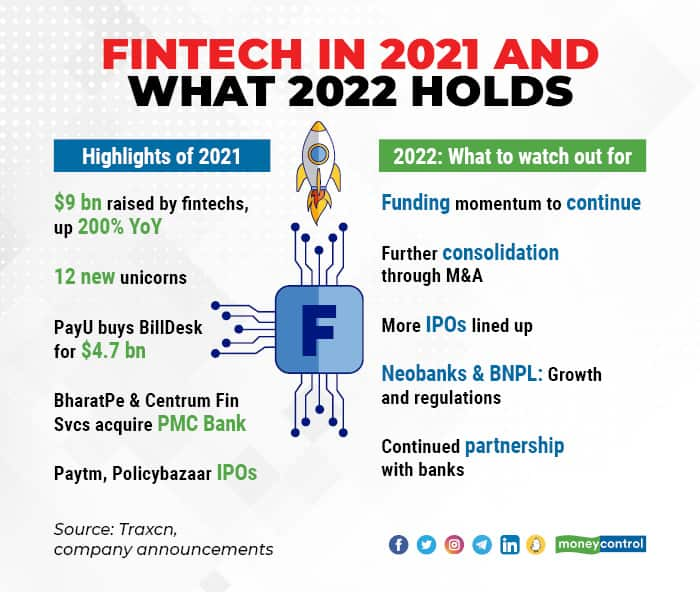

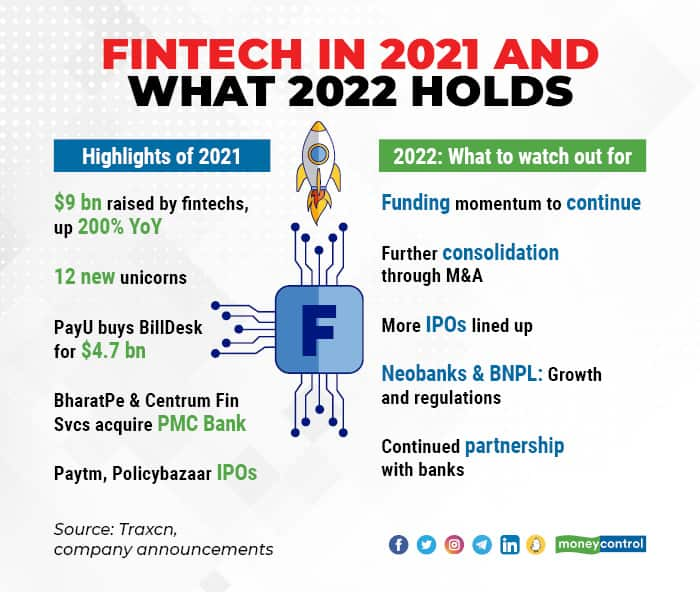

A fintech acquiring a sinking bank, PayU’s most expensive acquisition in India, record funding and a ‘blessing’ of Unicorns. For Indian fintechs, that was 2021 -- a year of many firsts.

In 2021, Indians saw, more clearly than ever, how fintechs are changing access to financial services – be it payments, neobanks, lending, insurance, stockbroking… you name it. New trends took shape, new words became part of our day-to-day vocabulary.

The fact that Indians are moving online for their financial needs faster than ever made investors pour money into the sector. A total of $9 billion was raised by fintechs in 2021, according to data by Traxcn.

As various fintech verticals grew their offerings and user base, regulators took notice and proposed regulations across sectors. Come 2022, we can expect digital lending and neobanks to be regulated, as per recommendations by the Reserve Bank of India (RBI) and Niti Aayog. But according to industry leaders, the collaboration between banks and these fintechs will not slow down anytime soon.

Also Read: FPIs have pumped in Rs 79,851 crore in IPOs this year

Here’s a look at the trends that shaped the Indian fintech space in 2021 and what is in store for the coming year.

