Market posted a fresh record high this week with the Nifty surpassing the 20,000 mark for the first time on the back of strong domestic fundamentals, lower US inflation, signs of recovery in Chinese economy, and the anticipation of a halt in rate hikes by the US Fed next week, and hints of a pause from the ECB.

The BSE Sensex ended the week up 1.86 percent or 1,239.72 points at 67,838.63, and Nifty50 gained 1.87 percent or 372.35 points to finish at 20,192.30.

"Elevated crude oil prices and concerns about inflation initially cast a shadow over the market. However, the negative sentiment was offset by robust domestic industrial and manufacturing production data, as well as a decline in inflation, which propelled the market to new highs. The market also received support from a set of positive global cues," said Vinod Nair, Head of Research at Geojit Financial services.

BSE SmallCap and MidCap indices, however, remained under pressure during the week with a decline of 1 percent and 0.5 percent, respectively, while the BSE LargeCap Index added 1.7 percent.

"However, the midcap and smallcap indices faced pressure as profit-booking set in, driven by concerns of overvaluation after reaching their all-time highs. Investors are now closely focused on the upcoming data releases and central bank meetings scheduled for the next week, including decisions from the US Fed Reserve, BoE, and BoJ," Nair said.

Among sectors, the Nifty PSU Bank index was up 7.2 percent, Nifty Information Technology index nearly 3 percent, Nifty Bank index 2.3 percent, and Nifty Pharma and Auto indices 2 percent each. On the other hand, Nifty Media index fell 3.6 percent and Nifty Oil & Gas index 1 percent.

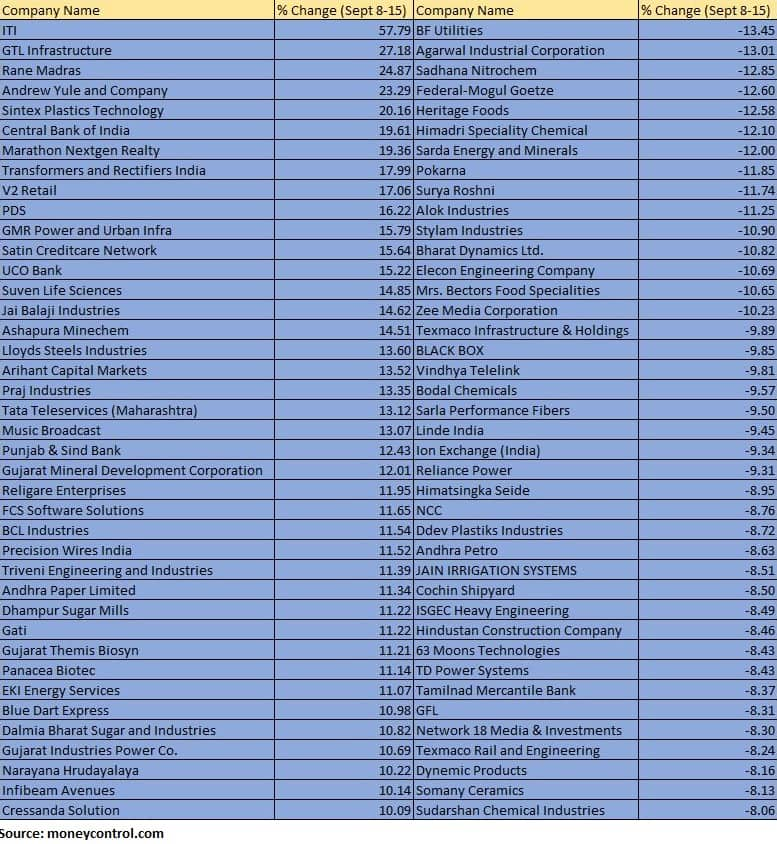

The BSE SmallCap index shed 1 percent, dragged by BF Utilities, Agarwal Industrial Corporation, Sadhana Nitrochem, Federal-Mogul Goetze, Heritage Foods, Himadri Speciality Chemical, Sarda Energy and Minerals, Pokarna, Surya Roshni, Alok Industries, Stylam Industries, Bharat Dynamics, Elecon Engineering Company, Mrs. Bectors Food Specialities and Zee Media Corporation.

On the other hand, ITI, GTL Infrastructure, Rane Madras, Andrew Yule and Company, Sintex Plastics Technology, Central Bank of India, Marathon Nextgen Realty, Transformers and Rectifiers India, V2 Retail and PDS rises 16-58 percent.

“The Nifty Index gained 1.8 percent this week and breached the 20,000 mark for the first time. Indian midcap and smallcap indices underperformed the large-cap benchmark in a volatile week. Among sectors, BSE Healthcare, BSE IT, BSE Auto and BSE Bankex indices were the major gainers this week. On the other hand, BSE Energy, BSE Capital Goods, BSE Oil & Gas, BSE Power and BSE Realty indices, posted negative returns for the week,” said Shrikant Chouhan, Head of Research (Retail), Kotak Securities.

“On the economy front, August CPI inflation moderated to 6.8 percent (from July 2023), while July 2023 IIP growth surprised on the upside at 5.7 percent. In the US, the inflation increased by 3.7 percent in August 2023 compared to a year ago. In Europe, the ECB raised interest rates to 4 percent, up 25 bps. Crude prices continued to strengthen with Brent crude trading above the USD 94 barrel mark,” he added.

The selling from Foreign institutional investors (FIIs) continued in the eight consecutive week as they offloaded equities worth Rs 746.62 crore, while domestic institutional investors (DIIs) bought equities worth Rs 3,363.36 crore in this week.

Where is Nifty50 headed?

Amol Athawale, Vice President - Technical Research, Kotak Securities:

A drop in US treasury yields have resulted in a recovery in world equity markets and also had a rub-off effect on local markets. On daily and weekly charts, the Nifty has formed a breakout continuation formation which is indicating that the uptrend wave is likely to continue in the near future. Although the larger texture of the market is bullish, the market is in temporary overbought conditions, and hence we could see some profit booking at higher levels. For short term traders, 20075 and 20000 would act as key support zones while 20300-20375 could act as crucial resistance areas for the bulls.

Rupak De, Senior Technical Analyst at LKP Securities:

The Nifty continued to exhibit strength as the index reached new highs. Strong Put writing at 20,100 has further bolstered positive sentiment in the market. The trend is expected to remain positive as long as the Nifty remains above the 20,000 mark. In the short term, there is potential for the Nifty to move towards the 20,480-20,500 range on the upside.

The sentiment remains positive as the Bank Nifty approaches its all-time high. The strong presence of Put writers at 46,000 has supported the index to stay in positive territory. The trend is anticipated to stay bullish as long as the Bank Nifty remains above the 46,000 mark. In the short term, there is potential for the Bank Nifty to reach levels around 46,700 and 47,000 on the upside.

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas:

The short-term outlook is positive, however, considering the sharp run-up since last three trading sessions we should have a cautious stance and be prepared for a correction. In terms of levels, 20,050 – 20,000 is the crucial support zone, while 20,200 – 20,250 shall act as an immediate hurdle zone.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.