Privi Specialty has had a tumultuous year. The aroma and fragrance-chemicals maker fell nearly 40 per cent over the last 12 months and then rose sharply by over 20 per cent over the last 30 days.

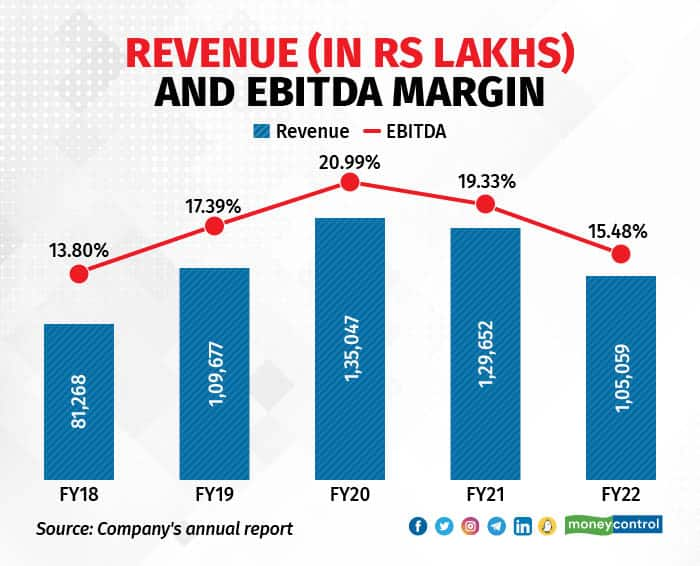

It posted weak numbers in the third quarter of FY23, with consolidated revenue from operations rising 6.4 per cent year-on-year (YoY) to Rs 419.84 crore and net profit plunging 77 per cent YoY at Rs 5.71 crore. The company’s topline and margins have been under pressure since FY21.

Also read: Know Your Stock| Olectra Greentech: A bet on green mobility and urban infrastructure

First, a little bit about the company.

Structure and product lines

The company, formerly Fairchem Specialty, was incorporated in 1982 to make edible oil. In 1992 it entered the aroma chemicals segment with two products. Today, Privi is focused on aroma chemicals with over 50 product lines and offers customised solutions.

Privi vends to leading global flavours and fragrance (F&F) manufacturers and has a significant presence in Europe and the US. F&F products are used in the personal-care industry which includes shampoos, soaps, oral care and fabric softeners, and the FMCG industry which includes beverages, snacks, sweets and dairy products. Among Privi’s FMCG clients are giants such as Procter & Gamble and Reckitt & Benckiser. In January this year, it started production of two new product lines from its two existing facilities—galax-musk from Jhagadia in Gujarat and camphor from Mahad in Maharastra.

The listed company also has three subsidiaries—two wholly owned ones are Privi Biotechnologies and Privi Speciality Chemicals USA, and one in which it has a 51 percent stake is Prigiv Specialties. Privi Biotechnologies does research and development in biotechnology, and works towards developing sustainable chemicals that can be used by varied industries including neutraceuticals, probiotics and food additives. It collaborates with various research organisations such as the Institute of Chemical Technology, the Department of Biotechnology and the Indo-German Science & Technology Centre (IGSTC).

The second subsidiary, which is USA-based, helps Privi expand its market in the region and Latin American markets while Prigiv Specialties is a JV formed in 2021 with Swiss fragrance- and flavour-maker Givaudan to make highly specialised aroma chemicals.

Notable change in shareholding

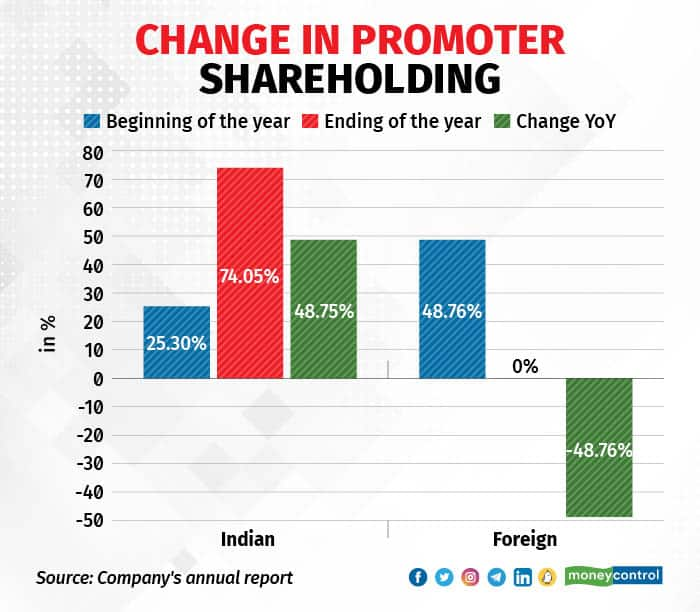

Privi has a large share of promoter holding of 74.02 percent as of FY22. That said, its shareholding pattern had changed significantly from FY21. Foreign promoters’ holding—held with Fih Mauritius Investments and Fih Private Investments—had plunged and Indian promoters’ shareholding nearly tripled.

