Shabbir Kayyumi

The Donchian Channel is a trend indicator that was developed by futures trader ‘Richard Donchian’. He would later be nicknamed "The Father of Trend Following". Several trading strategies have been developed based on Donchian Channels, yet day traders may also come up with their own strategies as the indicator is versatile and can be interpreted in different ways. Variation of the Donchian system was used by the legendary Turtle Traders.

What is an ‘Donchian Channel’?

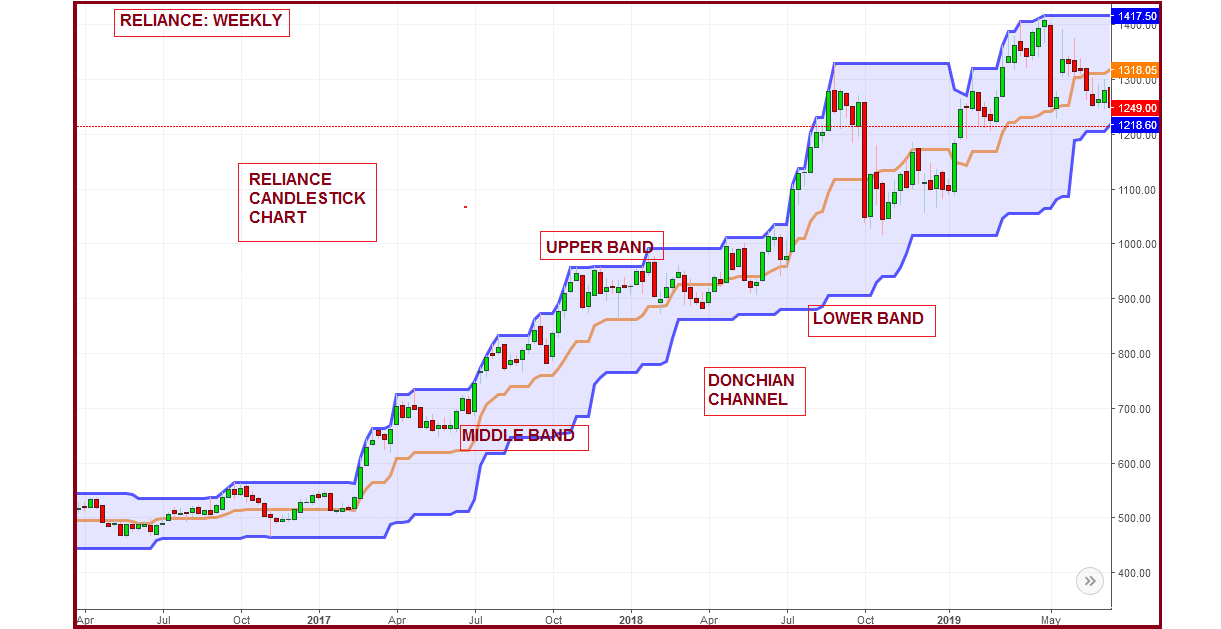

The Donchian channel is a useful indicator for seeing the volatility of a market price. If a price is stable, the Donchian channel will be relatively narrow. If the price fluctuates a lot, the Donchian channel will be wider. Its primary use, however, is to provide signals for long and short positions. Donchian Channels are three lines generated by moving average calculations that comprise an indicator formed by upper and lower bands around a mid-range or median band.

The upper band marks the highest price of a security over N periods while the lower band marks the lowest price of a security over N periods. The area between the upper and lower bands represents the Donchian Channel.

It really becomes most effective when confirming signals or conditions identified by additional technical analysis.

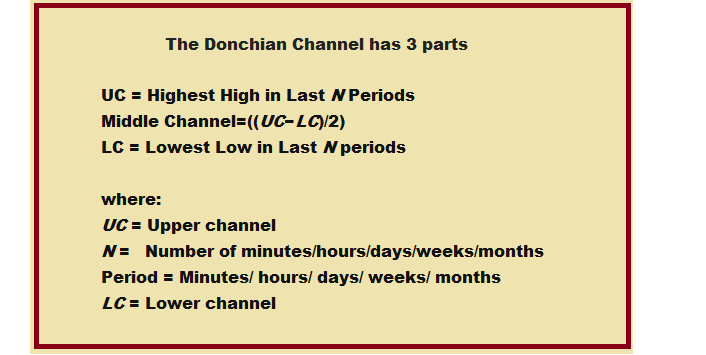

Construction of Donchian Channel

Understanding underlying formula used for construction of Donchian Channel helps traders to take prudent decision, while trading complex scenarios. Calculating the indicator is no longer required as charting platforms and trading software do it for us. However, knowing how the indicator is calculated will help you better understand the indicator and its strengths and weaknesses. Donchian Channel is calculated using the following formula:

Channel High:

• Choose time period (N minutes/hours/days/weeks/months).

• Compare the high print for each minute, hour, day, week or month over that period.

• Choose the highest point.

• Plot the result.

Channel Low:

• Choose time period (N minutes/hours/days/weeks/months).

