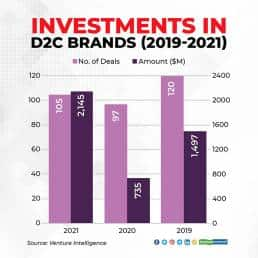

Direct-to-consumer (D2C) brands have nearly tripled the capital raised from investors this year, which is over $2 billion across 105 deals.

The segment had witnessed a dip last year when it raised $735 million, while in 2019 (pre-COVID), the mop-up neared $1.5 billion through 120 deals, according to data from Venture Intelligence.

The data shows that while the capital raised has significantly increased, the number of deals have not increased but the size has significantly grown. The top five deals of this year include Firstcry, Lenskart, Licious, Rebel Foods and MyGlamm through which MyGlamm, Licious and Rebel Foods also turned unicorns.

The D2C segment saw huge growth with the fillip of online adoption in the post-COVID world. The momentum is expected to continue with these brands expanding their reach in smaller towns and cities.

“We continue to see a fair amount of traction for funding in the D2C space. The pandemic years have also introduced new spaces and we are excited to see experienced entrepreneurs starting up innovative D2C companies,” said Dipanjan Basu, Partner and CFO at Fireside Ventures, which has invested in D2C brands like Mamaearth, boAt and Bombay Shaving.

“At the same time, the bar for the companies to be differentiated has gone up and funding will be polarised towards deep innovation in products and consumer propositions,” Basu said.

D2C brands could be looking at a $100-billion addressable consumer opportunity in India by 2025, Avendus Capital, the investment banking arm of financial services firm Avendus Group, said in a report last year.

“Creating and more importantly, delivering on differentiated propositions and building reliable, consistent product and brand experience are what D2C brands should be solving for. There are few barriers to entry today, and many are scaling profitably,” said Shankar Prasad, Founder and CEO of Vegan beauty Plum.

The space has seen a spurt of over 600 brands over the last few years. But, Basu says that some levels of consolidation have already begun in the space. “Some of the Fireside younger brands are getting folded under a House of Brand approach of larger D2C brands,” he said.

Indian startups have altogether raised over $30 billion this year. Privately held startups have raised $31.2 billion, nearly three times 2020’s $11.2 billion, and more than double the previous record of $13.1 billion in 2019.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.