average. India's spending is lower than even the sub-Saharan Africa average, highlighting a critical need for increased investment in health and education. Greater allocation for these important sectors can be achieved only with higher revenue mobilisation.

Modest disinvestment targets

The finance minister established the target for 2024-25 at Rs 50,000 crore. It is puzzling that the disinvestment targets are so modest given the need for reducing the public debt and interest payments. Disinvestment in public sector companies can generate much-needed income to cut the debt load and the revenue deficit. Not only could a more aggressive disinvestment approach increase revenue significantly, but it could also boost the public sector's competitiveness and efficiency.

CareEdge Ratings estimates that the potential market capitalization of the Indian government's current holdings, which can be off loaded in the capital markets, is estimated to be around ₹11.5 lakh crore with still retaining 51% stake. Given the current sky high market valuations of central public sector enterprises, this would be an optimal time to off-load the share of equity held by the government. Not only will this garner much needed non-tax revenue for the government, it will also prevent a bubble in CPSE stock prices, which otherwise could crash and harm a lot of retail investors.

Revenue surplus is essential to upgrade human capital quality

India still remains below the National Health Policy 2017 target of allocating at least 2.5 percent of GDP to healthcare. The Department of Health and Family Welfare's FY 2024-25 budget of Rs 90,959 crores shows a marginal 2 percent increase from the previous year's BE of Rs 89,155 crores. The government's total expenditure on education and health for FY 25 is 2.1 lakh crore rupees, which accounts for 4.4 percent of the total budget. For defence the corresponding figure is Rs 6.2 lakh crore rupees, comprising 12.9 percent of the overall budget. Interest payments alone total Rs 11.6 lakh crore, far exceeding combined spending on education, health, and defence. Generating a revenue surplus is recommended over financing through non-tax sources like dividends or borrowings.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.