Shubham Agarwal

In the aftermath of the Budget 2020, it looked like participants overdid with the fall. While the damage done on the Budget day had a sizable amount of fall, this week with over 3.5 percent rise in the Nifty and over 4 percent rise in the Bank Nifty, we could see a reversal of those two-days of losses after January expiry.

The open interest (OI) activity all the while, when Nifty was rising, did not seem to have agreed with the argument of everything is fine, unlike the price action. It failed to put things back to where they were.

If we look at the change in OI on Nifty futures for the week, there was hardly any change leaving the shorts yet to be covered. On the other hand, Bank Nifty, too, managed to cover just part of the shorts created post-January expiry. The only silver lining here is the outperformance for the week and a mid-week covered 10 percent longs.

The stock futures had a brilliant run as far as price action is concerned with almost 90 percent of the stocks rising for the week. However, to put things in perspective, accounting for the preceding fall, hardly 40 percent of the stocks have reached up to their pre fall level.

The OI activity for the week was overwhelmed with longs as value seekers seemed to have jumped into the bargain-hunting spree.

Most of the sectors added longs. Data suggest that it would have been all major sectors if it wasn’t for unwinding in Oil India.

On the sentimental front, looking at the risk index, India VIX, for any directional cues is not worth as the underlying just came out of an event and the depressing fear of the unknown that has led to over 3-points drop in India VIX for the week.

Even the composition of Nifty Options seems to be tilted towards bulls with Nifty OIPCR up to 1.4 level rising by almost 40bps for the week.

Among individual Nifty strikes, congestion is seen around 12000 which has been a saviour for Nifty so far in this expiry and the same seems to be holding on as heaviest Put as well.

However, similar congestion in the proximal call strikes indicates expectation is set that Nifty is not the mood to run away.

Finally, the Budget shorts in Nifty is yet to be covered despite the recovery on top of that there have been no notable longs either.

From the price action perspective, there are many stocks that have underperformed the index for the week and we are still a way to near the consensus lower end of 12000.

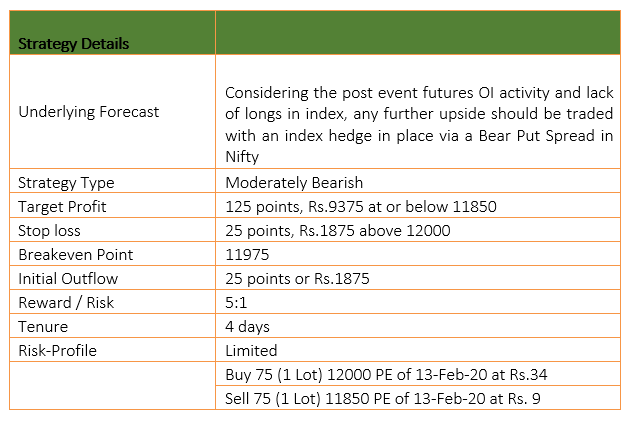

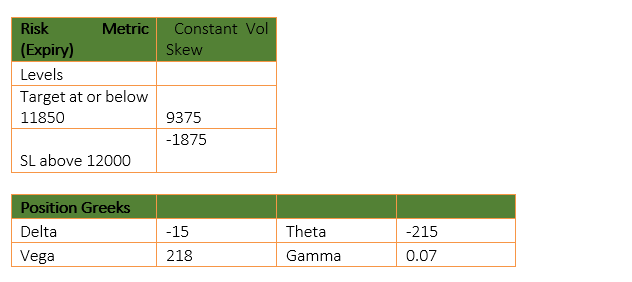

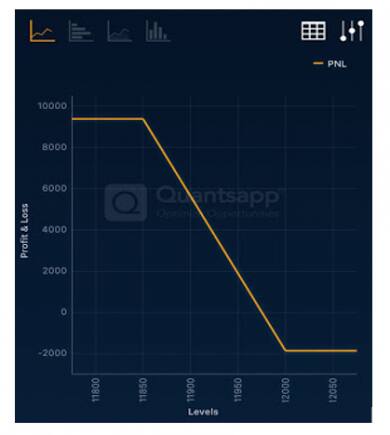

So, considering the post-event futures OI activity and lack of longs in the index, any further upside should be traded with an index hedge in place via a Bear Put Spread in Nifty.

Bear Put spread is a moderately bearish strategy. The strategy is built by buying a Put option close to the current market price of the underlying and selling the same expiry Put but of a strike lower than the Put bought.

The sold Put strike would be limit the profit but fund the put buying. Profits are limited to the difference between strikes minus the net premium paid.

(The author is CEO & Head of Research at Quantsapp Private Limited.)

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.