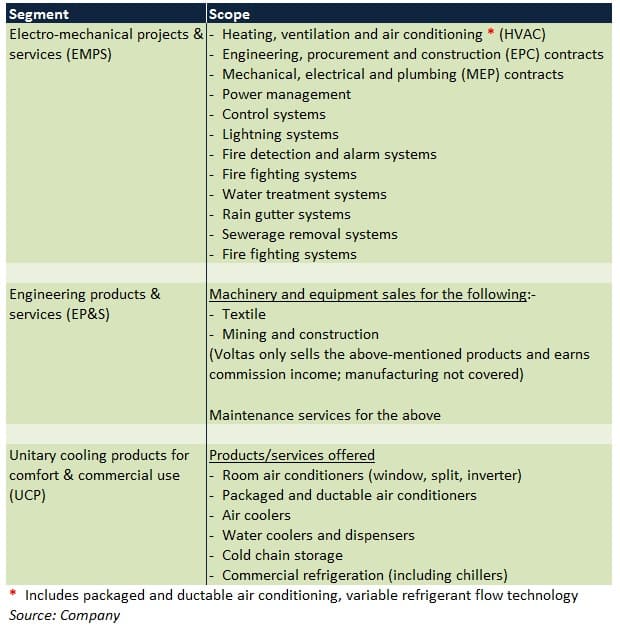

Voltas caters to a wide range of clients through its diversified product/service portfolio. Easing of hurdles in the international electro-mechanical projects and services (EMPS) segment, initiation of capital-intensive projects by the government, a positive outlook in the Mozambique-based engineering products and services (EP&S) arm, and a secular growth trajectory for unitary cooling products (UCP) products can augur well for the company in the upcoming fiscals. However, the stock’s pricing discounts the positives.

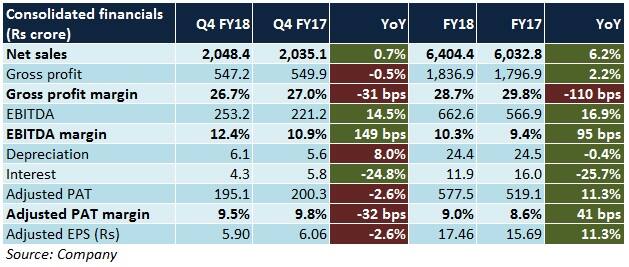

In FY18, Voltas' year-on-year (YoY) sales growth was impacted owing to Goods & Service Tax (GST) disruptions, unfavourable weather conditions, and air conditioner rating changes. Improved efficiencies across all three segments kept this disadvantage at bay, thereby keeping the overall margin profile intact.

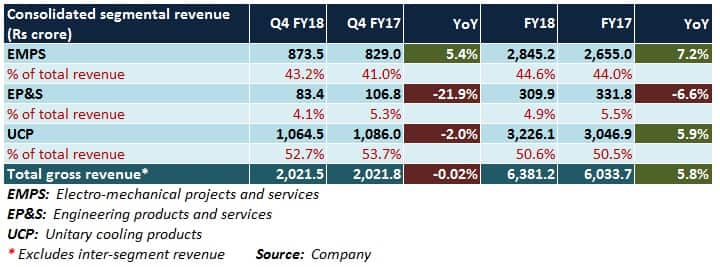

In the EMPS segment, the company’s FY18 carry forward order book increased 17 percent YoY to Rs 5,062 crore. Better quality orders, coupled with efficient execution in domestic and international businesses, led to an uptick in margins as well.

GST induced challenges impacted top-line performance of the EP&S segment, especially in case of textile machinery sales. In contrast, Voltas’ Mozambique-based operations that deal with mining and construction equipment sale, delivered healthy growth and caused the segment’s margins to improve too.

UCP segment revenues grew on account of increased offtake from customers and market share gains throughout the year. Consequently, Voltas continues to be the leader in room air conditioning (AC). Moreover, a product mix shift towards inverter ACs has been margin accretive.

Voltas' management’s continued focus on effective execution of ongoing projects and risk assessment practices, aided by a robust balance sheet and financial settlements of earlier contracts, should lead to an improvement in margins from this segment.

Carillion, a UK-based company operating as a sub-contractor for projects in Dubai and Oman, filed for bankruptcy in January. The company was engaging in joint venture (JV) tie-ups with local entities (contractors), including Voltas’ subsidiaries.

To ensure timely liquidation of receivables from Carillion, requisite steps are being taken by Voltas. Simultaneously, the management is speeding up processes of obtaining project certifications in connection with mechanical, electrical, plumbing (MEP) projects previously undertaken by it through the Carillion JV.

Given the embargo situation in Qatar, future orders from the country will be booked on a selective basis. Economic growth in the Gulf Cooperation Council (GCC) countries is picking up in 2018. This bodes well for Voltas since its operations in the Middle East are pivotal to this segment’s success.

The company recently bagged a contract connected with developments linked to Expo 2020. In addition to tailwinds stated above, this could be crucial in growing its international EMPS order book, which currently stands at Rs 2,004 crore.

EMPS segment - domestic operationsWeaknesses in the Indian private sector capex cycle are being offset by order book growth from government-funded projects. Rohini Industrial Electricals, a subsidiary representing 40 percent of the domestic order book, turned profitable in FY18 on the back of execution of rural electrification projects.

Internal efficiency measures will be prioritised to derive better margins. The management is looking forward to capitalising on opportunities in electrical distribution, water treatment, metro transport and smart city development. This should help its domestic EMPS order book of Rs 3,058 crore grow further.

EP&S segmentIndia’s textile industry, that bore the twin brunt of demonetisation and GST in the past, hasn’t been able to revive in entirety yet. Slow capital formation, declining profitability of spinners, and unwillingness on the part of banks to lend will be the major headwinds for textile machinery sales.

On the mining and construction equipment sale front, Mozambique operations will continue to drive this segment’s performance. In India, after a year of sluggishness, green shoots of a recovery are visible in road development. Therefore, some traction in the crushing and screening machines space is visible.

UCP segmentVoltas will strengthen its room AC portfolio through increased impetus on inverter, fixed-speed split, and window variants to retain its MARKET leadership position. Inverter ACs, that yield good margins, have been witnessing healthy demand of late.

The company sold about 207,000 air coolers in FY18, registering a growth of 38 percent YoY. An expanded product range, competitive pricing, differentiated features, and a wide network may help Voltas achieve greater market penetration in due course.

Commercial refrigeration products have been on an uptrend too. Voltas’ brand recall (for existing products), new offerings (combo coolers, chest freezers cum coolers) and presence across markets pan-India should enable it to create a niche for itself in this domain.

White goodsTo widen the gamut of its consumer durable sales in India, Voltas entered into a 50:50 JV with Arcelik, a leading European home appliance maker. Under the brand name of Voltas-Beko, washing machines, refrigerators, microwaves, and other brown (kitchen) goods will be sold starting H2 FY19.

ChallengesAs far as room ACs are concerned, Voltas operates in an industry that is substantially dependent on weather conditions. Inverter and fixed speed split ACs are characterised by stiff competition from other renowned brands, thus making it difficult for the company to pass on the entire increase in input prices to consumers.

OutlookVoltas is well positioned to reap the benefits of growing demand for ACs and commercial refrigeration products, robust order book in the EMPS segment, strong fundamentals, and capabilities to tap into markets pan-India.

At 22.4 times FY20e earnings, given the stock's current weakness, investors may consider buying.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.