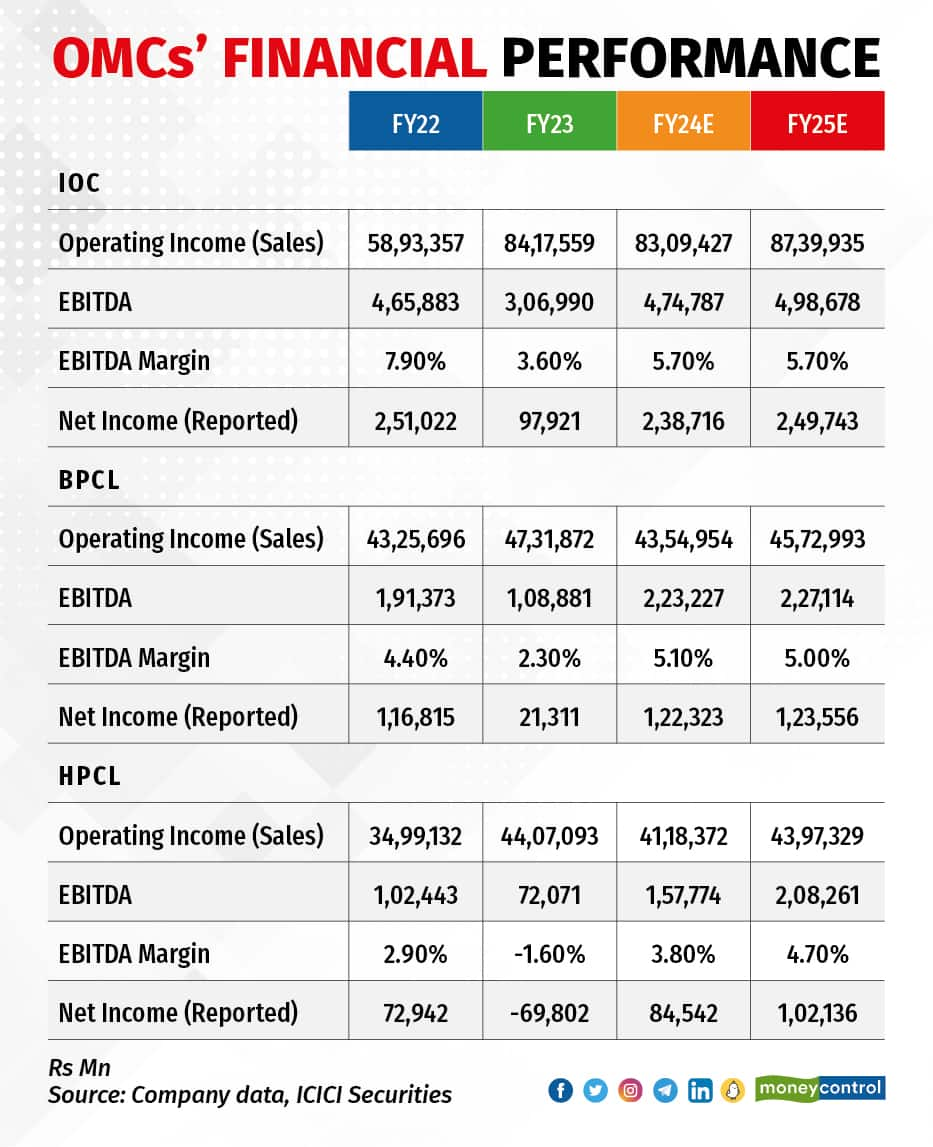

After a tough FY23, which saw global crude prices breaching the $100/barrel mark amid the Russia-Ukraine war, the outlook is improving for domestic oil marketing companies (OMCs), which can expect to reap the benefits of healthy margins, robust demand and additional capacity coming on-stream, say analysts.

However, they add that the Damocles sword of OPEC production cuts and the pressure from the government to reduce pump rates continues to hang over state-owned OMCs including Indian Oil Corp (IOC), Bharat Petroleum Corporation Ltd (BPCL) and Hindustan Petroleum Corporation Ltd (HPCL).

Global Brent crude prices soared to a multi-year high of $123/barrel in June 2022 due to the onset of the Russia-Ukraine war and active quota management by the oil producers’ cartel OPEC.

Additionally, the imposition of windfall taxes limited the gains for refiners and upstream players as well.

However, OMCs kept retail prices unchanged since April 6, 2022.

“As a result, their average marketing losses came in at Rs 0.68/Rs 10.1 per litre on petrol/diesel during 9MFY23,” analysts at Motilal Oswal said.

