Newly introduced flexi cap funds became the largest category among equity mutual funds, overtaking large caps at the end of the quarter ended December 2022, according to a report by Morningstar India.

The flexi cap category was introduced by the capital markets regulator Securities and Exchange Board of India (SEBI) in November 2020. These funds invest in companies across the market capitalisation spectrum, i.e. large cap, mid cap, and small cap stocks.

A flexi cap fund must have at least 65 percent of its total assets invested in equities.

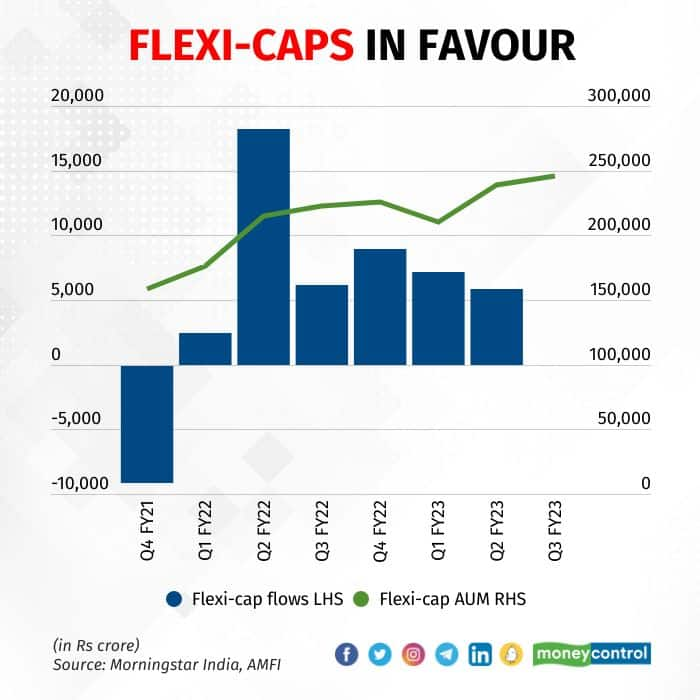

Data shows that Assets Under Management (AUM) of flexi cap funds have grown about 70 percent since they were introduced in November 2020.

Notably, schemes such as Quant Flexi Cap, PGIM India Flexi Cap, HSBC Flexi Cap, Bank of India Flexi Cap, Parag Parikh Flexi Cap and Canara Rob Flexi Cap Fund registered higher growth in AUM since the category was introduced.

Also Read | Sebi introduces Flexi-Cap Fund category for MFs; experts welcome move

Last year was a landmark for Indian mutual funds as the industry’s total AUM went past Rs 40 trillion. Data shows that assets of all 11 equity categories hit record highs during the year.

Mutual fund assets topped the Rs 40 trillion mark in November, but there was a slight sell-off at the end of the year. AUM of open-ended funds stood at Rs 39.58 trillion crore as of December 2022, up by 7 percent compared to the previous year.

Also Read | Check out Moneycontrol’s curated list of 30 investment-worthy mutual fund schemes

According to the Morningstar India report, the third quarter of financial year 2022-23 saw a net inflow of Rs 18,952 crore into open ended equity funds. The funds’ total AUM as of December 2022 stood at Rs 15.25 lakh crore, up by 4 percent since September 2022.

Here are the 5 key trends according to the Morningstar India report.

Flexi cap category flexes muscle

The flexi cap category became the largest by AUM in the open ended category, overtaking the large cap category, in the December quarter.

As per Morningstar, the AUM for the flexi cap equity category hit its peak, with total assets amounting to Rs 2.46 trillion during the quarter ended December 2022.

Also Read | Where to invest Rs 10 lakh today? Don’t lose faith in US tech stocks, says Rajeev Thakkar

In the calendar year, the category witnessed a marginal increase in net flows in 2022, wherein it managed to garner Rs 21,997 crore compared with Rs 17,882 crore in 2021. That said, the flows witnessed in 2022 in the flexi cap category were the highest among the open ended equity asset class.

“Many of the erstwhile multi cap funds moved into flexi cap category when it was created as the investment restrictions were similar to the earlier category,” said Harsha Upadhyaya, President and Chief Investment Officer-Equity, Kotak Mahindra Asset Management Company. “So, in that sense, the category didn’t start from scratch two years back. In this category, depending on opportunities in the market, the portfolio manager can move/explore investments across market capitalisation segments. One can say it is an all-weather equity category. This is what attracts investors into these kind of funds, where investor does not have to worry about which market segment to invest into.”