BharatPe and Centrum’s takeover of PMC BankUntil not very long ago, fintechs were seen as an extension of banking, aiding the growth of banking services and providing digital infrastructure for the same. The tables turned this year when payments and financial services startup BharatPe joined hands with Centrum Financial Services to acquire the beleaguered Punjab and Maharashtra Cooperative (PMC) bank, putting to rest two years of worries for depositors.

RBI granted the consortium a Small Finance Bank (SFB) licence to begin operations as a bank. During the announcement in June 2021, BharatPe’s founder and CEO Ashneer Grover said that both companies will be investing $250-$300 million to bring services back on their feet.

Many are seeing this as a change in how the regulator views fintechs. According to Jaikrishnan G, Partner, Financial Services Consulting, Grant Thornton Bharat, this acquisition is a milestone for digital players with banking aspirations.

“BharatPe, a fintech with a three-year legacy partnering with an NBFC (Centrum) to acquire a banking licence with plans to bail out a troubled co-operative bank, is an exceptional example of how the financial services industry has matured in the country. The regulator and the public have understood the importance of the role of fintechs,” he said.

The bank is expected to be operational in 2022.

PayU goes shoppingIn its largest acquisition in India till date, the Prosus-owned payment fintech PayU acquired another major payment gateway, BillDesk, for $4.7 billion. The deal brings together PayU’s fast-growing payment gateway business with BillDesk’s well-established gateway, which is the preferred service provider for utilities, financial services and government payments.

The acquisition will bring the combined entity’s Total Payment Volumes (TPV) to $147 billion, as per PayU’s investor presentation that quoted data from FY21 details. Of this, BillDesk makes up $92 billion in TPV. TPV refers to the total value of payments and reversals executed on a payments platform.

PayU’s aim behind this acquisition was to grow the scale of its business, and that is probably the way ahead for all fintechs.

Post the deal, BillDesk founder MN Srinivasu had shared his views on fintechs in an interview with Moneycontrol. “This is a game of scale. From now on, it's going to be about how people scale and deliver. The advantage this combined platform has is that most other players in the market still have to figure out the right platform by which they can build sustainable models,” he said.

A record year for fintech funding, fund inflows saw a growth of over 200 percent in 2021, compared to last year. Large deals were seen from early stage to late-stage rounds.

According to Traxcn data, a record $9.03 billion was raised by Indian fintechs across 410 equity funding rounds in 2021, up from $2.83 billion across 303 rounds last year.

Payments again topped the charts in attracting funds, with payment companies making up over $4.11 billion or 46 percent of the year’s fintech funds. They included large rounds by companies like Pine Labs ($700 million), Razorpay ($535 million), Cred ($547 million), among others.

Funds worth $4.8 billion were raised by fintech unicorns, many of them growing their valuation by leaps and bounds in the year. Of the 43 startups that turned unicorns, 12 were from the fintech space. A unicorn is a privately held entity with a valuation of $1 billion or above.

Pranav Pai, Founding Partner and Chief Investment Officer at 3one4 Capital, which is invested in fintechs Open and Jupiter, said that this funding momentum will help fintechs stay well-funded when the cycle turns and investment sentiment slows.

“The fintech opportunity in India is much larger than people had assumed. If the customer base expands quickly, more companies can become larger in that space. Which means more equity will enter those companies. In terms of future funding, I don't think it will stop for fintechs,” Pai said.

Pai also believes that with Paytm and PolicyBazaar going public this year and drawing attention, fintechs will be understood much better by prospective investors and the public at large.

BNPL, neobanks to lead in 2022The fintech story is only expected to grow in the coming year. According to Grant Thornton Bharat’s Jaikrishnan, funding traction will continue across all categories. However, the focus is likely to be on lending and neobanks, with both new regulations and opportunities awaiting these startups.

These fintechs also fill the key gaps of small-ticket credit requirements and access to online banking services, touting them as the fastest-growing verticals.

Lizzie Chapman, co-founder and CEO of BNPL (buy now, pay later) startup ZestMoney, said: "The world woke up to the potential of BNPL just 18 months back, but India has known this for a decade. We believe India will be the largest BNPL market in the world. There will be more market cap created in this segment in India than anywhere else in the world in the coming time. It will be an India category."

