The Republic Day break did little to dissuade the bears which were back in force on January 27, with the Sensex sinking 870 points to 59,330 and the Nifty slipping close to the 17,600 mark, as investors remained nervous ahead of Budget 2022-23.

Adani Ports, Adani Enterprises, ICICI Bank, SBI and BPCL were among the top Nifty losers. Nifty Auto, FMCG and Pharma indices managed to eke out some gains as other sectors ended deep in the red.

Despite firm global cues, investors remained nervous ahead of Budget 2023. Here were the factors that dragged D-Street lower:

1 Budget 2023

Market participants are hoping the government will continue with its infrastructure spending and announce measures to attract more funds from the private sector.

If Street expectations are not met, market could see a fall. The FY24 fiscal deficit number will also be watched keenly. Foreign brokerage Morgan Stanley expects the fiscal deficit to be 5.9 percent of the GDP in FY24 against 6.4 percent for FY23.

Also Read: Budget Expectations Survey: What the market thinks about Nominal GDP growth?

“There is a need to consolidate the fiscal deficit. The starting point of 6.4 percent is already so elevated that markets will not like it if there is any further slippage,” Upasana Chachra, Chief India Economist, Morgan Stanley has said.

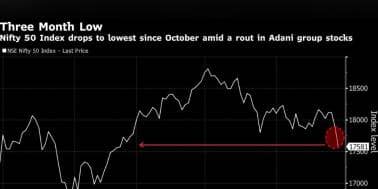

2 Big boys fall

Adani Ports and Adani Enterprises continued their free fall for the second straight session. The stocks ended lower by 16 percent and 18.5 percent, respectively. On January 25, Adani Ports had closed 6.3 percent lower.

Other heavyweights that dragged the index down were HDFC Bank, SBI and Reliance Industries, which closed 3-5 percent lower.

3 UN cuts India's 2023 growth forecast by 20 basis points

The United Nations has cut its GDP growth forecast for India for the calendar year 2023 to 5.8 percent, citing the effect of tighter monetary policy and weak global demand.

"Growth in India is expected to remain strong at 5.8 percent, albeit slightly lower than the estimated 6.4 percent in 2022, as higher interest rates and a global slowdown weigh on investment and exports," the UN's World Economic Situation and Prospects 2023 report, published on January 25, said.

Source: Bloomberg

Source: Bloomberg

4 FII selling

"Market sentiments are dampened by persistent FII selling, where funds are being shifted to other emerging markets as a result of attractive valuations," Vinod Nair, Head of Research at Geojit Financial Services said.

Till date, foreign institutional investors have already around $1.61 billion in stocks. Financials and IT have faced the brunt of this selling, followed by consumer services, oil & gas, telecommunication and autos.

5 Fed worries

The US economy expanded at a 2.9 percent annual pace from October through December, which was better than expected. Economists had predicted a 2.3 percent growth. This indicates that the US Federal Reserve might remain hawkish for a longer period of time.

Also Read: US economy posts strong growth in Q4, but with underlying weakness

“Recent data suggest that the pace of expansion could slow sharply in (the current quarter) as the effects of restrictive monetary policy take hold," Rubeela Farooqi, chief US economist at High Frequency Economics, wrote in a research report. “From the Fed’s perspective, a desired slowdown in the economy will be welcome news.”

The next Fed decision is scheduled for February 1, 2023, coinciding with India's Budget.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.