In public shareholding, institutional investors raised their shareholding by 1.6 percent YoY to 4.16 percent over the same period while non-institutional investors reduced it by 1.59 percent to 21.79 percent.

Why did the profits fall?

In the third quarter earnings call, the company’s management said the profit margins were affected by the cost of inputs such as coal and freight, and added that these concerns should ease in the coming quarters.

Coal costs shot through the roof following the Russia-Ukraine war and the ban on coal exports in Indonesia, said the senior executives of the company. But with Europe arranging for alternative gas supplies and Indonesia lifting the coal ban, things are already looking up, they added. Freight costs have been moderating since December and that trend has sustained in January too, they said.

The company has also managed to add a rider in client contracts that freight costs will be reviewed and updated quarterly.

The management is also expecting the profit to recover on healthy sales of the two new products—galax-musk and camphor—which they believe will drive up volumes by 13-17 percent in CY23 and CY24. With all of this, the management expects the Ebitda margin to hit 16-18 percent again by FY24.

What are the risks involved?

During the conference call, some of the concerns raised were poor communication from the management’s side, increasing competition from China, and the surge in finance and depreciation costs in the quarter.

Also read: Earnings cheer, renewable biz prospects spur interest in Torrent Power

In the call, investors repeatedly raised the issue about the management’s lack of communication with them and for being out of contact for nearly 10 months. The management acknowledged the concern and said the break in communications was due to personal troubles faced by a senior executive and that the communication breakdown would not be repeated.

On increasing competition from China, the management said that it definitely is a risk in the spot markets but added that they depend on decades-long relationships with global MNCs for their volumes and that the MNCs themselves would prefer to work with companies that follow ethical norms and environment-friendly practices.

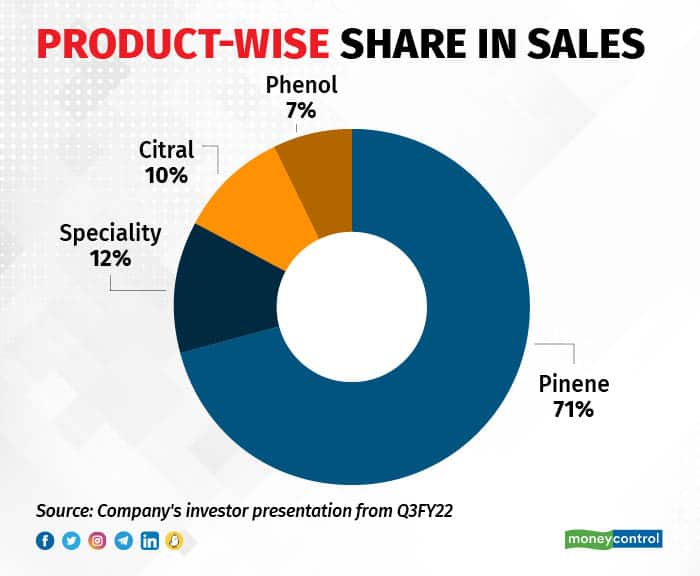

CST and GTO are two variants of raw materials used in the manufacture of pinene chemicals. While CST is procured through long-term contracts with paper-pulp manufacturers, GTO is bought in the spot market. According to Privi’s management, the company has managed to procure CST contracts and has the ability to refine it, which no Chinese or Indian manufacturer has. The only players which can refine it are in the US and European regions.

The weight of the financing and depreciation costs came in from capitalising plants for the two new products and revenues still not kicking in, according to the management. They will continue to be a drag on the bottomline in the March quarter and more so in the June quarter because the capitalising of Rs 120 crore will be done before March. But operating leverage from the new investments will also start to see “vast improvement” in the June quarter, particularly with camphor’s demand shooting up during the festive season that runs from April to December.

The stock was trading at Rs 1,087, which was 2.47 per cent lower than its previous close, on March 10 on BSE.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.