After the 2023 Indian Premier League (IPL) season, the newly-revamped Tata Neu app hit 60 million cumulative downloads (13 million happened during the IPL) and 75 million members in their NeuPass rewards programme (web + app). Given that the Tata Group was the title sponsor of IPL 2023 and the Neu app was heavily promoted during the matches, these numbers are not a surprise. Any such campaign is bound to bump up app downloads and bring in first-time users.

What’s really interesting are two other metrics:#1 App ratings: Post the revamp, Neu’s rating on the Google Play store has improved from 3.8 to 4.2.

#2 Repeats/retention: According to official sources, Tata Neu’s repeat purchase rate is a healthy 60 percent, with multicategory purchases increasing to 25 percent from only 10 percent last year.

Does that mean the UX improvements are paying off? Let’s take a closer look.Key UX updatesAccording to a Tata Neu spokesperson, the revamp was "not a one-time exercise but part of a continuous process to improve customer experience, add new features, and refresh the UI to make the customer journey seamless." New features include:

Browse without logging in: Users can now browse the service offerings without needing to log in.

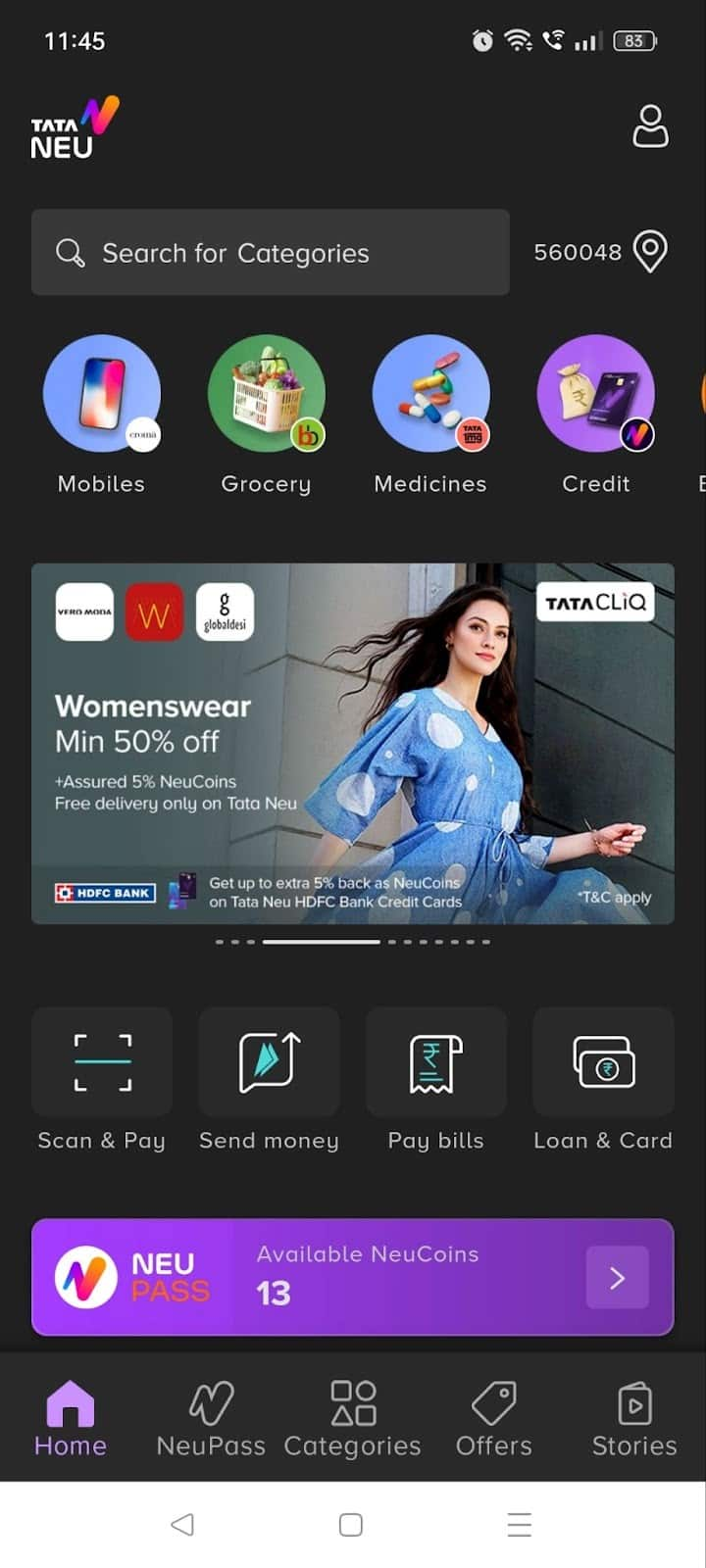

Categories tab: Category icons are now shown prominently on top of the app homepage. ‘Categories’ is also a prominent tab in the centre of the icons drawer at the bottom. These help users discover categories more easily.

