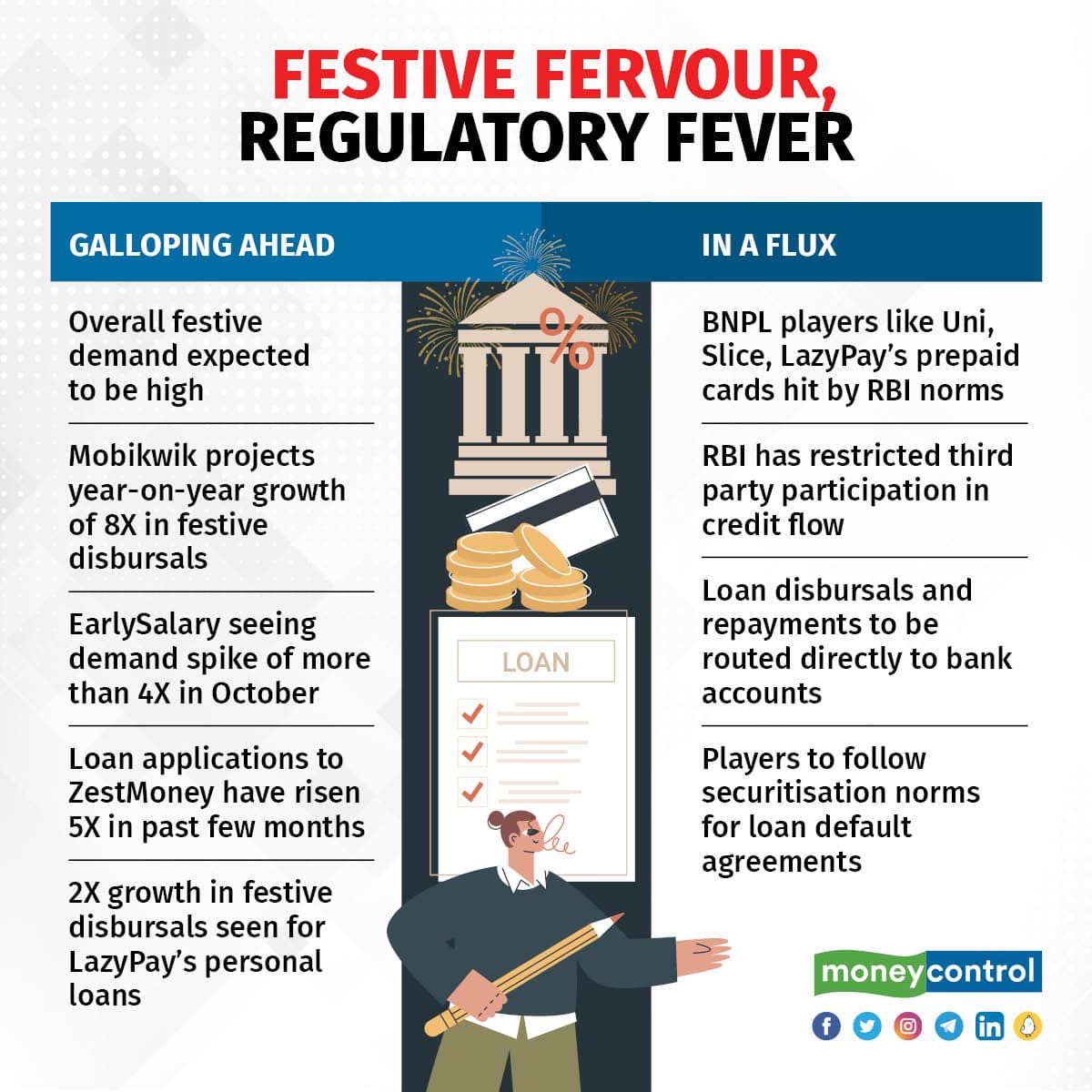

Despite a couple of regulatory hiccups, buy now pay later (BNPL) players are expecting a banner festive season with as much as an 8X rise in disbursals compared to the same period last year.

