Indian markets went through a rough patch in the first six months of 2018 but managed to recoup their losses in July, with the Sensex hitting a fresh record high led by a rally in largecap stocks.

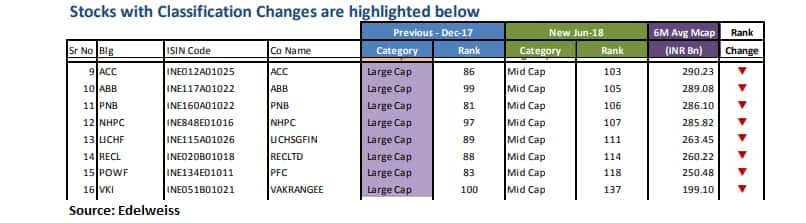

But the rally was not broad-based and six stocks which were considered largecaps in 2017 became midcaps in 2018 going by the recent classification changes brought in by market regulator SEBI.

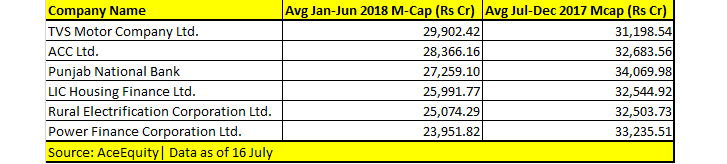

According to data compiled from AceEquity, six stocks whose average market capitalisation for the last six months (January-June) slipped below the Rs 30,000 crore mark compared to average mcap recorded in the second half of 2017 (July-December 2017).

Six stocks which turned midcaps include: TVS Motor Company, ACC, Punjab National Bank, LIC Housing Finance, Rural Electrification Corporation and Power Finance Corporations.

As per the circular released by the Securities and Exchange Board of India (SEBI) on October 6, 2017, Indian mutual funds schemes have to be strictly categorised into various baskets with a well-defined classification of largecap, midcap and smallcap stocks. Indian MFs will have to re-align the schemes within one month.

Here is the definition of largecap, midcap and smallcap:

a) Largecap: 1st -100th companies (cut-off at six month average mcap of Rs 30,600 crore)

b) Midcap: 101st-250th companies (cut-off stood at six month average mcap of Rs 9,980 crore)

c.) Smallcap: 251st companies onwards

SEBI's reclassification rule and additional surveillance measure (ASM) where stocks are put under the scanner for suspected manipulation also weighed on sentiment.

Apart from regulatory headwinds, high valuations, concerns regarding corporate governance, global headwinds in terms of a trade war and crude oil prices, fall in the rupee-dollar and slower-than-expected economic growth weighed on Indian markets, especially midcaps and smallcaps.

“A churn has been taking place for the past few months, which means smart money is moving from mid- and smallcaps to laregcaps. There seems to be a preference for largecaps for sure. Additional margin requirement, which was hiked for some stocks, is actually steadily drying up liquidity in the broader space, which is a worrying sign,” Hadrien Mendonca of IIFL told Moneycontrol.

“Select heavyweight private banks, IT, auto and FMCG stocks attracted buying. On the other hand, metals, realty and the broader midcap and smallcap indices were badly beaten down,” he said.

So, what should investors do? Should they buy into stocks which have fallen from skies, hold them or sell on rallies? To answer this question, we spoke to various experts and here’s what they recommend.

Analyst: Atish Matlawala, Sr Analyst, SSJ Finance & Securities

TVS Motor Company: Hold| Target: Rs 750-800| Stop Loss: Rs 500

According to the weekly chart, the stock has moved upside from Rs 290 odd levels in July 2016 to Rs 790 in January 2018. The stock has made a higher top and higher bottom pattern with an increase in volume.

From January 2018 to till date we have seen the stock to correct and retrace almost 50 percent of the upside rally making multiple bottoms around Rs 540.

For the last 8-10 weeks, the stock is moving sideways in the range of Rs 540-600 and a breakout on the higher side will give further upside rally till Rs 750-800.

Traders can hold the stock for the next 6-12 months for the upside level of 750-800 with downside level of Rs 500. A close below Rs 500 could result in a correction to Rs 450-420.

ACC: Buy on dips| Target: Rs 1500-1650

In the weekly chart, the stock made the double top at its all-time level of Rs 1,860 in the month of Sept 2017 and January 2018 and from there we have seen a steep fall in the stock.

It is making lower tops and lower bottoms pattern and currently took a strong support around Rs 1,250 odd level. It looks like the selling pressure likely to continue in the cement sector, we can see further correction once Rs 1,250 level is taken away till Rs 1,170-1,100.

Traders one should wait for some more downside rally and then buy for new upside rally till Rs 1500-1650.

PNB: Hold for upside rally| Target: Rs 120-130

According to the weekly chart, the stock has made a 52-week high around Rs 231 in October 2017 and from there we have seen a correction at the top.

Volumes were marginally higher as compared to previous upside rally. The stock is currently taking the support of its previous bottom of 71 odd levels.

A break down below Rs 71 will give further 20%-30% correction. The stock has minor resistance around Rs 95 and once it has taken away on the higher side we can see further upside rally till Rs 120-130.

Power Finance: Add long above Rs 85| Target: Rs 120-130

In the weekly chart, we have seen the stock to consolidate in the range of Rs 70-90 in the period from February 2016 to July 2016. After breaching the higher level of Rs 90 we have seen an upside rally for almost two years as it made 52-weeks high of Rs 169 in the month of June 2017.

From July 2017 to till date we have seen a correction of almost 100 percent of its upside rally. It came down to its previous bottom levels of Rs 70. Below this level, we can see further downside till 55-50 odd levels.

One should wait for a fresh investment at the current level and above Rs 85 and one can invest for a higher level of Rs 120-130.

Analyst: Ritesh Ashar, CSO at KIFS Trade Capital

LIC Housing Finance: Buy above Rs 575| Target: Rs 680

LIC Housing Finance has shown a weak performance by underperforming key benchmark index. On the higher time frame chart, mainly on monthly, supportive oscillator, RSI is taking multiple support and trading above the bullish zone.

If bulls manage to surpass the Rs 575 mark then bulls may take the stock towards Rs 680 in the proximity of 61.8% Fibonacci retracement of the previous fall.

Analyst: Hadrien Mendonca, Sr Technical Analyst at IIFL

REC and PFC both continue to remain under pressure as they extend their lower top lower bottom structure. There seems to be no sign of base building or attempt of a rebound. It would be prudent to avoid these stocks at the current juncture.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.