NeuPass Ledger: Users now get a unified view of the reward points (NeuCoins) they have earned, unlocked, and spent.

My Account: The user profile icon has been added to the top right of the app homepage so that users can quickly access their profile and settings.

Screenshot of the revamped Tata Neu app homepage

Screenshot of the revamped Tata Neu app homepageA look at ~150 Twitter and Reddit posts tells me that two things seem to be working in Tata Neu’s favour. The first is the NeuPass membership programme in which everyone who signs up on the app and website is automatically enrolled for free. You earn NeuCoins on every transaction, which can be redeemed on Tata-owned and partner brands, including 1mg, AirAsia, BigBasket, Croma, Westside, Titan, Tanishq, CLiQ, Qmin, and IHCL (Taj) hotels. One NeuCoin is worth Re. 1, a pretty good rate compared to standard reward programmes.

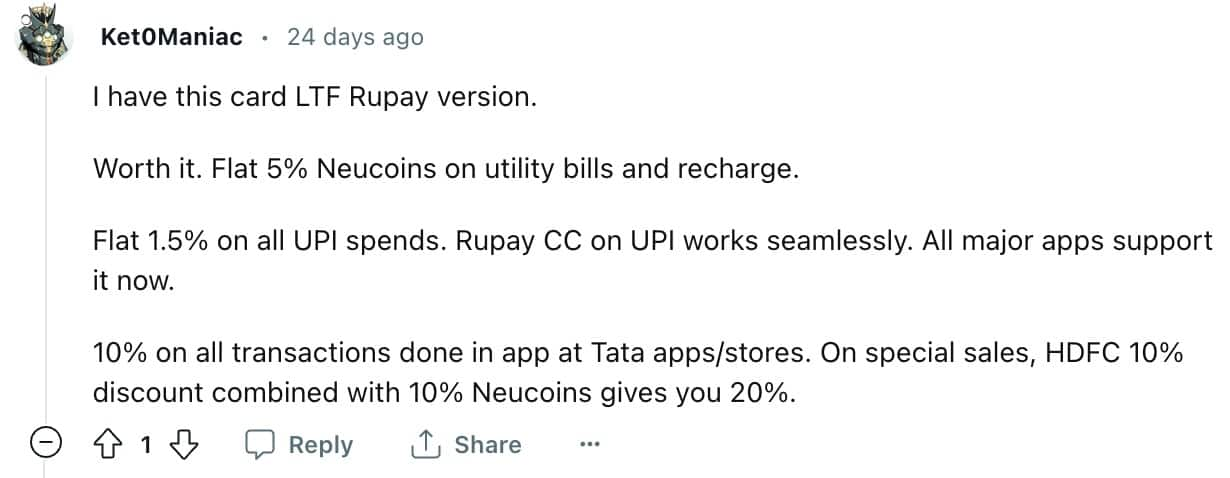

The second is the Tata Neu HDFC Bank credit cards (Infinity and Neu Plus) launched in November 2022, which give users up to 5 percent additional NeuCoins on transactions. When you search for Tata Neu on Reddit, over 95 percent of the results are about how to get these cards than about the app experience. The biggest attraction for users seems to be that NeuCoins earned via the cards can be redeemed on Tata brands without downloading the Neu app.

A Reddit post about the Tata Neu Infinity HDFC Bank credit card. Source

A Reddit post about the Tata Neu Infinity HDFC Bank credit card. Source

According to official sources, this is all part of Tata Neu’s omnichannel experience, with the NeuPass reward programme at its centre to build customer loyalty. The NeuCoins customers earn can be used to shop at partner brands, both online and offline. The advantage of using Neu is that currently, the base earn rate for NeuCoins is significantly higher than on the individual brand stores.

Rewards, yes. But what more?On Reddit, there are entire threads discussing hacks to wangle a lifetime free offer on the Tata Neu HDFC Bank credit cards. But how sustainable is growth fuelled primarily by rewards? Says Rahul Gonsalves, founder of digital product consultancy Obvious: “India is largely a value-seeking market where people tend to migrate as soon as someone else comes along with a better deal. NeuCoins are fundamentally a form of cashback. What happens when eventually a business decision is made to make them less attractive? Will users stay or go?”

The question is pertinent because the market is getting competitive. Tata Digital has already invested $2 billion in Tata Neu, while others, including Reliance and Adani, are expected to enter the super app race soon.