• Compare the low print for each minute, hour, day, week or month over that period.

• Choose the lowest point.

• Plot the result.

Channel Middle:

• Choose time period (N minutes/hours/days/weeks/months).

• Compare high and low points for each minute, hour, day, week or month over that period.

• Subtract the highest high price from lowest low price and divide by 2.

• Plot the result.

The Donchian Channel uses a default setting of 20-period, but one can adjust it to your preference (30-day, 50-day, etc.). There is also the option to add a third line between the upper and lower lines. This mid-band is an average of the upper and lower channel lines as mentioned above.

The Donchian Channel is available on most trading platforms, such as Tradingview and MetaTrader. The indicator is also available on many free online charting sites, such as Investing.com, StockCharts.com and Yahoo! Finance.

Working of Donchian Channel

• The Donchian Channel can be used on any market or time frame.

• The indicator seeks to identify bullish and bearish extremes that favour reversals as well as breakouts, breakdowns and emerging trends, higher and lower.

• The middle band simply computes the average between the highest high over N periods and lowest low over N periods, identifying a median or mean reversion price.

• Donchian Channels identify comparative relationships between current price and trading ranges over predetermined periods.

• The top line identifies the extent of bullish energy, highlighting the highest price achieved for the period through the bull-bear conflict.

• The centre line identifies the median or mean reversion price for the period, highlighting the middle ground achieved for the period through the bull-bear conflict.

• The bottom line identifies the extent of bearish energy, highlighting the lowest price achieved for the period through the bull-bear conflict

• The indicator does not include the current price bar in the calculation. In other words, if you choose to apply the indicator over 20 price bars, the bands are calculated and plotted based on the 20 prior price bars.

• One should not use the Donchian Channel indicator to identify overbought/oversold market conditions.

• Like all technical indicators, it is important to use the Donchian Channel in conjunction with other technical analysis tools.

Trading Technique:

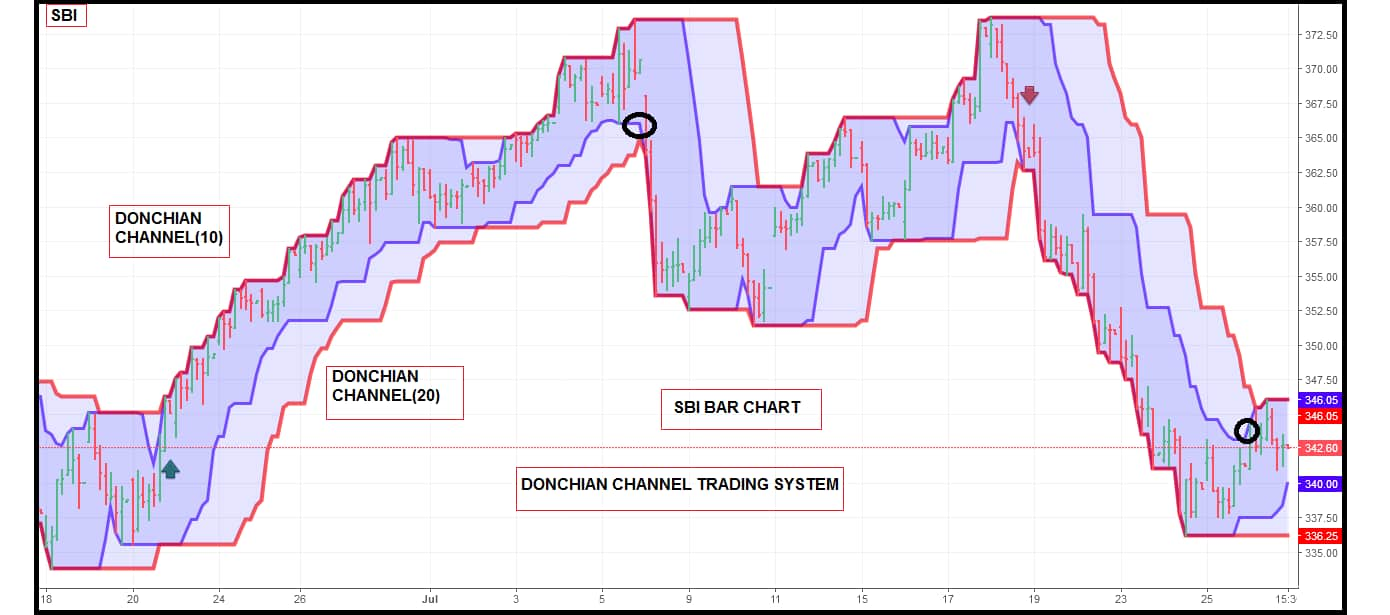

Donchian channels are mainly used to identify the breakout of a stock or any traded entity enabling traders to take either long or short positions.

Dual Channel Trading System

Traders can take a long position if the stock is trading higher than the Donchian channels “20” period and book their profits/short the stock if it is trading below the DC channels “10” period. A short position is created if the stock is trading lower than the Donchian channels “20” period and book their profits/short the stock if it is trading above the DC channels “10” period.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.