At the core of neo-banking and digital lending models like BNPL is the collaboration between banks, NBFCs and fintechs. Over the past two years, banks have been increasingly tying up with fintechs to expand their customer base.

“Year 2022 will see more collaboration between fintechs and banks as they roll out innovative products. India has one of the most stable regulatory regimes in the world and with banks and fintechs coming together, we can address the diversity of demand and drive financial inclusion for the country," Chapman added.

Consolidation and acquisitions, such as those by PayU and BillDesk, are seen by many as the next step of change in the Indian fintech space. With a multitude of startups vying for a pie of every fintech vertical, it is inevitable that only the best and the largest will eventually survive, and will acquire many smaller players on the way.

The gates have also opened for major fintechs that have plans to go public. Taking advantage of the bullish scenario, players like Pine Labs and Digit Insurance may go for IPOs in 2022.

However, what is it that fintechs must keep in mind as governments and regulators increase scrutiny over the sector?

According to 3one4 Capital’s Pai, 2022 will be a year when not only legacy financial institutions have to ask themselves what the future holds but startups will have to ask the existential question as well.

"Fintechs that pretend they are financial institutions will suffer, because they are not. And financial institutions that pretend they are fintechs will also suffer. It is a marriage; it is a partnership. One side claiming they can do everything will struggle," he said.

A fintech acquiring a sinking bank, PayU’s most expensive acquisition in India, record funding and a ‘blessing’ of Unicorns. For Indian fintechs, that was 2021 -- a year of many firsts.

In 2021, Indians saw, more clearly than ever, how fintechs are changing access to financial services – be it payments, neobanks, lending, insurance, stockbroking… you name it. New trends took shape, new words became part of our day-to-day vocabulary.

The fact that Indians are moving online for their financial needs faster than ever made investors pour money into the sector. A total of $9 billion was raised by fintechs in 2021, according to data by Traxcn.

As various fintech verticals grew their offerings and user base, regulators took notice and proposed regulations across sectors. Come 2022, we can expect digital lending and neobanks to be regulated, as per recommendations by the Reserve Bank of India (RBI) and Niti Aayog. But according to industry leaders, the collaboration between banks and these fintechs will not slow down anytime soon.

Here’s a look at the trends that shaped the Indian fintech space in 2021 and what is in store for the coming year.

BharatPe and Centrum’s takeover of PMC BankUntil not very long ago, fintechs were seen as an extension of banking, aiding the growth of banking services and providing digital infrastructure for the same. The tables turned this year when payments and financial services startup BharatPe joined hands with Centrum Financial Services to acquire the beleaguered Punjab and Maharashtra Cooperative (PMC) bank, putting to rest two years of worries for depositors.

RBI granted the consortium a Small Finance Bank (SFB) licence to begin operations as a bank. During the announcement in June 2021, BharatPe’s founder and CEO Ashneer Grover said that both companies will be investing $250-$300 million to bring services back on their feet.

Many are seeing this as a change in how the regulator views fintechs. According to Jaikrishnan G, Partner, Financial Services Consulting, Grant Thornton Bharat, this acquisition is a milestone for digital players with banking aspirations.

“BharatPe, a fintech with a three-year legacy partnering with an NBFC (Centrum) to acquire a banking licence with plans to bail out a troubled co-operative bank, is an exceptional example of how the financial services industry has matured in the country. The regulator and the public have understood the importance of the role of fintechs,” he said.

The bank is expected to be operational in 2022.

PayU goes shoppingIn its largest acquisition in India till date, the Prosus-owned payment fintech PayU acquired another major payment gateway, BillDesk, for $4.7 billion. The deal brings together PayU’s fast-growing payment gateway business with BillDesk’s well-established gateway, which is the preferred service provider for utilities, financial services and government payments.