Large cap AUM hits record

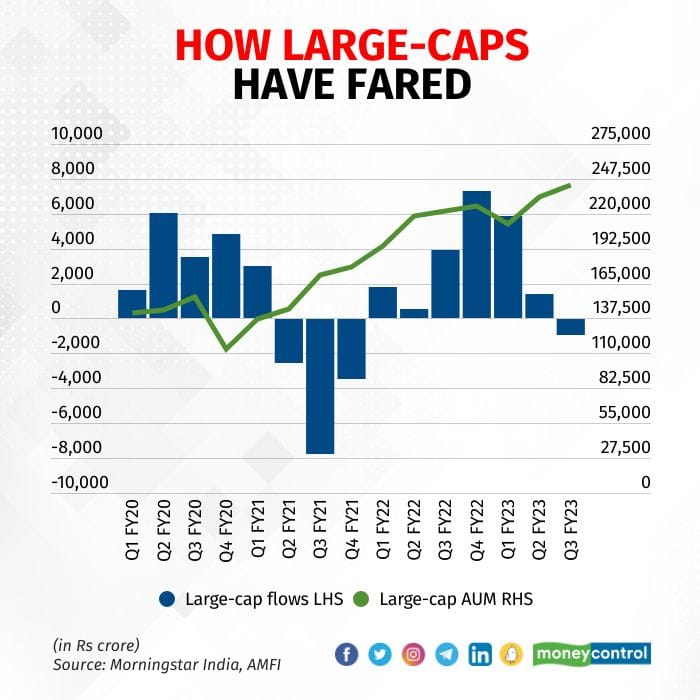

AUM in the large-cap equity category hit a peak of Rs 2.42 trillion in the quarter ended December 2022. While the flows during the quarter were negative, the rally in the large cap category benchmark (S&P BSE 100 at 5.08 percent) aided this category to reach an all-time high AUM.

The year-on-year growth for the category stood at 9 percent, while assets rose by 4 percent since the previous quarter.

Large cap funds experienced net outflows worth Rs 892 crore in the third quarter of FY23. While the category was witnessing a deterioration in net inflows over the last few quarters, the net outflows seen this time around have been after six consecutive quarters of net inflows.

This data is purely for actively-managed large cap funds.

“Funds in large cap category in the recent few years have had a difficult time beating their benchmarks, with the quantum of alpha as well as the number of funds outperforming their benchmark has come down. We are witnessing some investors move large cap allocations into low-cost index funds,” said Kaustubh Belapurkar, Director- Manager Research, Morningstar India.

Notably, despite witnessing large net outflows (around Rs 1,000 crore) during the third quarter, Axis Bluechip Fund continued to be the largest fund in the large cap category, said Morningstar.

Consistent inflows into mid caps

The mid-cap category had net inflows for the eighth consecutive quarter, wherein it managed to garner net inflows of Rs 4,524 crore in the third quarter of fiscal 2022-23. Interestingly, during the quarter, the mid cap category received the second highest net inflows in the equity asset class, only behind the small cap category.

Also Read | Edelweiss MF, Kotak MF put restrictions on international funds

AUM for the mid-cap equity category hit its peak, with total assets amounting to Rs 1.85 trillion during the quarter ended December 2022.

Since the fourth quarter of 2019-20, AUM for the mid cap category has seen a consistent rise courtesy market movement coupled with positive net inflows every quarter.

During 2022, assets under the category rose by a sharp 17 percent while, on the other hand, over a one-year period, only two mid cap funds saw net outflows.

Fixed Income pain continues

The open-ended fixed income category had net outflows of Rs 21,096 crore in the third quarter of fiscal 2022-23. It was the fifth consecutive quarter that the category had net outflows.

Month-wise, the quarter started negatively as the asset class witnessed net outflows of Rs 2,818 crore in October, but bounced back with net inflows of Rs 3,669 crore in November.

The quarter ended on a sombre note with net outflows of Rs 21,947 crore in December 2022.

The Reserve Bank of India (RBI) had raised interest raised rates by 225 basis points since April 2022. While the RBI announced a 25 basis points rate hike on February 8, experts believe that the central bank is close to the peak in interest rates this cycle.

Also Read | Equity mutual funds to adopt T+2 redemption payment cycle from Feb 1

Many mutual fund companies during 2022 launched Fixed Income-Passive index funds / target maturity funds.

Visible returns, attractive yields, low expense ratio and liquidity have been among the reasons why investors have been looking at target maturity funds.

With interest rates peaking, experts are suggesting increasing allocation towards the longer end of the yield curve.

After hitting a peak of Rs 14.16 trillion in the second quarter of fiscal 2022, AUM in the fixed income category has been on a steady decline. As of December 2022, the AUM stood at Rs 12.41 trillion, almost the same as the last quarter but down by 12% since the same period last year.

‘Others’ take the crown

The ‘other’ schemes category, composed of index funds, gold exchange-traded funds (ETFs), other ETFs, and global funds of funds (FoFs), has had phenomenal flows over the past year-and-a-half. Most subcategories have experienced positive flows all through the quarter ended December 2022.

Cumulatively, the assets of the other schemes category continue to grow from strength to strength in each quarter. As of December 2022, the AUM for funds in the others category ended up at Rs. 6.68 trillion, up by 12 percent since the last quarter and 42 percent since the last one year.

Also Read | Investors shrug off volatility, equity fund inflows surge 72% in January

The assets of the index funds category, too, have increased substantially since the last quarter by 23 percent and a phenomenal 184 percent over the last year. With a total of 146 schemes now, the subcategory has assets of almost1.29 lakh crore. These include both the equity index funds as well as fixed income index funds.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.