With major players like Slice, Uni and PayU-owned Lazypay’s prepaid card issuance being dented by the regulatory norms, others in the space are looking to capitalise on the situation and gain more market share during the festive season.

For instance, EarlySalary which raised $110 million in a Series D round last month, expects to disburse Rs 650 crore of credit in October this year, more than four times the Rs 150-odd crore it did in the festive period last year.

“This year we are chasing some serious growth… fuelled by 7X growth in customer acquisition as compared to last year. I am also looking to gather a larger market share ceded by the competitors who have been restricted by new guidelines and customers have large expectations with festive mindset,” said EarlySalary co-founder and CEO Akshay Mehrotra.

Digital payments wallet Mobikwik, which operates a pay later service called Zip, said its credit disbursals may rise as much as 8X compared to last year’s festive season. While the company was doing monthly disbursals of around Rs 100 crore during this period last year, it has grown to more than Rs 700 crore of monthly disbursals.

The fintech, which is reportedly in talks to raise $100 million in funding after deferring its initial public offer plans due to a meltdown in tech stocks, expects to see monthly disbursals to be in the Rs 800-900 crore range during the festive period.

In June, bigger fintechs were dealt the first blow when the Reserve Bank of India (RBI) barred the loading of credit lines into prepaid cards. Subsequently, the central bank also restricted third-party operators like them from intermediating the flow of credit between bona-fide lenders and borrowers.

Following the norms, Moneycontrol had reported that Slice, Uni and LazyPay had to stop onboarding new prepaid card customers after their partner State Bank of Mauritius India took a call to pause until further clarity. Uni then announced that it is suspending its prepaid card services for existing customers as well.

While the mode of BNPL that depends on prepaid instruments is in the regulatory crosshairs, other routes based on zero interest equated monthly installments and short-term personal credit are expected to take off.

For example, easy EMI provider ZestMoney has seen new customer applications go up by 5X over the last few months as people start planning their shopping. The company is also projecting strong demand at offline stores.

“Our offline business has seen 100 percent growth over the last three months and the trend is expected to continue. We anticipate a similar demand over the next three months for the overall business,” said Lizzie Chapman, CEO and co-founder of ZestMoney.

Meanwhile, LazyPay, which has stopped onboarding new customers for its prepaid card launched only in January this year, continues to disburse personal loans. This year it expects to see a growth of 2X as compared to last year’s festive season on the back of a rise in spending on travel, weddings and home decor, said the company's CFO and COO Mayuresh Kini.

Inflation impactAccording to several BNPL players, there has been no adverse impact on their disbursals due to retail inflation and fuel prices creeping up in the last few months. If anything, they expect inflation to be a tailwind for credit demand in the festive season.

“Inflation will increase the demand for credit. While interest rates have gone up at the inter-bank level, that rise has not really been transmitted through consumer credit instruments. So with prices rising ahead of income, consumers will have every reason to buy on credit rather than with cash,” said Prithvi Chandrasekhar, President – Risk & Analytics, InCred.

Moneycontrol reported earlier that growth in festive season sales on e-commerce platforms will be muted this year due to inflation. Year-on-year growth is anticipated to be 15-20 percent compared with 25-50 percent over the past few years. Additionally, the resumption of offline shopping as Covid-19 eases may eat into the growth of online sales.

Sales of smartphones and electronic appliances are expected to remain flat, although fashion, cosmetics and home decor are expected to log steady growth.

For BNPL players, however, smartphones and electronics are expected to be one of the largest categories in festive sales, followed by large home appliances, fashion, home decor and travel. Travel especially is picking up strongly with people planning vacations well in advance.

“Definitely we are expecting a good festive season. We are already seeing early signs of things picking up across categories. We expect the most traction for online purchase of consumer durables and other e-commerce categories that typically spike during the festive season,” said Sashank Rishyasringa, co-founder of axio finance (formerly Capital Float).

“D2C brands will also see a spike. Also, with travel coming back strongly, we expect that to increase during Diwali. There will be an increase in spends from existing customers as well as new customers," he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.