Have been using it and it's highly rewarding.. enjoying till the party lasts..glad that 12k of that 2 billion is in my pocket— Siddharth Shah (@iSiddharthShah) June 6, 2023

“To keep users coming back organically, a certain stickiness needs to be built into the Tata Neu experience. Building trust could be one lever. Contextual personalisation that elevates a user’s experience could be another,” Gonsalves added. This is one aspect Tata Neu needs to work on.

Long way to goEven with the UX revamp, Gonsalves says that Neu appears to work like a gateway or portal to many sub-apps. For example, If you click on Mobiles you are taken to a page that displays sub-categories such as ‘Mobiles under Rs 10,000’, ‘Browse Samsung mobiles’, etc. But if you click on Groceries, you are taken to the BigBasket app to choose from their services. Yes, everything is displayed within the Tata Neu app with its logo on the top left. But the shopping experience for customers is still… weird.

There is no unified shopping cart. That is, you cannot add a dress (say, from Westside), a mobile phone (from CLiQ), and some medicines (from 1mg) to your cart and check out with a single payment. Each of these orders must be placed separately from Neu. The browse, search, and shortlist experience works differently for each category. Customer care and returns / exchange are also separate and based on the individual brand’s policies.

While all Tata brands seem to be part of the NeuPass programme, many are running their own reward and membership programmes as well. They do not mention NeuCoins at all until the checkout page — this can be confusing for customers.

Take a look at the Westside checkout page. I was already logged into Neu, but was prompted to login again. The checkout page does not mention how many NeuCoins I will earn on the purchase, and the banner at the bottom asks me to sign up to become a WestStyleClub member. What about my NeuPass membership then? On the other hand, when I tried to order a watch (powered by Tata CLiQ), the free shipping available under NeuPass was clearly called out on the checkout page.

Screenshot of the Westside checkout page within the Neu app.

Screenshot of the Westside checkout page within the Neu app.There are also smaller UX inconsistencies that regular customers may perhaps not notice. BigBasket uses a basket icon and urges you to ‘Add to Basket’. Westside uses a cart icon and prompts you to ‘Add to Cart’. And Tata CLiQ wants you to ‘Add to Bag’!

Most importantly, there’s a vast difference in ease of shopping on digital-first brands such as BigBasket versus Croma or Titan Eye Plus. Neu helps offline-first brands get discovered by online shoppers but ultimately, they stand or fall by their own design. Slow load times and counterintuitive UI choices on many of these pages will cause users to drop off without making a purchase.

Gonsalves points out that super apps are taking on a tough challenge: changing established user behaviour. “We are used to having different apps for different needs. A user’s mindset when they need to order an everyday essential like dal or diapers is completely different from when they’re booking a luxury holiday. Can a single app cater to these diverse needs contextually and effectively?”, he asks.

He points out that successful super apps such as Gojek (Indonesia) and Grab (Southeast Asia) started by establishing themselves in one key category, before expanding into others. This too was done by leveraging a common underlying infrastructure, such as logistics or payments.

“Tata Neu is playing in multiple high-competition categories without having established itself in any, and it is not clear what underlying synergy exists between these. Tata Neu wants to be a super app, but it’s not giving its users any superpowers right now,” Gonsalves added.

Would it be better if the app repositioned itself as a Tata brand aggregator? In that case, in-house brands need a lot more visibility on Tata Neu. Right now, individual brand names are displayed on the app banners or hidden away under generic category names such as ‘Groceries’, ‘Lab tests’, ‘Watches’, etc. Searching by brand name brought up inconsistent, unhelpful results. E.g., searching for Croma or Tanishq does not take you to a single, well-designed brand page, but brings up product results. And when you search for an everyday product such as dal, you are taken to the groceries gateway of BigBasket, not shown the product.

Yet, in spite of all these glitches, India’s love for the Tata brand is evident even in negative reviews of the Neu app. Some users call out the glitches but also make suggestions on how to fix them. Three-star reviews on the Play Store sound supportive and encouraging. Many reviews talk about how they want Tata Neu to succeed. Clearly, Indians are willing to cut Tata Neu a lot more slack than they would for any other brand.

Tata Neu user review screenshots from the Google Play Store

Tata Neu user review screenshots from the Google Play StoreIt’s honestly hard to be unmoved by such a show of faith and goodwill. On paper, Tata Neu is a brilliant idea that should succeed. The Tata Group has the category spread, brand love, and pan-India reach that others can only dream of. But their user experience needs a significant upgrade and soon. To misquote JRR Tolkien, if there should be one app to find them all and one app to rule them, I secretly want it to be Tata Neu.

Gowri Kishore is a freelance writer. Views are personal, and do not represent the stand of this publication.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.