The PMS and AIF industry has grown rapidly over the past few years, despite higher expenses compared with mutual funds, as high-ticket investors prefer the comfort of having more direct access to their investment advisors/fund managers than being seen as one of the millions of investors invested in a mass product.

With no significant long-term track record, this asset growth came on the back of goodwill and sheer marketing. However, with smaller- size making PMSs funds more nimble, they have also now built a healthy track record. So much so that, the returns delivered by the top PMS schemes handily beat those delivered by the top MF returns across categories, and across time periods, according to a report by PMS AIF WORLD. Currently, PMS funds have a total corpus of Rs 29 trillion versus Rs 53.4 trillion of equity assets under management under equity mutual funds. Size, does, matter it seems. And in this case, the smaller, the better.

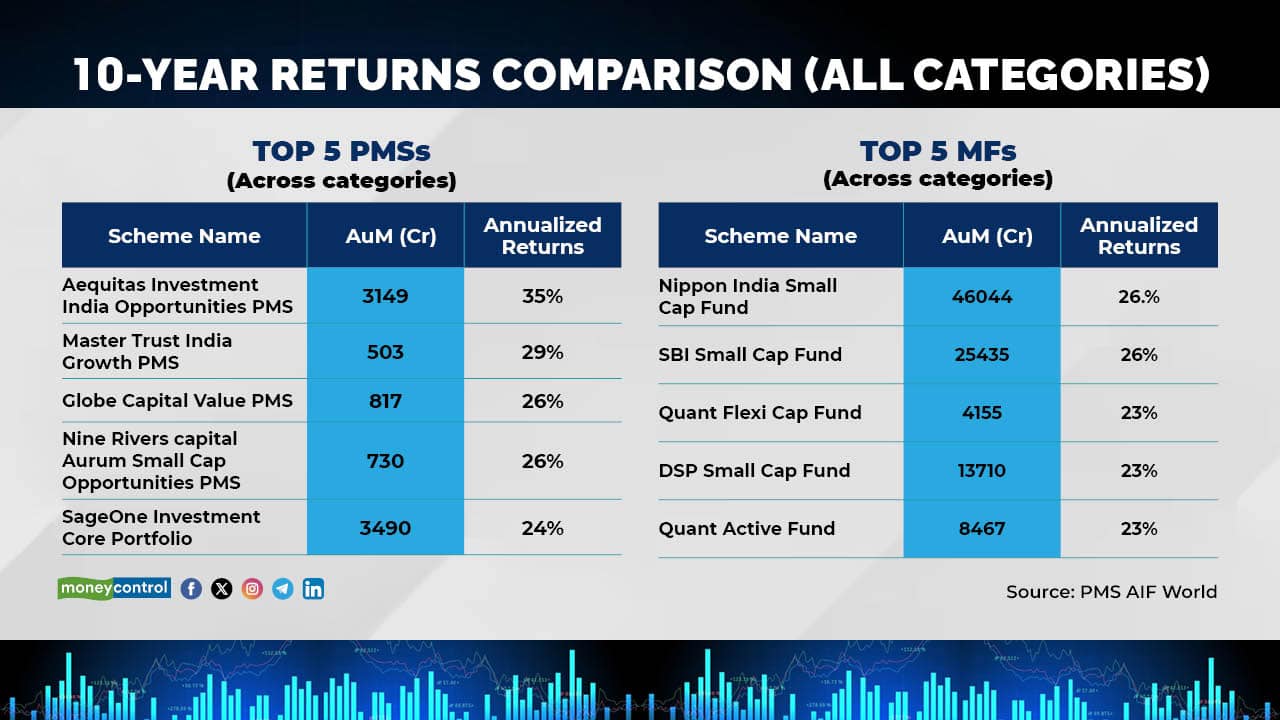

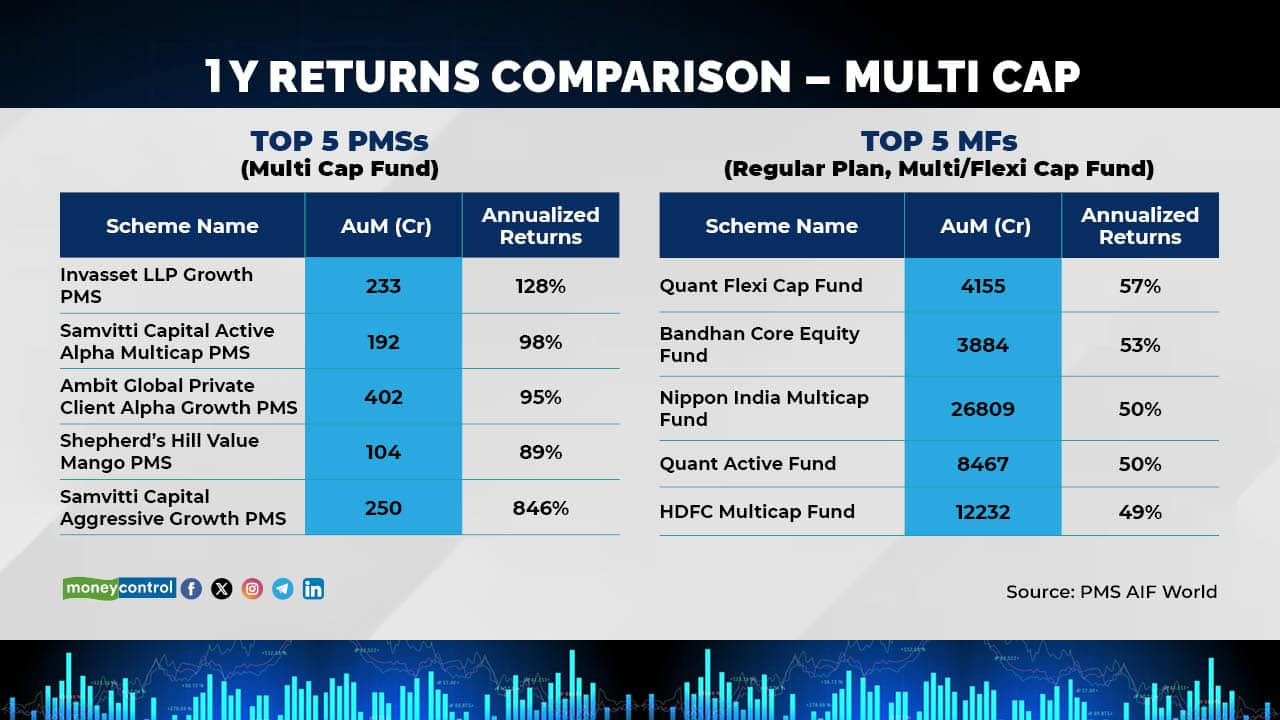

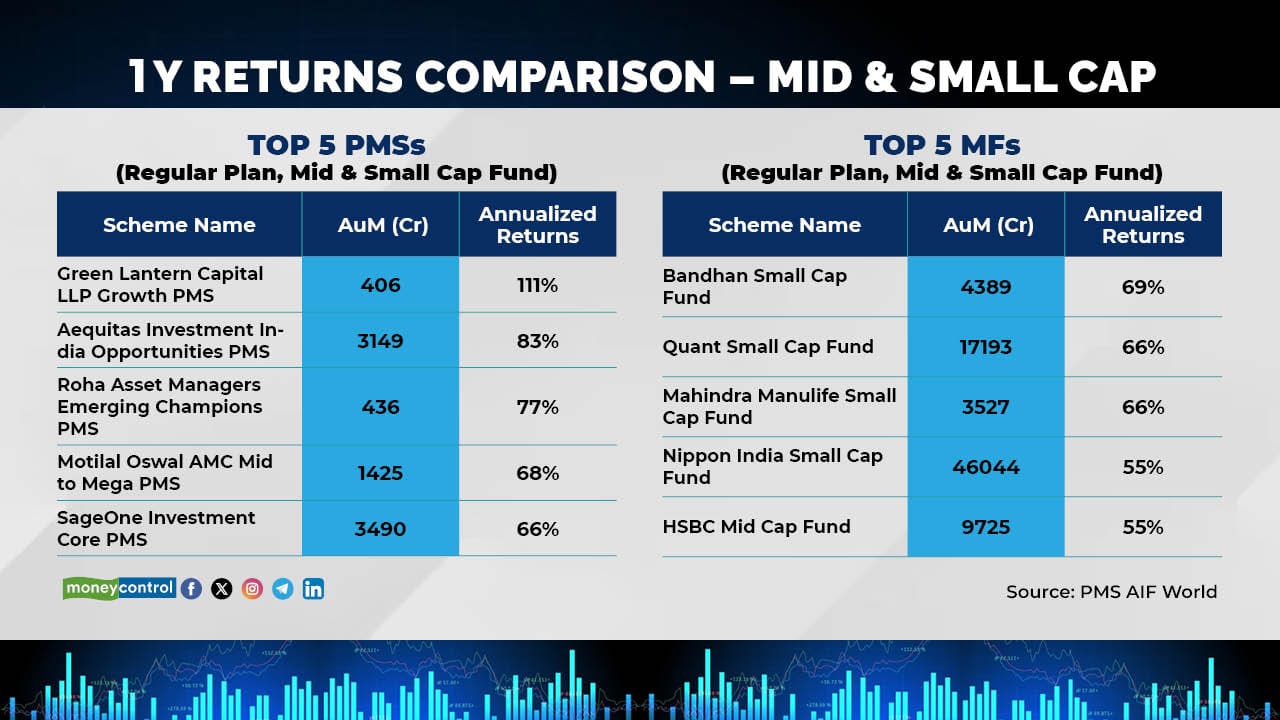

Take a look at how the best PMSs compare with the best MFs

10-year returns

For a 10-year period, had one invested Rs 2.5 crores in the top 5 PMSs on April 1, 2014, one would have generated Rs 30.77 crore, around Rs 8.75 crore more than that from the top 5 equity mutual funds. The best PMS returned 35 percent in this segment in the last 10 years, versus the top mutual fund’s 26 percent.

For a 10-year period, had one invested Rs 2.5 crores in the top 5 PMSs on April 1, 2014, one would have generated Rs 30.77 crore, around Rs 8.75 crore more than that from the top 5 equity mutual funds. The best PMS returned 35 percent in this segment in the last 10 years, versus the top mutual fund’s 26 percent.

