Prices of coking coal, a key ingredient in making steel, are rebounding and will likely continue to squeeze margins of steel companies for the rest of the year.

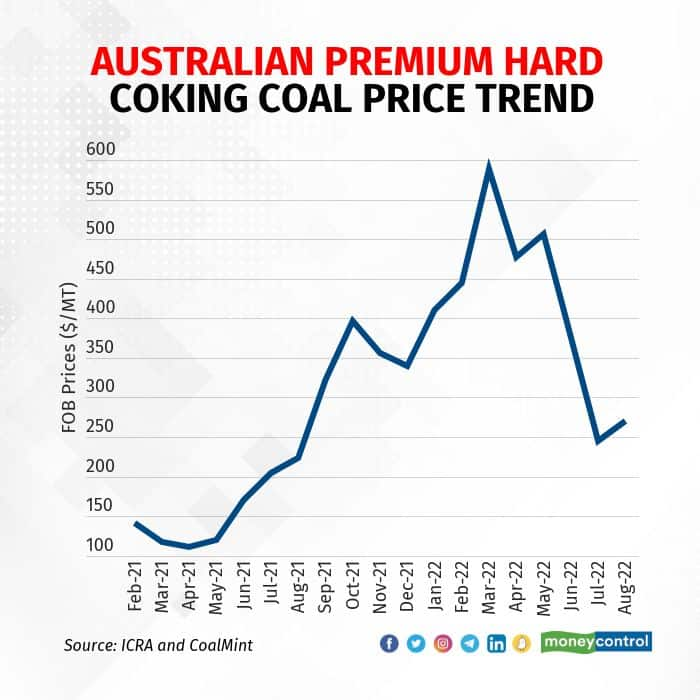

After falling for almost two months and touching a one-year low of $190 per tonne in the first week of August, Australian coking coal prices rose by over 40 percent to $270 per tonne, according to CoalMint, a market intelligence website.

Australian coking coal prices are likely to touch $300-330 per tonne in the December quarter, with some experts suggesting it could go as high as $350 per tonne. Restocking, mainly by traders on expectations of a revival in steel demand, has helped push up prices of late, CoalMint said in an article dated August 26.

“On a daily trend basis, prices have gone up by over $80 per tonne for the month of August 22. This would lead to a cost increase of over $60 per tonne in steelmaking through the blast furnace route if everything else remains the same,” Jayanta Roy, senior vice president at ICRA, told Moneycontrol over the phone. “Considering a two-month procurement lead time for coking coal, the average coking coal price for an Indian buyer would be almost $200 per tonne higher in Q2FY23 over Q2FY22, which would translate into a cost-push of close to $150 per tonne for steel.”

Most industry experts had factored a margin compression for the quarter ending September but it appears there will be little relief for the steel industry on the cost inflation front even for the quarter ending December.

“The Q3 margins of steel makers will come under pressure as coking coal prices are going up and steel prices are reducing,” said Rakesh Arora, managing partner of Go India Advisors, a business consulting firm. “High coking coal prices will last at least till winters as low-grade coking coal is now being sold in place of thermal coal, a commodity which has been witnessing acute shortage.”

Rising coking coal prices have been a concern for the steel industry and one that isn’t likely to go away soon. Prices had cooled down substantially towards the end of the first quarter of April-June, suggesting that inflationary pressures would ease.

Tata Steel expects margins to be compressed for its Indian and European divisions in the second quarter because coking coal prices had started inching lower only in July. The impact of lower prices would be felt with a lag after a month or two in September-October, Tata Steel managing director TV Narendran told Moneycontrol in an interview on July 26, 2022.

However, just when the industry expected to get some relief from September, coking coal prices have started rising again.

Although monthly average prices still show a declining trend between March 22 and August 22, the daily price has increased by over $80 per tonne over the three weeks ended August 22.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.