The acquisition will bring the combined entity’s Total Payment Volumes (TPV) to $147 billion, as per PayU’s investor presentation that quoted data from FY21 details. Of this, BillDesk makes up $92 billion in TPV. TPV refers to the total value of payments and reversals executed on a payments platform.

PayU’s aim behind this acquisition was to grow the scale of its business, and that is probably the way ahead for all fintechs.

After the deal, BillDesk founder MN Srinivasu shared his views on fintechs in an interview with Moneycontrol. “This is a game of scale. From now on, it's going to be about how people scale and deliver. The advantage this combined platform has is that most other players in the market still have to figure out the right platform by which they can build sustainable models,” he said.

A record year for fintech funding, fund inflows saw a growth of over 200 percent in 2021, compared to last year. Large deals were seen from early stage to late-stage rounds.

According to Traxcn data, a record $9.03 billion was raised by Indian fintechs across 410 equity funding rounds in 2021, up from $2.83 billion across 303 rounds last year.

Payments again topped the charts in attracting funds, with payment companies making up over $4.11 billion or 46 percent of the year’s fintech funds. They included large rounds by companies like Pine Labs ($700 million), Razorpay ($535 million), Cred ($547 million), among others.

Funds worth $4.8 billion were raised by fintech unicorns, many of them growing their valuation by leaps and bounds in the year. Of the 43 startups that turned unicorns, 12 were from the fintech space. A unicorn is a privately held entity with a valuation of $1 billion or above.

Pranav Pai, Founding Partner and Chief Investment Officer at 3one4 Capital, which is invested in fintechs Open and Jupiter, said that this funding momentum will help fintechs stay well-funded when the cycle turns and investment sentiment slows.

“The fintech opportunity in India is much larger than people had assumed. If the customer base expands quickly, more companies can become larger in that space. Which means more equity will enter those companies. In terms of future funding, I don't think it will stop for fintechs,” Pai said.

Pai also believes that with Paytm and PolicyBazaar going public this year and drawing attention, fintechs will be understood much better by prospective investors and the public at large.

BNPL, neobanks to lead in 2022The fintech story is only expected to grow in the coming year. According to Grant Thornton Bharat’s Jaikrishnan, funding traction will continue across all categories. However, the focus is likely to be on lending and neobanks, with both new regulations and opportunities awaiting these startups.

These fintechs also fill the key gaps of small-ticket credit requirements and access to online banking services, touting them as the fastest-growing verticals.

Lizzie Chapman, co-founder and CEO of BNPL (buy now, pay later) startup ZestMoney, said: "The world woke up to the potential of BNPL just 18 months back, but India has known this for a decade. We believe India will be the largest BNPL market in the world. There will be more market cap created in this segment in India than anywhere else in the world in the coming time. It will be an India category."

At the core of neo-banking and digital lending models like BNPL is the collaboration between banks, NBFCs and fintechs. Over the past two years, banks have been increasingly tying up with fintechs to expand their customer base.

“Year 2022 will see more collaboration between fintechs and banks as they roll out innovative products. India has one of the most stable regulatory regimes in the world and with banks and fintechs coming together, we can address the diversity of demand and drive financial inclusion for the country," Chapman added.

Consolidation and acquisitions, such as those by PayU and BillDesk, are seen by many as the next step of change in the Indian fintech space. With a multitude of startups vying for a pie of every fintech vertical, it is inevitable that only the best and the largest will eventually survive, and will acquire many smaller players on the way.

The gates have also opened for major fintechs that have plans to go public. Taking advantage of the bullish scenario, players like Pine Labs and Digit Insurance may go for IPOs in 2022.

However, what is it that fintechs must keep in mind as governments and regulators increase scrutiny over the sector?

According to 3one4 Capital’s Pai, 2022 will be a year when not only legacy financial institutions have to ask themselves what the future holds but startups will have to ask the existential question as well.

"Fintechs that pretend they are financial institutions will suffer, because they are not. And financial institutions that pretend they are fintechs will also suffer. It is a marriage; it is a partnership. One side claiming they can do everything will struggle," he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.