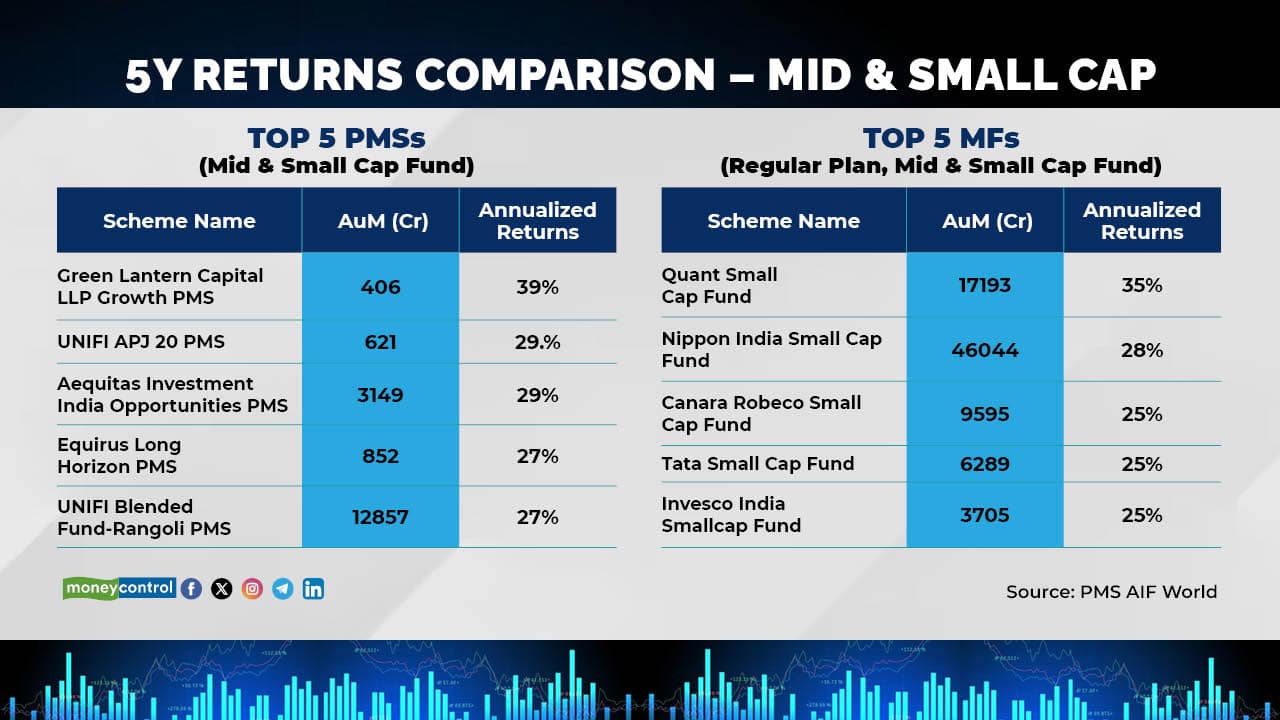

5-year returns

On a 5-year return basis, if one had invested Rs 2.5 crore in the top 5 PMS Multi Cap funds on April 1, 2019, the report suggests that one would have generated Rs 9.08 crore, which is around Rs 1.68 crore more than the similar category of mutual funds.

On a 5-year return basis, if one had invested Rs 2.5 crore in the top 5 PMS Multi Cap funds on April 1, 2019, the report suggests that one would have generated Rs 9.08 crore, which is around Rs 1.68 crore more than the similar category of mutual funds.

Similarly, if one had invested Rs 2.5 crore in the top 5 PMSs Small and Mid Cap funds on April 1, 2019, the report suggests that one would have generated around Rs 9.36 crore -- that is around Rs 0.83 crore more than mutual funds.