Brent prices have since then moderated and are currently hovering at $72, which augurs well for OMCs as their marketing margins have improved considerably to about Rs 10/Rs 12.7 per litre on petrol/diesel, respectively, in the first quarter of FY24.

“This should propel earnings growth in the upcoming quarter as well,” the domestic brokerage added.

India’s petrol and diesel sales maintained their upward trajectory in May as agriculture and transport demand picked up, according to preliminary industry data.

Also Read: Petrol, diesel sales soar in MayDemand for diesel – the most consumed fuel in the country accounting for about two-fifths of the demand – soared 9.3 per cent to 7.46 million tonnes in May compared to the year-ago period. Petrol sales jumped 10.4 per cent to 3.08 million tonnes in May 2023.

Petrol and diesel sales have been on the rise from the second half of March on the back of a pick-up in industrial and agriculture activities.

Also, the windfall tax on crude petroleum has been slashed to nil from Rs 4,100 per tonne, with effect from May 16. Windfall tax, also called the special additional excise duty (SAED), was already nil on aviation turbine fuel (ATF), petrol and diesel.

Windfall wax was introduced by the government on July 1, 2022, to charge the industry for the large profit it has been earning through the sale of refined crude in the international market. Its quantum is reviewed every fortnight, on the basis of the fluctuations in the international crude rates.

Gross refining marginsElevated crude oil prices are not always bad news for OMCs, as they mean higher refining margins.

“…refining margins (in FY23) saw some of its strongest levels in the past few years, with benchmark Singapore GRMs rising to levels of $24/bbl by June 2022 from as low as $6/bbl (Jan ’22) in early CY22. This reflected in record high GRMs for OMCs and drove a steady improvement in RIL OTC segment earnings as well over FY23,” ICICI Securities said in a report.

While the strength in GRMs was a positive, the flip side to this was that marketing margins saw sustained weakness through most of FY23 as an unofficial freeze was put in place for fuel price hikes from April’22.

Resultantly, the spike in global crude prices was absorbed by OMCs and retail losses widened considerably over the last FY, it added.

With oil prices cooling off now, marketing margins have improved substantially but Singapore GRM has softened to around $3.8/bbl during the first quarter (to date) of FY24 from $8.2/bbl in Q4 of FY23 ($10.8/bbl in FY23).

“While softer GRM may partially offset gains from marketing segment in the upcoming quarter, we expect Singapore GRM to eventually rebound to its long-term mean of $5-7/bbl,” Motilal Oswal analysts said.

Analysts have flagged two major risks to their rosy projections for OMCs this fiscal – muscle-flexing by OPEC+ and the government asking the companies to reduce prices ahead of the general elections next year.

Crude prices spurted earlier this month after OPEC kingpin Saudi Arabia surprised the markets by announcing an additional production cut of 1 million barrels per day, to be effective from July.

On April 3, several OPEC members revealed a combined 1.66 million barrels per day of production declines until the end of this year. OPEC+ accounts for approximately 40 percent of the world’s crude output.

Also Read: Why OPEC needs oil prices to stay elevatedOn the domestic front, the government expects OMCs to cut fuel prices after the fuel giants reported profits in the fourth quarter of the financial year 2022-23, as per reports.

The OMCs were expected to pass on the benefits to the consumers as their performance was now “close to normalcy”, according to a senior petroleum ministry official.

“We model marketing margins of Rs 3.3/litre for petrol and diesel from 2QFY24 onwards considering a spike in crude oil prices due to active quota management by OPEC+ or a cut in retail prices due to the upcoming state and general elections may significantly impact marketing margins and also increase earnings volatility,” Motilal Oswal added.

A change of $1/barrel in crude prices impacts marketing margins by around 52 paise/litre.

IOCL is set to commission various expansion projects over the next two years, including Panipat refinery 25 million metric tonne per annum (mmtpa), Gujarat refinery (18 mmtpa), and Baruni refinery (9 mmtpa), which will drive growth further. BPCL’s estimated capex for FY24 stands at Rs 10,000 crore, including for setting up an ethylene cracker unit at the Bina refinery.

HPCL too will see various projects coming on stream over the next three to five years, such as Bhatinda and Vizag refineries expansion, and the new Rajasthan (Barmer) refinery in FY24.

Shares of IOCL have climbed over 18 percent this year to date while BPCL has gained 12 percent and HPCL 15 percent.

All of them have comfortably outperformed the benchmark Nifty, which has inched up 2.8 percent during this period. Currently, BPCL has the most ‘buy’ recommendations at 25, followed by IOCL (24) and HPCL (23), as per Bloomberg data.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.