The share price of Adani Enterprises took a fresh knock on February 3, plunging 35 percent in the morning trade, a day after it was placed under National Stock Exchange's Additional Surveillance Measure framework.

At 10.41 am, the stock was down 35 percent at Rs 1,017.45 apiece on the NSE. This is the worst-ever intraday fall for the stock. The stock has wiped out 76 percent value from its peak of Rs 4,190 hit in December 2022.

Follow our live blog for all the market action

In the F&O segment, call and put writers were also constantly shifting their positions lower; 1100 and 1200 strikes were seeing the most action, while higher strikes were unwinding.

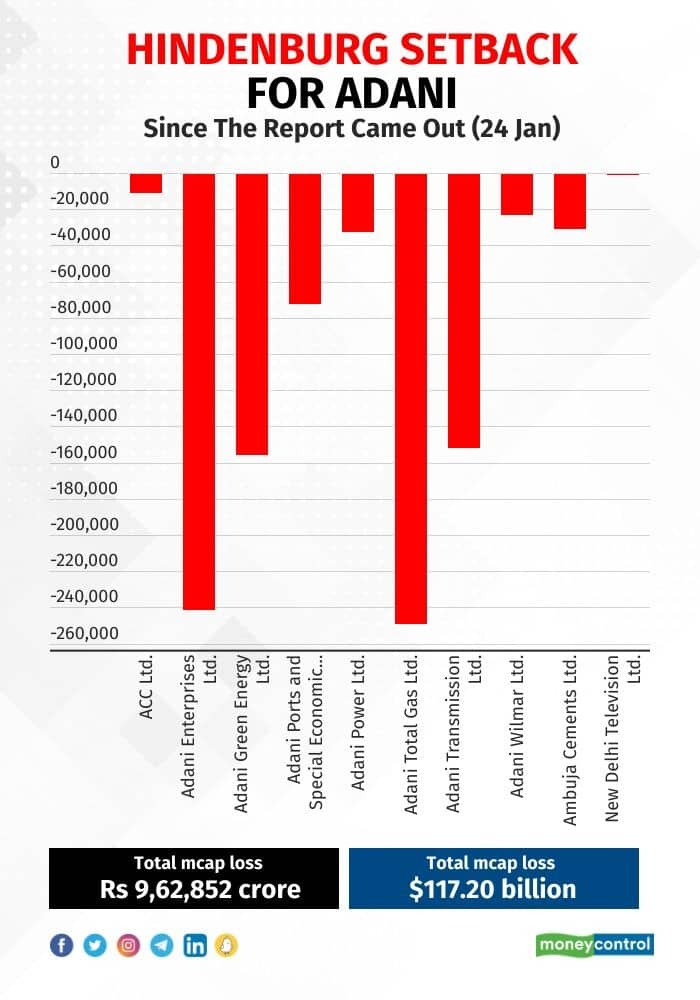

Since the release of the Hindenburg report on January 24, the Adani group has erased around $117 billion market cap, one of the worst in history. This is almost half of the Group's combined market value.

Adani Enterprises has plunged over 60 percent in the last three sessions. Adani Green Energy has lost over 51 percent, Adani Total Gas 58 percent and Adani Transmission has erased 50 percent since January 24.

What happened on January 24?

Short-seller Hindenburg Research said that it holds short positions in Adani Group companies through US-traded bonds and non-Indian-traded derivative instruments.

"Key listed Adani companies have taken on substantial debt, including pledging shares of their inflated stock for loans, putting the entire group on precarious financial footing," Hindenburg said.

It also accused the group of stock manipulation and using tax haven, charges denied by the conglomerate in a 413-page rebuttal.

Also Read: Adani says Hindenburg’s conduct 'calculated securities fraud' under applicable laws

What about the FPO?

Despite the report and the ensuing share price volatility, the Rs 20,000 crore follow-on public offering (FPO) of Adani Enterprises was subscribed 112 percent, led by non-institutional investors and qualified institutional buyers (QIB).

On February 1, the FPO was called off by the company's Board of Directors on February 1. "The company’s board felt that going ahead with the issue will not be morally correct. The interest of the investors is paramount and hence to insulate them from any potential financial losses, the Board has decided not to go ahead with the FPO," group chairman Gautam Adani said.

Also Read: Sebi increases scrutiny of Adani group: Reuters report

What is ASM and what happens next?

Prompted by the volatility, NSE put Adani Enterprises, Adani Ports and Ambuja Cements under the additional surveillance measure (ASM) framework on February 2.

In its circular, it said that the applicable rate of margin shall be 50 percent or the existing margin, whichever is higher, subject to the maximum rate of margin capped at 100 percent w.e.f. February 6, 2023 on all open positions as on February 3 and new positions created from February 6.

Also Read: Gautam Adani in talks to prepay share pledges to boost confidence

Adani Ports and Ambuja Cements are on the F&O ban list for February 3. The stocks were down 5-6 percent, relatively smaller fall than Adani Enterprises.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!