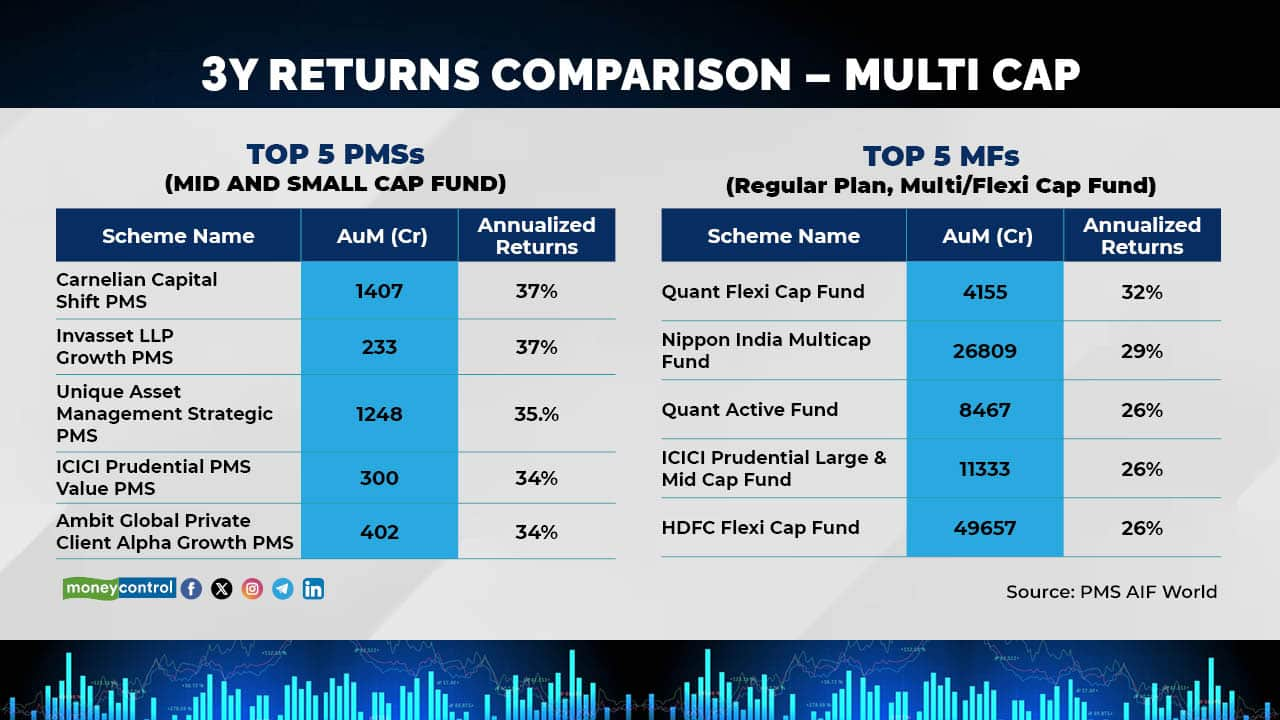

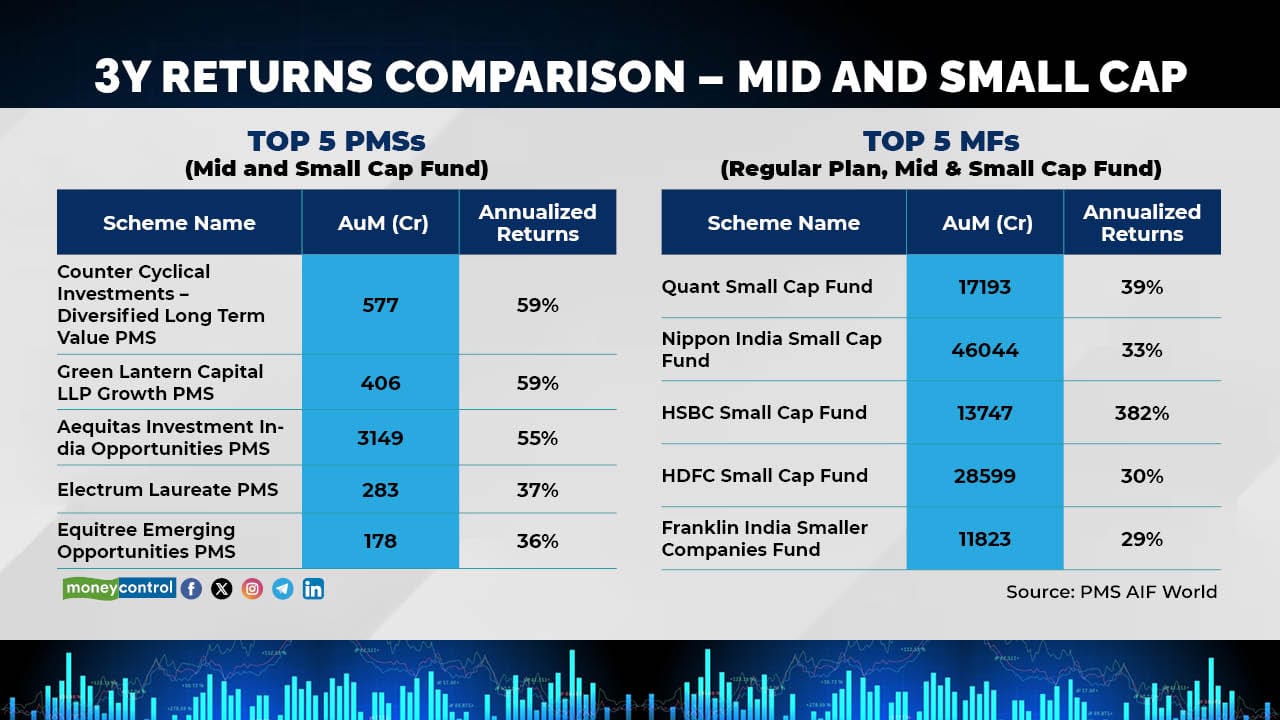

3-year returns

On a 3-year return basis, if one had invested Rs 2.5 crore in the top 5 multi-cap PMS funds on April 1, 2021, one would have generated Rs 6.23 crore according to the report. That is around Rs 1.01 crore more than mutual funds.

On a 3-year return basis, if one had invested Rs 2.5 crore in the top 5 multi-cap PMS funds on April 1, 2021, one would have generated Rs 6.23 crore according to the report. That is around Rs 1.01 crore more than mutual funds.

Similarly, the report shows that if one had invested Rs 2.5 crore in the top 5 mid and small-cap PMS funds on April 1, 2021, one would have generated Rs 8.43 crore -- around Rs 2.59 crore more than mutual funds.

1-year returns

On a 1-year return basis, if one had invested Rs 2.5 crore in the top 5 multi-cap PMS funds on April 1, 2023, the report suggests that one would have generated Rs 4.97 crore, that is around Rs 1.18 crore more than mutual funds. On a 1-year return basis, if one had invested Rs 2.5 crore in the top 5 small and mid-cap PMS funds on April 1, 2023, one would have generated Rs 4.52 crore, which is around 0.47 crore more than the top 5 Mutual Funds.

PMS AIF WORLD is a new age investment platform which is creating its niche in the wealth management industry by truly focusing on alpha-driven managers and funds.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.