Kshitij Anand

Moneycontrol News

Investment in high dividend yielding stocks could be quite tempting as they offer steady flow of income to shareholders but on the other hand, not all stocks provide capital appreciation or become multi-baggers which most investors want.

The dividend yield is calculated by dividing dividend per share by the current market price. A high dividend yield can be a function of either higher dividend or fall in price because of a market correction.

For example, if the market price of the stock is Rs 100 and it pays an annual dividend of Rs 4, the dividend yield will be calculated as dividend/market price = 4/100 = 4%.

It represents the annualised return a stock pays out in the form of dividends. Investment decision based on dividend yield should be taken after looking at the movement of the stock price.

High dividend yielding stocks should not be by virtue of sudden fall in the company’s stock price. If the fall pertains to the reasons like poor financial performance as well as weak demand scenario, then such companies should be avoided, suggest experts.

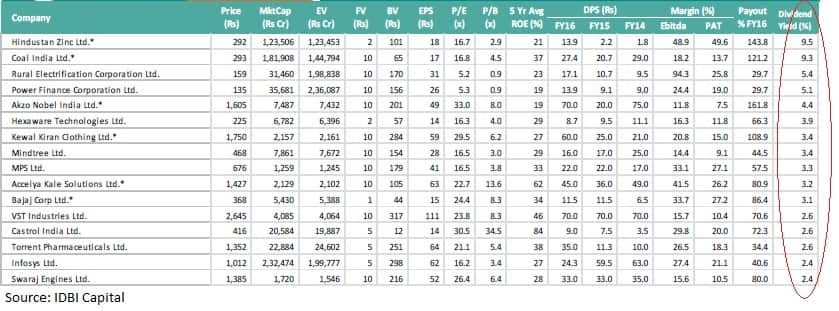

IDBI Capital in its latest report highlighted more than 50 stocks which have been consistent performers based on various parameters such as return on equity (ROE), profit margin, and has a market cap of minimum Rs 1,000 crore in the last 5 years.

Top fifteen stocks which fit the criteria of quality dividend yielding stocks include names like Hindustan Zinc which has a dividend yield of 9.5 percent, followed by Coal India, REC, Power Finance Corporation, MindTree, VST, Hexaware Technologies, Infosys, Castrol India etc.

“Investing in the high dividend stocks makes sense; however, one has to see if the company has been able to increase the dividends and how the stock price has moved,” Shrikant Akolkar, Sr. Equity Research Analyst, Angel Broking Pvt Ltd told moneycontrol.

“While investing, one must also see if the company has high dividend record and is able to maintain stable growth along with good balance sheet,” he said.

Not necessarily multi-baggers

High dividend yielding stocks are at best characterised as safe stocks and should not be mistaken with those stocks which can turn multi-baggers.

Investors turn to high dividend yielding stocks at times when the market is in a downtrend and these stocks are least impacted by the volatility.

For a portfolio to withstand volatility at all times, investors should construct a portfolio with some percentage of high dividend yielding stocks which can act as a hedge.

“There stocks are safe stocks which can pay a dividend and not necessary they be multi-baggers. Indian PSU companies pay a good dividend and are not multi-baggers. Take Coal India or NTPC as an example which continues to pay a dividend and stock prices remain flat over past many years,” said Akolkar.

When should investors buy high dividend yield stocks?

Smart investors should also look at another metric apart from dividend yield, i.e. dividend payout ratio. Dividend Payout Ratio is calculated by dividing dividends with Net income.

It gives an indication how much money company is giving out as dividends and how much it is keeping to reinvest in growth, payoff debt or add to reserves.

A dividend payout ratio might not be something which the company can sustain for long and investors should give them a miss.

“One cannot generalise that all high dividend yield stocks are good investment candidates. High dividend yield is not always sustainable,” Devarsh Vakil, Head - Advisory (Private Client Group), HDFC securities told moneycontrol.

“Investors should buy a high dividend yield company only when she is confident that company will be able to sustain the dividend for a long time to come. The company’s stock price has fallen much more than fundamental value of the company and its prospects are improving,” he said.

Vakil further added that investors should look at companies from those industries which have reached a saturation phase and does not require much capital to sustain the business. They will also keep on giving a steady stream of dividends.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.